Quick Links

- Token Statistics (LUNA) (As of 30th June 2022)

- Terra UST LUNA price crash explained

- What went wrong?

- The De-peg of UST

- Terra LUNA Classic Price Movement

- Terra UST Classic price Movement

- Terra Circulating Supply

- Bitcoin Transfer after UST & LUNA Crash

- UST price and volume over time

- Recovery Plan

- Core Team

- Conclusion

Terra LUNA and UST de-peg were a massive blow to the crypto community. It was one of the most appalling events in crypto history. Through the analysis below, we try to determine what factors led to the fall of Terra LUNA, in which investors lost around $40 Bn within a week and its recovery plan.

Terra is the decentralized blockchain built by Terraform Labs. It was founded by Do Kwon and Daniel Shin and launched its main net in April 2019. It uses the COSMOS SDK, a framework for building blockchain applications that use the Tendermint-powered Proof of Stake consensus mechanism. There are two coins in the Terra ecosystem: one algorithmic stablecoin called UST and the other one called LUNA.

UST was designed to maintain its peg through the on-chain mint and burn mechanism, a virtual automatic market maker (vAMM) rooted in the condition that 1 UST, irrespective of its market value, is worth approximately $1 of LUNA. This mechanism was constructed so volatility and UST price dislocations could be smoothed out with UST and LUNA supply expansions or contractions via on-chain arbitrageurs.

Token Statistics (LUNA) (As of 30th June 2022)

| Current Market Price | $2.43 |

| Market Capitalization | $310 Mn |

| Market Cap Rank | 220 |

| 52 weeks High/ Low | $19.53 / $1.9 |

| Circulating Supply | 1 Bn |

| Symbol | LUNA |

Terra UST LUNA price crash explained

Terra LUNA was performing very well in the market during the times when most of the crypto assets were consolidating. The LUNA price reached its highest level at around $116 on April 5, 2022, and after May 7 2022, it lost 100% in value, and billions of dollars of wealth were vaporized.

On the other hand, the UST coin, which was designed to retain a value of $1 at all times, was de-pegged on May 9 and has since fallen to just $0.0165. It was the most spectacular crash ever recorded in the history of crypto.

What went wrong?

Let’s first understand the pegging mechanism of Terra, which has two assets, which are TerraUSD (UST) – (Stablecoin) and Terra, the native coin (LUNA).

UST is the algorithmic stablecoin, and its price stability is deeply co-related to the LUNA price. If the UST is trading below $1, then the UST is burnt, and new LUNA coins are minted.

If UST goes above $1, then LUNA is burnt while new UST coins are minted. Through that, UST maintains its peg.

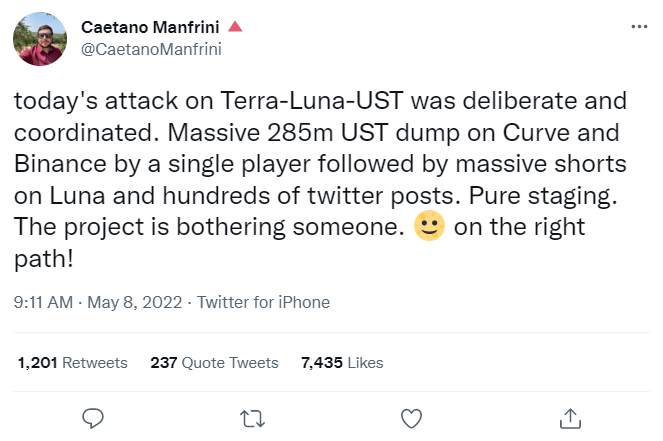

The De-peg of UST

It all started when someone liquidated $285 Mn worth of UST on Curve and Binance. It was continuously de-pegged. The LUNA foundation guard liquidated most of their BTC holdings to stabilise the peg.

It also leads to the fall of Bitcoin from $40K to $27K for the first time since December 2020. As most of the assets co-relate with Bitcoin, this leads to the fall of the entire market.

At the same time, 200 million USTs were unstaked (taken out of the Anchor Protocol) and immediately sold. It’s a popular lending protocol that offers a 20% yield on deposits.

The price fell to 91 cents due to the huge sells. Traders tried to leverage arbitrage, exchanging 90 cents’ worth of UST for $1 worth of luna, but then a speed bump occurred. Only $100 million worth of UST can be exchanged for LUNA each day.

Once the stablecoin failed to maintain its peg, investors, already flighty in the current market, sold their UST. The week following the initial de-peg fluctuated between 30 cents and 50 cents, then fell steadily to under 1 cent. Around $18 billion in early May, its market capitalisation is now $579 million.

Terra LUNA Classic Price Movement

- Since the beginning of the 2022 trade, Terra’s price has risen and peaked above $120.

- However, during the price recovery from April, the UST de-pegged incident took place, which wiped out the asset.

- The price dropped by almost 100% every day until it lost its value and added up to a couple of zeros.

Terra UST Classic price Movement

- Since the beginning, TerraUST has maintained its $1 peg. However, the recent liquidation destabilized the asset heavily as the UST lost its peg to slip to 0.02 right now.

