Quick Links

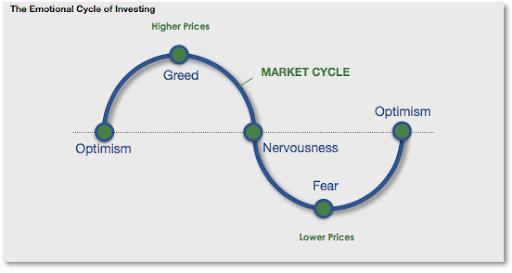

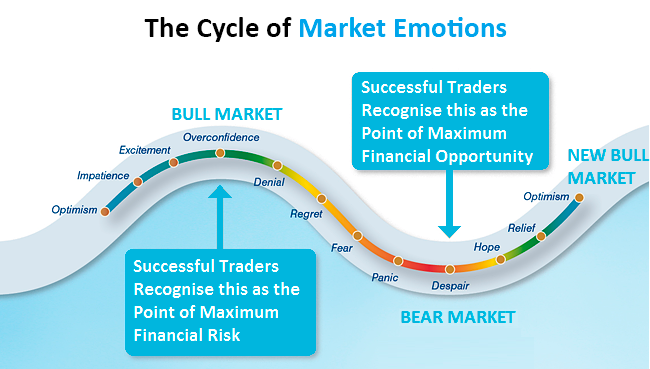

Whenever people sit before their monitors to initiate trades, many feelings and thoughts strike their heads. They get anxious, some get motivated, some fear losses while some keep their heads cool and let their strategy work for them. Your internal belief systems are highly responsible for your trade success as the crypto markets are a huge sea sweeping volatility in and out with every wave. Focusing on Moving averages, charts and trends put your assets on the line as it may get harder to concentrate on your goal. Being too aggressive or timid will not get you far. Let us gather a basic understanding of crypto trading psychology that will help you minimize the odds and keep you focused on the important aspects.

What is Crypto Trading Psychology?

Trading psychology is the trader’s self-awareness, rational thinking ability, and responsibility that impact the way they trade and take decisions. To put this into perspective, it is similar to driving a car on a busy street. The driver needs to be conscious of his surroundings while also maneuvering the car using different mechanisms to keep the car moving without engaging with other vehicles, i.e. accidents. Decisions you take while crypto trading highly affects your trade outcome and keeping your emotions chained up, and building a systematic approach is critical.

One should keep an eye on these decisions and tasks to prevent any detrimental effects on your trading goals. These are preemptive measures taken to forestall any threat that may arise while you are crypto trading because one slight mistake can reduce the chances of you making desired profits. You can also switch to different potential trading strategies and styles if you think you’re not gonna make it whilst in a trade.

Evaluation of Crypto Trading Results

The process of judging and assessing all the actions you took over the course of a trade life spanning from days, weeks, and months. You won’t be needing to trade for weeks and months since you’re a beginner so you can stick to day trading and scalp trading as mentioned here. Evaluation is a psychological phenomenon that consists of analyzing everything from your trade results and your crypto trading strategy to your mood and the market conditions you were trading in.

These are several metrics you can take leverage of while gradually learning what could have gone wrong and what did. This is an important feature in your crypto trading psychology that will teach you key insights such as profitability, maximum drawdowns, slippage, Sharpe ratio, annualized return, annualized volatility, and more which will help you realize the strengths and weaknesses in your crypto trading.

Key Takeaways of Crypto Trading

Overtrading can often lead to bad decisions and mental fatigue. Set specific times and do not check your trades repeatedly. Perform thorough market research as to where the market sentiments lie at the moment and then initiate trades. To avoid huge losses and inadvertent situations traders should focus on the following mentioned factors which are of grave necessity. Don’t be too emotional Don’t let fear and greed sink in Don’t stress out Overcome negative emotions while crypto trading. Don’t speculate just follow your strategy and exit on time Trade as if it were your profession Trade during favorable market conditions don’t trade more than what you are not willing to lose Practise, practice, and practice don’t be overconfident, don’t be too sure don’t get impatient don’t let outside influence such as social media, phone calls, and disturbance dictate your presence while on an active trade.