Quick Links

Until recently, the primary use case of Bitcoin was primarily viewed as digital gold, and its uses were limited as a store of value and medium of exchange. The game-changer innovation of Ordinals Protocol by Bitcoin Core contributor Casey Rodarmor has allowed developers to innovate on top of the Bitcoin blockchain and create NFTs and fungible tokens. Within two months of launch, these tokens caused a stir in the Bitcoin blockchain, which we will understand in detail here.

What is BRC 20 Token?

In March 2023, a Twitter user with the handle @domodata created the BRC-20 token, an experimental fungible token based on the Bitcoin blockchain. With this token standard, developers can quickly build and transact tokens using the Ordinals platform. Although modeled after the Ethereum ERC-20 token, the two token types differ fundamentally. Unlike ERC-20 tokens, BRC-20 tokens do not rely on smart contracts to operate. They can only be traded or minted using a Bitcoin wallet.

How did it come into existence?

To understand the origin of BRC 20, we need to understand ordinals. Combining the two upgrades of Segwit (2017) and Taproot (2021) utilizing the Bitcoin network, Ordinals Protocol was launched in the mainnet in January 2023. It is a Layer 1 protocol that allots a unique number to each satoshi minted and inscribes additional data in a satoshi in the form of images, text, video, and applications, eventually leading to the first-ever Bitcoin NFT. The popularity of ordinals has increased since the time of launch. It has attracted attention from NFT giant Yuga Labs, who announced to release of a series of NFTs called TwelveFold using the Ordinals Protocol.

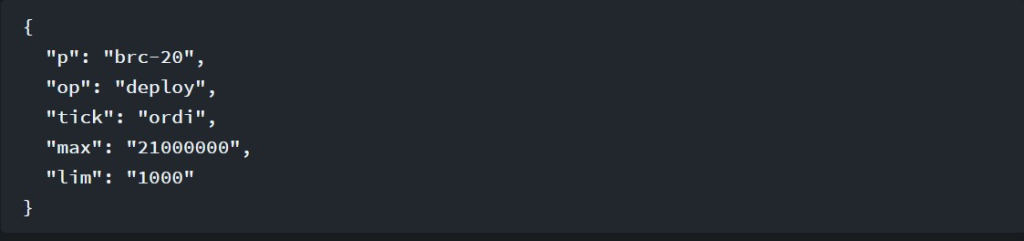

Using the same ordinal inscriptions, Domo proposed to launch fungible tokens on Bitcoin by attributing JSON data in satoshis, allowing users to deploy, mint, and transfer tokens. ‘Ordi’ was one of the first tokens to be launched, with a maximum limit of 21,000,000, making up 67% of the total market cap of BRC tokens.

Need of BRC 20 Tokens

The main objective of these tokens is to analyze the possibility for users to issue and transfer fungible tokens on the Bitcoin chain. Although having no significant utility, these tokens have garnered immense popularity fueled by their respective communities and value of bitcoin. As of writing, there are approximately 24,677 BRC-20 tokens in circulation, with a majority falling under the category of meme tokens. You can keep a track of the number of BRC 20 tokens launched here.

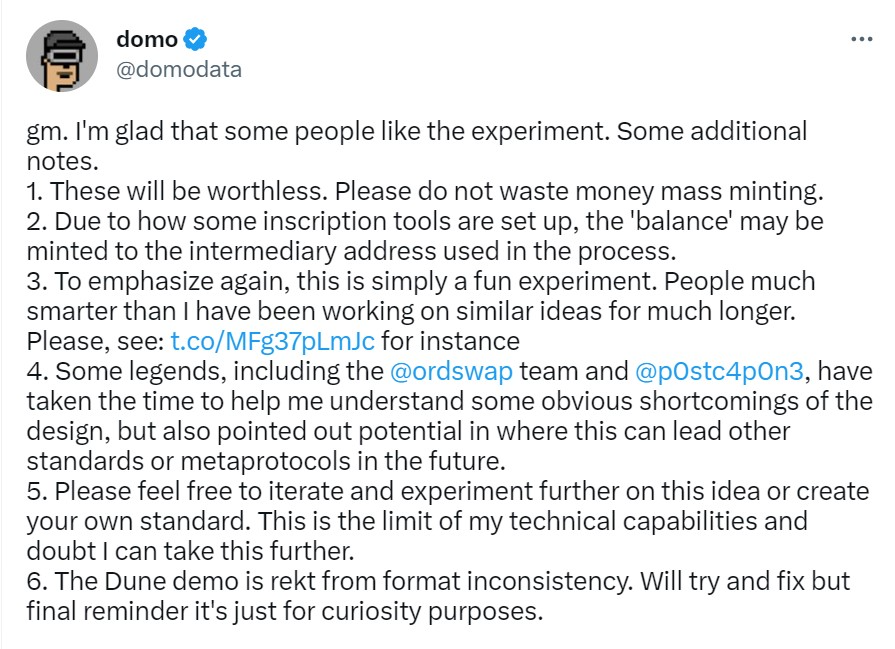

Domo has explicitly mentioned that these tokens are just a fun experiment and have no inherent value and, therefore, should not be used as a basis for making financial decisions. He highlighted the need for improvement in its design structure that poses a risk to anyone engaging in trading activities. However, developers can use it to reiterate and experiment further to refine and create their standards.

