Before cryptocurrencies boomed and became popular in the financial markets, there have been other commodities in the market that investors and traders alike have been trading on. Commodities like crude oil and gold have been the assets with the largest popularity among traders. For a long time, the debate about crypto being either just currencies or commodities has divided many financial experts on their opinions but this argument was seemingly put to bed in late 2014 when the US Commodity Futures Trading Commission (CFTC) declared Bitcoin and other crypto as commodities under the US Commodity Exchange Act.

Prosecuting fraud, manipulation, and other forms of abuse and illegalities are some reasons why cryptocurrencies were made commodities by the CFTC, but they however have instead had an impact that has to some extent transformed the regulated CFTC markets and even the agency itself.

It is a known fact that crude oil and its Derivatives are the most traded commodities in the world and there are costs attached to their exploration, refining, and even their use. The total global oil production was averaged at 76,124,800 barrels per day in 2020. Of this figure, approximately 71% came from the top ten oil-producing countries and an overlapping 36% came from the thirteen members of OPEC. In early 2007, oil prices that were about $50 dramatically rose to a high of $147 in July 2008, before falling sharply to US $34 in December 2008, because of the financial crisis of 2007–2008.

The COVID-19 caused crash

The breakout of the Coronavirus in 2020 caused a lot of harm to the global oil markets. Forced quarantines and movement restrictions left fewer cars on the road, thus, giving way to a massive economic meltdown. The confined life back then indicates that there was oil in abundance but people weren’t able to use it.

During the COVID-19 pandemic and in the middle of the 2020 Russia–Saudi oil price war, WTI Crude futures contracts fell below $0 for the first time on April 20, 2020. The following day, Brent Crude fell below $20 per barrel. These crises resulted in the biggest crashes in oil prices and the demand for oil reduced greatly. As oil prices crashed to astonishing lows, there was a scamper to hedge funds. “Usually when oil is cheap, the dollar is stronger. But we haven’t seen that in this crisis because of the Coronavirus,” said Fado Aboualfa, Managing Director of the MEES energy newsletter.

Big oil-producing nations like Russia, Iran, and China have even explored the option of using cryptocurrencies to navigate around sanctions that may result from deals related to the oil markets or other commodities. “Big crypto mining pools are rejecting Iranian miners because of sanctions,” said Mikhael Jerlis, CEO of the Russian EMCD.IO mining pool to the fact that the sentiment then was that of outright defiance. “We don’t give a damn about sanctions. If we get sanctioned we’d just shut down the company and open a new one.”

However, oil prices have been recovering since restrictions on movements began lifting around the world. On July 1, 2021, oil prices broke to a near three-year-high above $75 a barrel ahead of a decision from key producers on production policy for the second half of 2021. At the time of writing this report, the price of oil was $67.

Adoption of Bitcoin

During this period of oil falling and recovering, Bitcoin and other cryptocurrencies have increased in popularity as a lot of traders saw these commodities as a way of hedging their funds and discovering other investment opportunities. The asset class has seen an adoption rate so fast that it’s said to be beating that of the Internet.

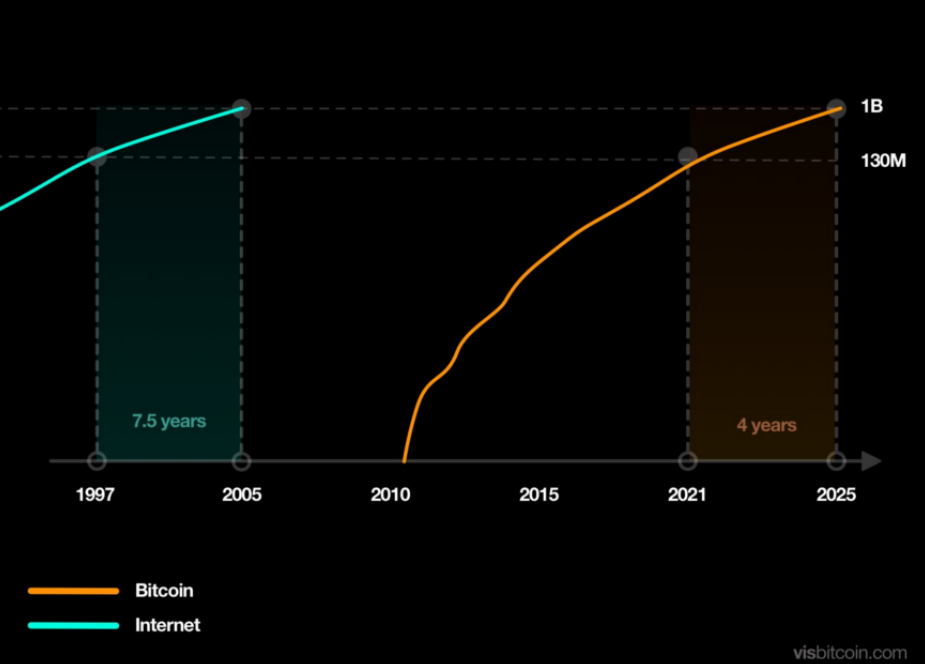

Blockchain technology has had increased adoption ever since Bitcoin was first incepted in 2009. In only 12 years, the crypto asset has reached 135 million users with projections to have 1 billion users by 2025 according to Michael Levin, a former employee at Google. “Despite the fear-mongering, Bitcoin, like all innovative technologies before it, is following a predictable and transparent adoption curve, albeit, at an accelerated rate,” Levin said.

In the chart above, it is possible to determine that when the Internet was at this same point in its adoption curve, it took about 7.5 years to reach 1 billion users. BTC is on its way to doing the same almost half the time.

Bitcoin dominance, which is the ratio of cryptocurrency’s total value to the overall market capitalization of digital assets, was at its lowest level in May 2021 since April 2018. The declining dominance ratio suggested that traders were rotating into altcoins such as Ether (ETH), Dogecoin, Binance coin (BNB), etc. This isn’t a bad thing for cryptocurrencies as it showed that people saw other viable investment opportunities in projects and digital assets outside of Bitcoin, hence, keeping those investments in the space.

Conclusion

There is indeed a lot of hype around cryptocurrencies, but that hype has proven to be accurate. Cryptocurrencies have given the world something that had never existed before; an alternative to financial transactions. The people have seen how they can carry out transactions and exchange services and values without reporting or being held to ransom by a central body. There’s a freedom that crypto transactions have given people that is thoroughly enjoyable and has got a lot of people wanting more. Now, the big players in the financial sphere are wanting a taste of the action and are steadily adopting these crypto. The adoption rate will definitely increase as more and more solutions to traditional finance problems are offered in this alternative financial world we’ve discovered.