- After the UST lost its peg with LUNA, many exchanges stopped trading.

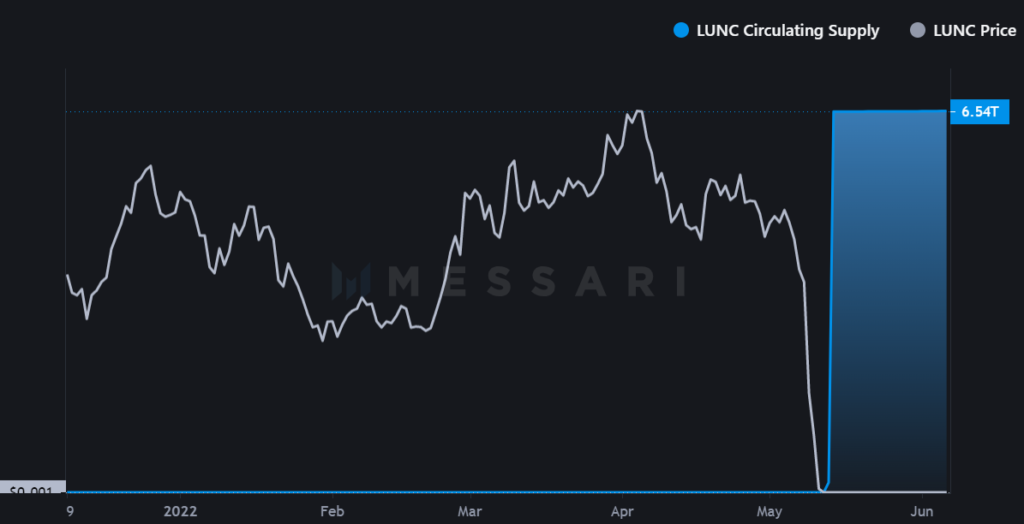

Terra Circulating Supply

Due to simple supply and demand dynamics, LUNA token demand eased out as LUNA tokens flooded into the market. Consequently, the price was negatively impacted heavily.

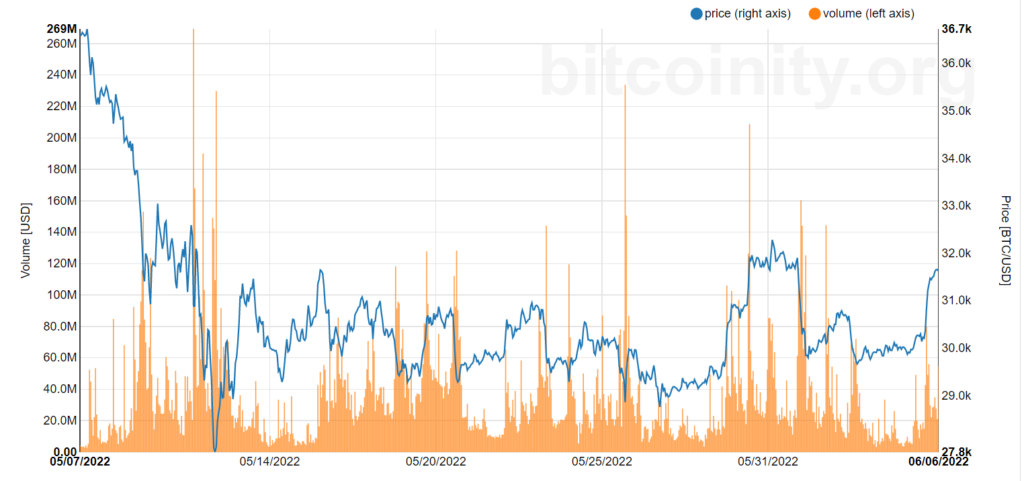

Bitcoin Transfer after UST & LUNA Crash

Bitcoin’s price was settled at $36K. However, once the price started to fall, the volume increased. Furthermore, as the price dropped to 10-month lows of $27K, the volume peaked at 268 million, the day the Luna Foundation Guard depleted their BTC stockpiles.

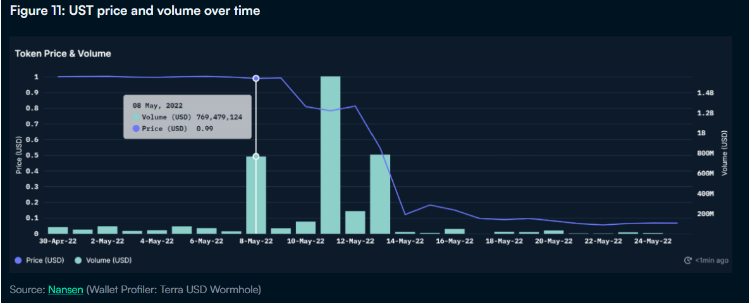

UST price and volume over time

By comparing the price and volume of UST displayed in the chart above, we found that volume increased significantly on May 8, originating during the same time as the token’s initial loss of value. Similarly, the historical transfers from Terra to Ethereum showed significant activity around the exact dates.

