Yield farming is a strategy used to farm crypto tokens in a protocol and maximize the returns on capital as yields. By lending funds in a liquidity pool of a particular protocol, one can maximize the return on investment by using different strategies. The profits offered to users are determined by the liquidity pool’s APY (Annual Percentage Yield) or APR (Annual Percentage Rate).

The use case of yield farming and DeFi staking are prevalent. But which of the following streams can result in a maximum gain on the capital invested while also considering the risk involved?

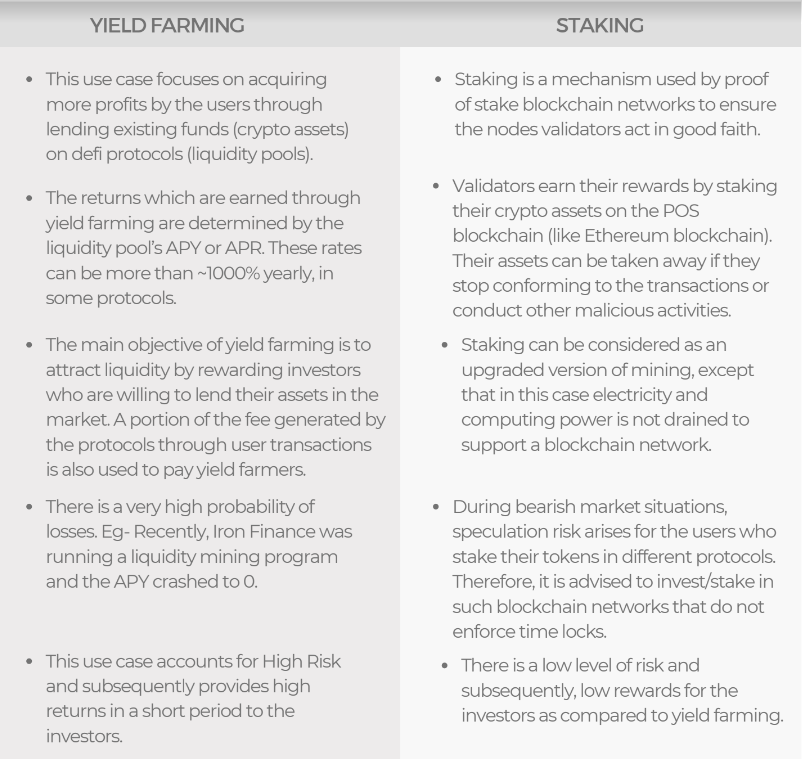

The following table explains the difference between both the concepts

To know more about Yield farming, access our TradeDog Insight Report which consists of detailed information and analytical aspects including:

- Report Overview

- What is yield farming?

- Important factors

- Comparison with DeFi Staking

- Analyst’s Remark