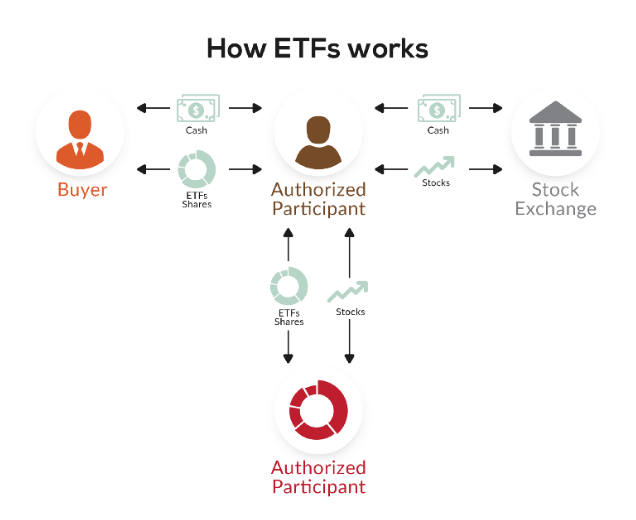

An Exchange Traded Fund or product (ETF-ETP) is a tax-efficient investment fund that tracks the price of an underlying security, cryptocurrency or index. The ETF is largely used in the traditional markets by pooling funds from various sources and purchasing tradable assets such as securities, shares, bonds and derivatives. The ETF funds are listed on stock exchanges and are available for buying and selling.

Exchange-traded funds pool the financial resources of several people and use them to purchase various tradable assets such as shares, debt securities, bonds, and derivatives. The company running this ETF owns the assets it is tracking where this ownership would be represented by shares. Investors would then purchase these shares and own these tokens indirectly thus unlocking the full value of the said tokens.

The ETF Mechanism

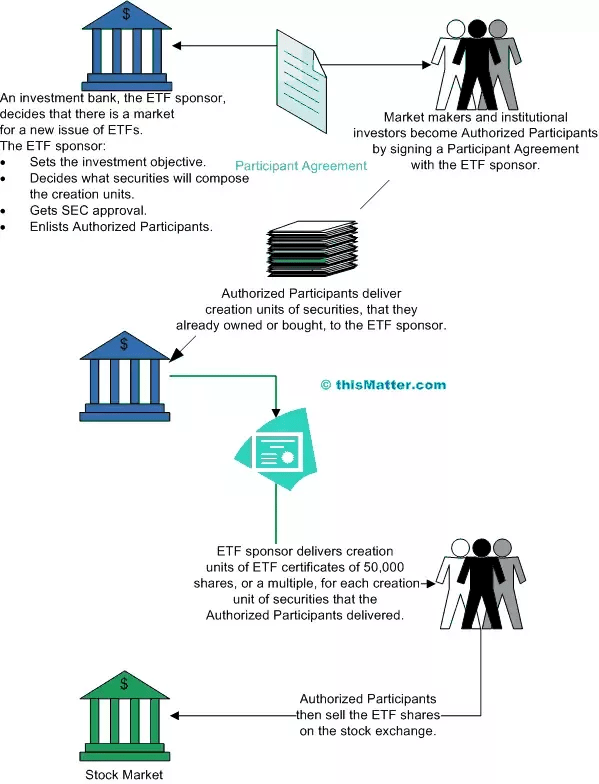

AP- Authorized participant, simply someone with a lot of buying power

The company leading an ETF will plan the number of assets in a pool and announce the number of shares or tokens it would be creating

The EFT then needs to be vetted by a regulatory body such as the SEC post which the ETF will be ready to sell its shares to the authorized participants.

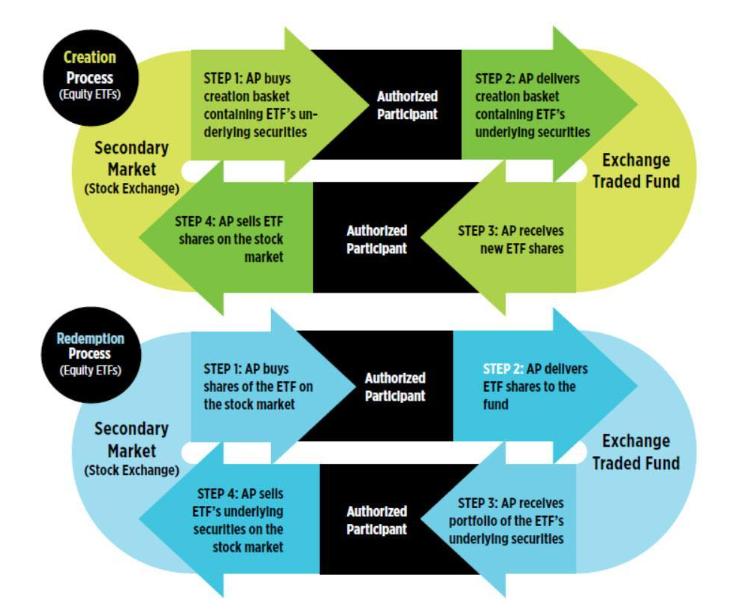

The third yet important aspect of an ETF is the Creation/redemption process which keeps ETF share prices trading in harmony with the fund’s underlying Net Asset Value or NAV. Creation units are traded for a similar number of the assets the share represents.