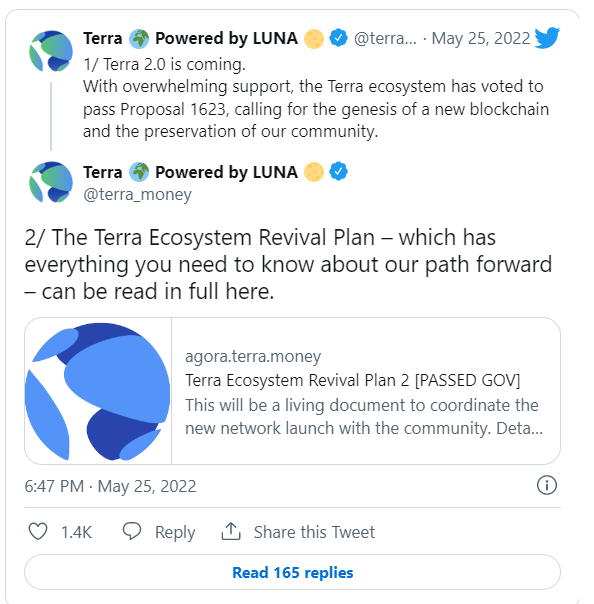

Recovery Plan

After the situation got out of hand, Do Kwon announced a recovery. He announced that he would be abandoning the stable coin TerraUST and creating a new chain without the algorithmic stable coin.

According to Terra’s revival plan document, the old chain was to be renamed Terra Classic (token Luna Classic – LUNC), and the new chain was to be renamed Terra (token Luna – LUNA).

Further, Luna will be airdropped across its Luna Classic stakers, Luna Classic holders, residual UST holders, and essential app developers of Terra Classic. Also, TFLs’ wallets will be removed from the whitelist for the airdrop – making Terra a fully community-owned chain.

Core Team

Do Kwon

Founder and CEO of Terra

Studied Computer Science at Stanford University

Ex- Microsoft worked in the natural language processing team.

Daniel Shin

Co-Founder of Terra

Graduate from Wharton School of Business

Founder of E-commerce platform called TMON and startup incubator called Fast track Asia

Founder of Chai Payment App

After the collapse of the fatally flawed Terra blockchain, Do Kwon lost the crypto community’s trust, and he previously acknowledged that his stablecoin mechanism had already proven to be broken.

His statement that Terra is more than UST is one of the misleading statements in the crypto community because Terra is not more than UST. It is why the chain exists.

As the trust is already broken, we shouldn’t think Terra Do Kwon should have a platform within the blockchain industry.

As per Coindesk, he also failed to disclose his previous work on the failed algorithmic stablecoin called Basis Cash. If people had known this earlier, they would not trust this man.

Conclusion

Terra UST is a decentralized stablecoin and is pegged with LUNA. After decoupling, many people are heartbroken, and some even lose their life-saving. As the market is already in bear mode, the fall of Terra LUNA works like oil in the fire.

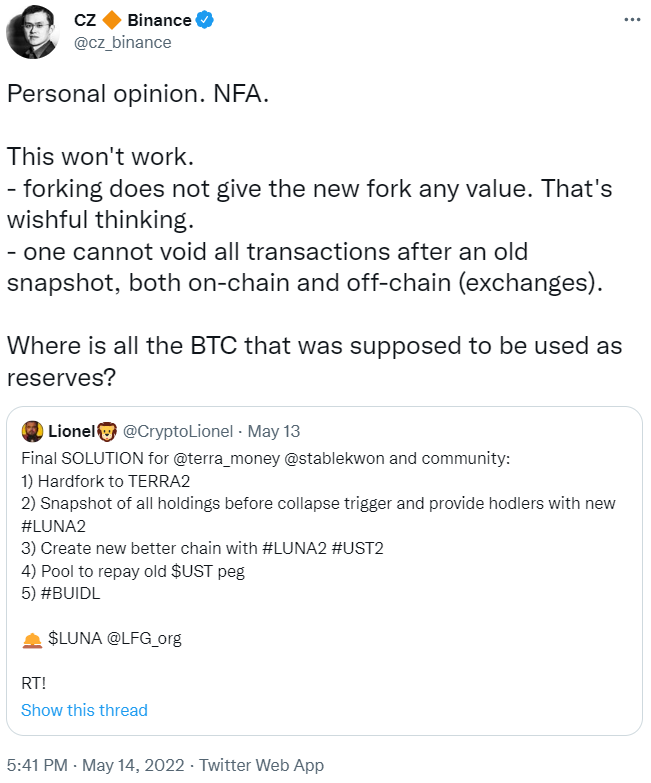

Even the CEO of Binance agreed and described the earlier proposal to fork and relaunch LUNA as’ wishful thinking’.

There is no reason to exist on Terra without stablecoin, and we don’t see any real hope for price recovery or stability.

Trust is an essential ingredient in the crypto community, and once it’s lost, it’s hard to get it back. With trust in leadership broken and no fundamental reason for existing, we are giving the SELL rating as the new LUNA token will not be able to restore faith in the crypto community, and it’s a dark road for Terra LUNA to travel.