Quick Links

Institutionalizing cryptocurrencies, or adopting digital assets by traditional financial institutions and large corporations, has become increasingly important in recent years. This trend has been driven by various factors, including the growing mainstream acceptance of cryptocurrencies, increased regulatory clarity, and the potential for digital assets to hedge against inflation and geopolitical risks. According to a survey conducted by Coinbase Institutional in 2022, 62% of institutional investors invested in crypto had increased their allocations over the past 12 months. Furthermore, a majority of the participants, 58%, expressed their intention to augment their portfolio’s exposure to cryptocurrencies in the coming three years. Almost half agreed strongly that digital assets’ valuations would surge in the long run.

However, a JPMorgan Chase & Co. survey at the start of the year stated that 72% of institutional traders, out of the 835 surveyed, “have no plans to trade crypto” in 2023. Only 8% said they currently trade crypto and digital coins, and 14% said they plan to in the next five years.

Latest Institutional Fund Flow in Digital Assets

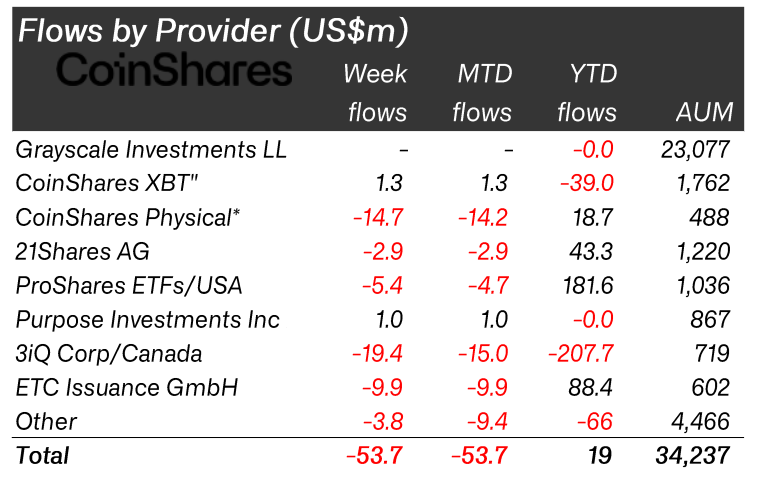

Overall, in the past week, digital asset investment products saw outflows totalling $54 million, representing the 3rd consecutive week of negative sentiment for the asset class.

For the majority of the digital assets investment provider, the weekly flow was negative. 3iQ Corp faced a significant outflow of $19.40 million during the past week. Taking regions into consideration, the majority of outflows were from Germany and Canada with $27 million and $20 million, respectively. However, it is worth noting that the year-to-date flows remain positive for some of these providers including CoinShares, 21Shares, ProShares ETFs, and ETC Issuance. The overall YTD flow remained positive with a $19 million investment received.

So, one might sense that the institutionalization of cryptocurrencies in 2023 might have been skeptical. But certainly, that’s not the whole picture. Institutions including PayPal and Microstrategy have shown increased holdings and interest in digital assets this year.

PayPal and Microstrategy: Leading Institution Adoption in 2023

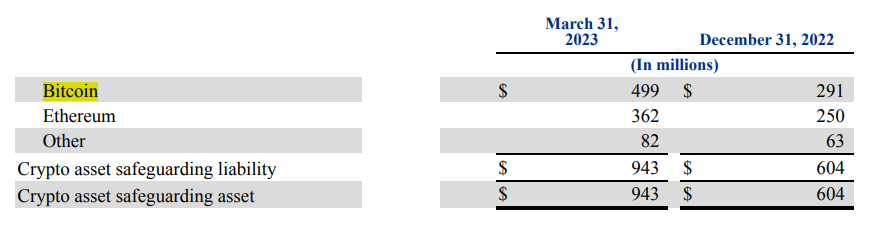

PayPal recently disclosed its cryptocurrency holdings in a quarterly report filed to the United States Securities and Exchange Commission. The filings show a 56% increase over its previous quarter where PayPal disclosed $604 million as compared to a combined total of $943 million in crypto assets as of March 31. The total reported financial liabilities for PayPal in Q1 were $1.2 billion, with crypto assets making up 77.90%.

The asset breakdown for PayPal includes $499 million in Bitcoin, $362 million in Ethereum, $82 million in Bitcoin Cash, and Litecoin.

Alongside, Microstrategy is again buying Bitcoin and making its financial health increasingly aligned with the largest cryptocurrency. MicroStrategy reported that it purchased approximately 1,045 Bitcoins for approximately $29.3 million in cash, including fees and expenses, between March 24 and April 4. The average price paid for each Bitcoin was roughly $28,016. As a result, MicroStrategy and its subsidiaries now possess around 140,000 Bitcoins, which are valued at approximately $3.9 billion.

However, the aggregate purchase price of all the acquired Bitcoins is $4.17 billion, with an average cost per coin of around $29,803, indicating that the company’s Bitcoin holdings are currently valued at a lower price than the total amount invested.

Closing Thoughts

In conclusion, the institutionalization of cryptocurrencies has been a hot topic in the financial world, with both positive and negative sentiments surrounding it. While some institutional investors have shown reluctance to invest in digital assets, others such as PayPal and Microstrategy have increased their holdings and demonstrated interest in cryptocurrencies. The trend of institutionalization has been driven by factors such as regulatory clarity, mainstream acceptance, and the potential for digital assets to serve as a hedge against geopolitical risks and inflation. Although the past three weeks have seen negative sentiment for digital assets, the year-to-date flows remain positive for some providers. The adoption of digital assets by traditional financial institutions and corporations is a complex and evolving process that is likely to continue shaping the future of the financial landscape.