The introduction of Exchange Traded Funds to the crypto markets would solve major problems the retail-investor face when investing in digital assets. In crypto markets, ETP shares would highly simplify asset acquisition, custody, disposition, valuation, and hedging.

The investor gets a diverse portfolio of assets and Investing in such ETFs would help the investor spread her finances over equities of different crypto startups rather than relying on the performance of one company which usually comes with greater risks.

When you get so many assets in a huge basket, you are significantly diluting your risk exposure. So, if an asset in the fund collapses, you can recover that lost chunk with the growth of other assets in the fund.

Blockchain Exchange Traded Funds

Blockchain ETFs own stocks in companies that run on blockchain technology or in some way profit from it.

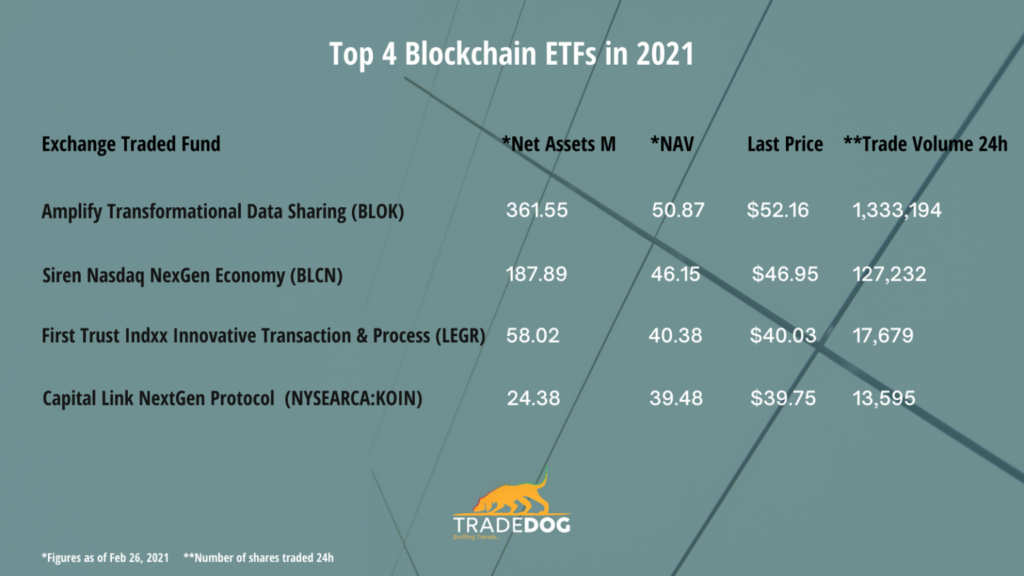

The 4 blockchains ETFs are as follows:

Amplify Transformational Data Sharing ETF (BLOK)

Reality Shares Nasdaq NexGen Economy ETF (BLCN)

First Trust Indxx Innovative Transaction & Process ETF (LEGR)

Capital Link NextGen Protocol ETF (NYSEARCA: KOIN)

World’s First Bitcoin ETF is in Canada

Purpose Investments has won the race to establish the world’s first Bitcoin ETF. The firm now has $594mn in AUM (assets under management) within a week of its start. The ETF hit a captivating $421.8 mn in AUM and is now also listed on the Toronto Stock Exchange with the BTCC ticker. This listing might open up new possibilities for more ETFs to appear and take the unclaimed front.

But things in the markets always operate at a breakneck pace, and the ones who cannot tailgate and overtake are the ones to suffer a huge whiplash.

Another ETF fund, Evolve Funds Group with over $1.7 billion in AUM has reduced its management fee on its own Bitcoin ETF EBIT. Evolve Funds has slashed its management fee from 1% to 0.75% and intends to take on the markets with its reduced fees.

The traditional ETF market is a huge $7.7 trillion industry and commands over $100bn of trade volume on a 24-hour basis. The advent of crypto ETFs and the rising popularity of digital assets can just barely scratch the surface of this macrocosm of financial markets. But increased crypto adoption through ETFs is imminent.

Benefits of an ETF at a glance

- Lower fees and additional management expenses as compared to traditional ETFs or even crypto exchanges and funds.

- Much more liquidity

- Passively managed ETFs invest only in the high-yield assets

- Offers easy access to assets without interacting with the actual crypto market

The SEC has been blockading and rejecting the listing of Exchange-traded funds on exchanges for many reasons, majorly because the investor could evade the legal framework associated with crypto investing. Many firms in the past have applied for an ETF but fell on deaf ears. The SEC has addressed the lack of transparency and surveillance as a major aspect of the disinterest. More instances of firms vocalising the need for an ETF can be found in this article.

After the Canadian ETF’s exceptional 7-day performance, The SEC could finally contemplate approving these instruments with staunch regulatory frameworks. But the advent of easily accessible crypto ETFs would help crypto oblivious people, retail investors, and even traders take advantage of an open, decentralized and transparent ecosystem without risking to extreme volatility.