On Chain Analysis of BRC-20 Tokens

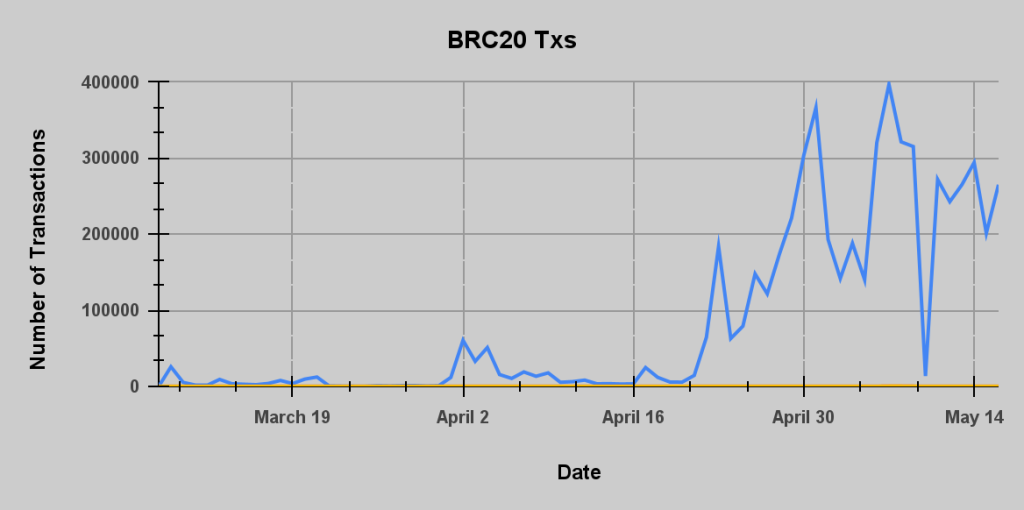

Number of Transactions

The chart represents the number of transactions using BRC20 tokens from the date of launch till date. The token volume peaked on May 7 at 396763 transactions and represented 65% of the overall activity in the blockchain. Moreover, overall the total number of BRC20 transactions has exceeded 6 million. For the first time since 2017, miners profited more from processing transactions than minting new BTC.

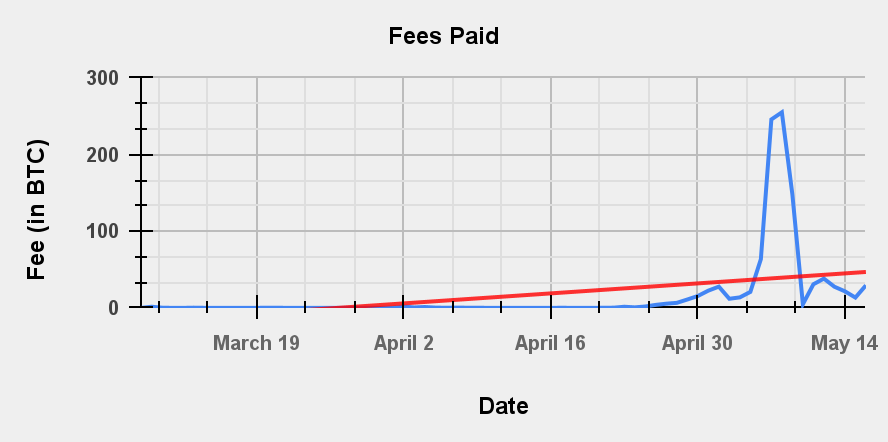

Fees Paid in BRC20 Transactions

The chart represents the fees incurred by users in BTC involved in BRC20 transactions. Unlike other conventional token standards, the data in Bitcoin is stored on-chain, which has led to a surge in block space demand, eventually leading to a hike in transaction fees.

Earlier, the fees paid per transaction usually ranged from $1- $2. However, due to a long queue of pending transactions and network congestion, the fees rose to approximately $31 on May 8. However, within the last three days, the fees have fallen by more than 80%, with user activity declining.

Impact of BRC 20 Tokens

Though launched as only an experiment, these tokens have become widely popular among crypto enthusiasts, with the total market capitalization crossing the $1B mark on May 7. The primary reason attributed to the Bitcoin blockchain is that it is considered the most valuable, decentralized, and secure network. The Bitcoiners were excited to find more to Bitcoin beyond its traditional use cases. They jumped over to participate in the BRC20 token activity. The recent memecoin craze in other blockchains also added to the popularity of BRC tokens, which comprise most meme coins.

However, these tokens’ activity level added more stress to the Bitcoin blockchain as it was overwhelmed by the increasing number of transactions. The network was reported to have over 300,000 transactions pending in queues which eventually led to an increase in the transaction fees and confirmation time. Moreover, one of the largest crypto-centralized exchanges, Binance, stopped withdrawals of Bitcoin twice within 12 hours due to a congestion issue.

The hype of these tokens was short-lived and faced a sharp decline in its market cap from $1B to $500M in a week. The token needed a clear roadmap or a significant utility for it to maintain its position in the long term. Moreover, there were several vulnerabilities and concerns regarding the security of the project, or it could be a ‘pump and dump’ scheme led by large investors to artificially inflate the price of a cryptocurrency before selling it at a profit.

Conclusion

The development of these tokens has gained mixed sentiments from users. While some are positive about new developments in the blockchain, some have criticized it for clogging the network activity and polluting the network with data not aligned with Nakamoto’s mission of building a peer-to-peer network. Despite the massive popularity, the users must be cautious that it was just an experiment and evaluate their risks when investing in these tokens.