Quick Links

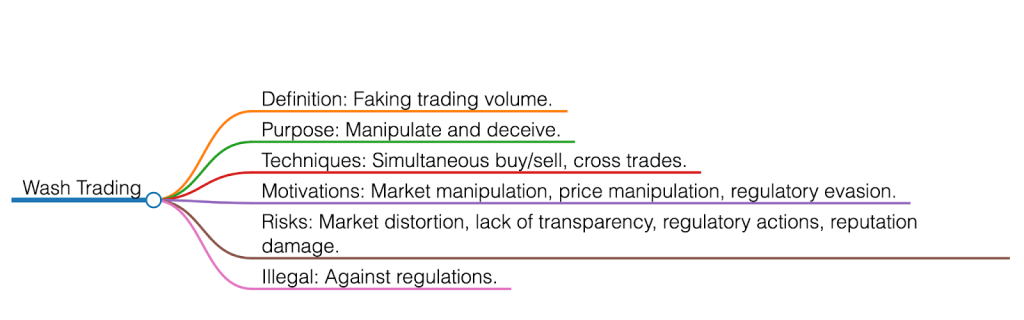

Wash trading is a deceptive tactic employed by individuals in the cryptocurrency space. It involves artificially inflating trading volumes by executing simultaneous buy and sell orders for the same asset. This deceptive practice creates the illusion of high market activity, but it is entirely fabricated. In this blog post, we’ll explain what wash trading is, how it affects the crypto market, and what steps are being taken to stop this shady behavior.

What is Wash Trading?

Wash trading is when someone buys and sells a financial asset to make it seem like actual trading is happening, but they’re just trading with themselves or their friends. This happens often in the crypto market because it’s less regulated than other financial markets. People engage in wash trading for different reasons, like creating the illusion of more trading activity or manipulating prices to make money.

How Wash Trading Works?

Traders use techniques like layering and spoofing to make wash trading look real. Layering means placing many orders at different prices to trick others into thinking there’s genuine interest in the asset. Spoofing involves placing big orders to manipulate prices and canceling them before they are executed.

Automated algorithms and trading bots also play a role in wash trading. These programs can make a lot of trades very quickly, which helps wash traders inflate trading volumes and manipulate prices.

Detecting Wash Trading Activities

Detecting wash trading in the crypto market can be tricky, but some signs can help identify suspicious behavior. High trading volumes with minimal price movements, consistent order placement and cancellation patterns, and unusual differences between buying and selling prices can be red flags. Data analysis techniques and machine learning algorithms are being developed to assist in the detection process. Studying real-life examples of wash trading incidents can also provide valuable insights.

Impact of Wash Trading on the Crypto Market

Wash trading has severe consequences for the crypto market:

- Distorted Trading Volume and Liquidity: Wash trading makes it seem like there’s more trading going on than there is. This can confuse investors and traders when they make decisions based on trading activity.

- Price Manipulation and Volatility: Wash trading can create false price movements and increase market volatility. Traders manipulate prices to make others panic or get excited, which leads to big swings in cryptocurrency prices.

- Damage to Market Integrity and Trust: Wash trading makes investors lose trust in the crypto market. People who suspect the market is being manipulated might not want to trade anymore. This hurts the growth and development of the market.

Preventive Measures and Regulatory Actions

To stop wash trading, different measures have been put in place:

- Initiatives by Crypto Exchanges: Many cryptocurrency exchanges use advanced technologies to detect and prevent wash trading. They’re also working with regulators to share information and improve their efforts against wash trading.

- Collaboration between Regulators and Exchanges: Regulators and exchanges work together to create rules and guidelines preventing wash trading. By sharing information and cooperating, they aim to make the trading environment more transparent and secure.

- Legal Consequences and Penalties: People who engage in wash trading can face severe penalties and legal action. Regulators impose strict punishments to deter others from doing it and to maintain market integrity.

- Technological Advancements: Technology is also being used to fight wash trading. Blockchain analytics and artificial intelligence are used to monitor trading activities, spot suspicious patterns, and take action to stop manipulative behavior.

Is Market Making and Wash Trading same?

They are not the same.

Market-making plays a vital role in keeping things running smoothly in financial markets. It involves specialized traders or companies that always ensure buyers and sellers are available for a particular asset. Their job is to provide liquidity by continuously offering to buy or sell the asset. They earn a small profit from the difference between the buying and selling prices.

Wash Trading is considered a shady practice. Some traders use this technique to create the illusion of activity in the market. They do this by simultaneously buying and selling the same asset or conspiring with others to give the impression of genuine interest. The purpose behind wash trading is to manipulate the market and deceive other traders by creating false liquidity or price movements.

It’s important to understand that market making is a legitimate and regulated practice that helps ensure smooth trading, while wash trading is illegal and unethical. Wash trading harms the integrity and transparency of the market, which is why it’s essential to promote fairness and transparency in financial markets.

Differences Between Wash Trading and Market Making

| Parameters | Wash Trading | Market Making |

| Definition | Artificially inflating trading volume or creating false market activity | Providing liquidity to the market by continuously quoting bid and ask prices |

| Objective | Create false liquidity or price movements | Provide liquidity and promote market efficiency |

| Purpose | Manipulate the market and deceive other participants | Facilitate smooth trading and ensure liquidity |

| Impact on the Market | Distorts market data and misleads investors | Enhances market efficiency and liquidity |

| Technique | Simultaneously buying and selling the same asset or coordinating trades with other parties | Quoting bid and ask prices continuously |

Conclusion

Wash trading is a big problem in the crypto market. Understanding its impact helps investors, traders, and regulators ensure fair and transparent trading practices. The crypto market can strive towards a healthier and more trustworthy ecosystem by taking preventive measures, collaborating between regulators and exchanges, and using advanced technologies. Combating wash trading requires constant vigilance and strong regulatory oversight.

In summary, wash trading is a bad practice where traders artificially inflate trading volumes to create a false sense of market activity. It distorts trading data, manipulates prices, and undermines the integrity of the crypto market.

However, measures are being taken to combat wash trading, including increased surveillance, collaboration between regulators and exchanges, strict penalties for offenders, and advancements in technology for better detection. By working together, the crypto market can become more transparent, secure, and attractive to investors and traders.

Remember, staying informed about these issues is essential to make wise investment decisions and contribute to a fair and trustworthy trading environment.