Ethereum has to date emerged as the global infrastructure provider in the Blockchain ecosystem allowing the DeFi and other applications to be built on it. It’s novel and first of its own kind smart contract architecture enables the two parties to transact with each other eliminating the need to trust any third party.

Follow TradeDog for more insights on Twitter and Tradingview.

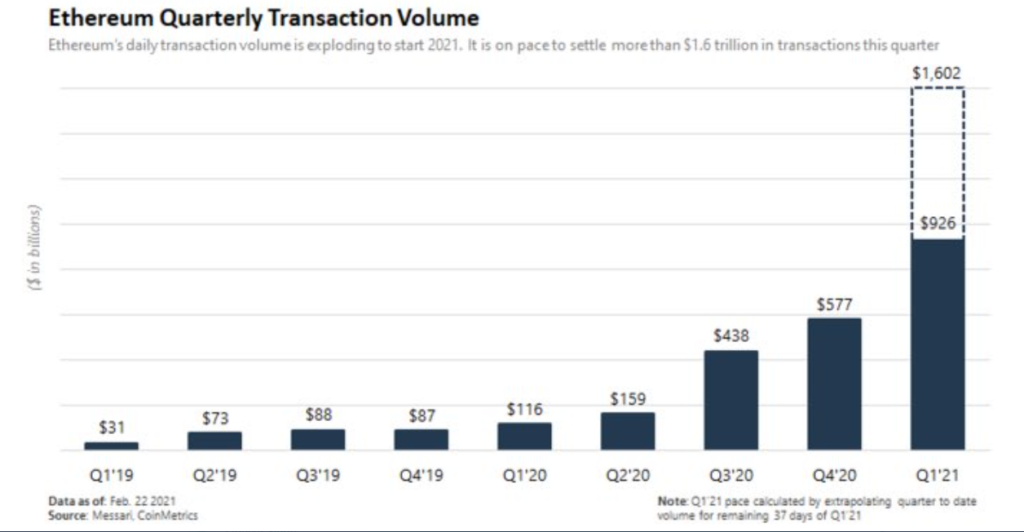

With the governments across the globe being in a doldrum on their stand on cryptocurrency, the people have shown faith and trust in this evolving technology. This hypothesis can be realised by the fact that the Ethereum network is forecasted to settle $1.6 trillion ($1,600,000 M) in transactions for the first quarter of 2021, according to Messari.

As per the data from Statista, the total transaction value in the Digital Payments segment is forecasted to reach $6,685,102 M in 2021. If we generalize the quarterly forecast for the year, Ethereum would be transacting $6,400,000 M which comes out to be ~95% of the total transactions in the Digital segment as forecasted by Statista.

The analysis of the above data lights the way forward for the growth of the Ethereum network and also helps to realize the future prospects of the crypto ecosystem.

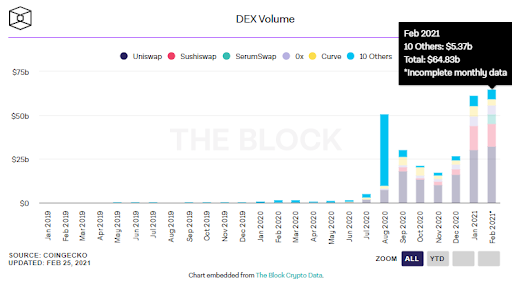

With the Decentralized exchanges (DEXs) built on Ethereum being the current theme in the crypto space, DEX volumes surpassed $120 B in 2021. They are set to end February with the record highest monthly volume. To date in February, monthly volume stands at $64.83 B crushing the previous all-time high volumes of $61.16 B in January.

As per Cryptofees.info, Ethereum has reported an average daily fee of $32 M over the past seven days of which the DEXs- Uniswap and Sushiswap cumulatively account for ~17% of the fees generated on Ethereum. The adoption of DEXs by the crypto community as an alternative way to trade crypto has been rising at an escalating pace since the launch of the first DEX.

Conclusion

As per the reports in the Wall Street Journal, “Visa Inc. and Mastercard Inc. are planning to raise swipe fees for some types of credit-card purchases in April”. The rise in fees by these traditional giants of the credit card industry will encourage the adoption of crypto as an alternative means of payment, boundless by the political demarcation of the countries. With the ETH 2.0 scheduled in the roadmap of Ethereum, the consequence of which will be a multifold decrease in the transaction fees, it will make Ethereum the payment network for the future accelerated by the DeFi ecosystem being built on it.