Quick Links

With the transition to a PoS mechanism in Sept 2022 and the implementation of the Shanghai/Capella upgrade in April 2023, the Ethereum blockchain has garnered attention from more users to participate in staking and validating transactions. Though the upgrade solves the liquidity problem by allowing users to withdraw staked tokens, the minimum eligibility of staking is 32 ETH, and the technical complexities of maintaining software to provide timely attestations are in the way of the users’ ability and willingness to stake.

Recap of Liquid Staking

Consequently, liquid staking became the preferred method of Ethereum staking, where 37% of all staked ETH flows through it. Liquid staking is a third-party staking service that allows users to participate in staking without restriction on a high minimum deposit or maintaining a robust software system. They can deposit the network tokens in which they want to participate in staking with the liquid staking protocols, which appoint professional node operators to perform staking on behalf of depositors. In return, a certain % of the staking yield is given to the node operators. At the same time, the depositors receive a liquid staking token representing their claim on the deposited assets and yield. Moreover, the LS tokens can also be traded or used as collateral in popular DeFi protocols.

To onboard the next billion users to staking and DeFi, Stader Labs will launch an Ethereum liquid staking token soon. This noncustodial liquid staking platform is operational on six chains, including Polygon, Fantom, BNB, NEAR, Hedera, and Terra 2.0. It has already grown a community of 150K+ members and is trusted by 70+ wallets. Let’s delve into the details of this token and explore its potential to compete with major protocols like Lido, Rocketpool, and Frax, which have already captured a significant market share.

ETHx Token

ETHx is an ERC-20 standard token that serves as a receipt for staked Ether coins on Stader, which can be used in DeFi protocols to earn additional rewards and can be traded and used to transfer ownership of staked tokens. The value of these tokens increases as the staking rewards, MEV, and tips are earned through staked ETH.

Challenges in Ethereum Staking

ETHx aims to bring unique benefits to the ETH community by overcoming challenges in the current state of Ethereum Staking. First, Let’s understand the problems in detail to understand their value proposition better.

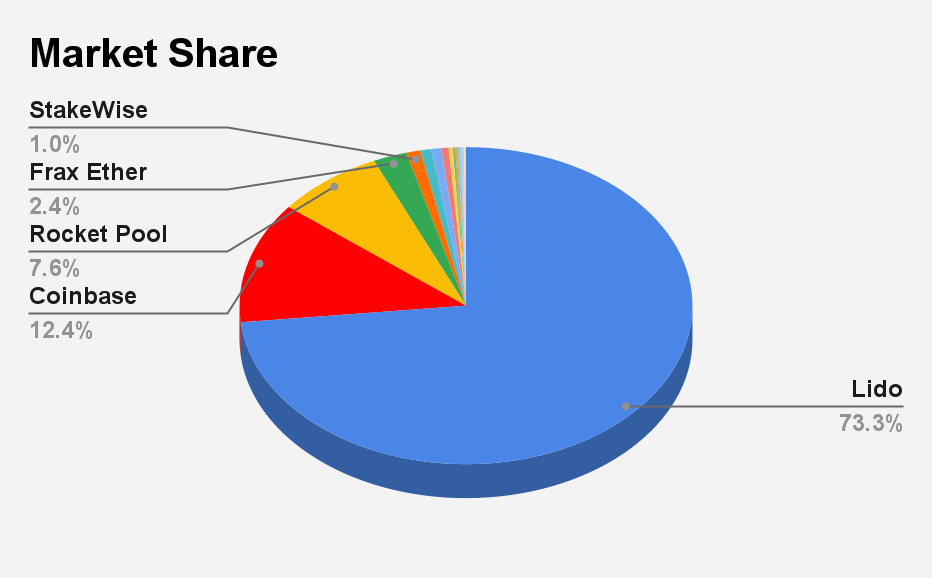

(I) Concentration of Staked ETH: As we can observe through the data presented by DeFiLlama, there is a high concentration of staked tokens within a few LSDs, with Lido Finance leading by capturing 73% of the market share with 6,660,892 staked ETH, which hampers decentralization of network aimed to achieve through PoS mechanism.

(II) Eligibility for Node Operator: These node operators are granted permission to validate transactions and blocks but must meet the eligibility criteria of their working protocol. The top LSD protocols follow a robust process to approve operators like Lido whitelists by evaluating them on several factors, including reputation and past performance. At the same time, Rocketpool requires them to deposit a minimum of 16 ETH bonds.

(III) Inadequate DeFi Acceptance: There need to be more DeFi integrations with liquid staking platforms, making it unattractive for users to stake through them.

ETHx aims to bring unique benefits to the ETH community by overcoming a series of challenges in the current state of Ethereum Staking. Let’s first understand the problems in detail to understand their value proposition better.

Value Proposition of ETHx

ETHx overcomes these challenges and ensures more comprehensive decentralization by adopting a multi-pool architecture which means operating permission and permissionless pool.

- Permissioned Pool

These operators will be reputed entities with a track record of high performance and a good reputation in the market. They will not have any bonding requirement similar to the policies followed by other LSDs in the ecosystem.

- Permissionless Pool

Protocols like RocketPool have appointed permissionless node operators where they are not required to have a proven track record of performance or prior reputation but have a high bond limit which serves as collateral if any operator validates blocks in bad faith. Considering it a capital-inefficient method, StaderLabs conducted research alongside SSV where they stimulated worst-case scenarios of validator mal performance, including MEV theft, slashing events, and more, to find the suitable bonding requirement to keep the users’ funds safe. Hence, the operators must deposit as low as 4 ETH and 0.4 ETH worth of $SD (governance token) per validator to protect user funds from key tail risks.

- DVT Pool

Many node operators are discouraged from participating in staking because penalties are charged due to technical complexities like software or hardware issues, cloud failures, or double signing. The development of Distributed Validator Technology (DVT) allows the duties of a validator to be distributed among multiple nodes, thereby avoiding the issue of a single point of failure and encouraging more participation in staking. StaderLabs is currently testing this technology with a leading DVT protocol, SSV, and has received a grant from them, and they will adopt this as soon as it is considered stable.

- Staking Yield

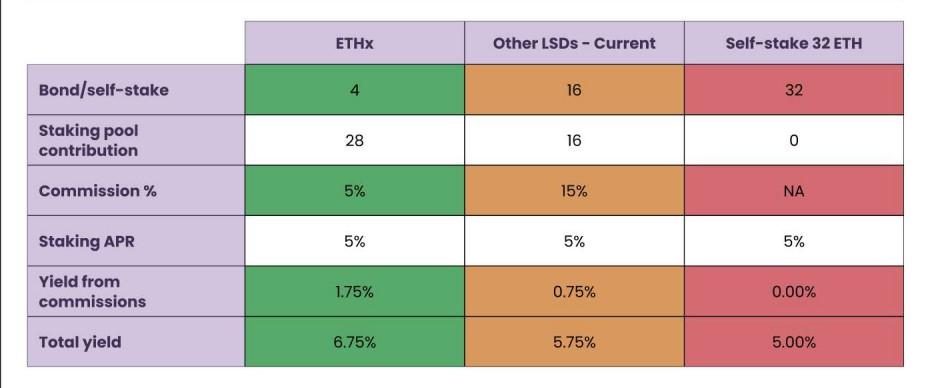

ETHx aims to generate maximum yield for its node operators, with permission node operators earning a commission of 5% on staking rewards, MEV, and tips. In the case of permissionless stakers or home stakers, though the commission is fixed at 5%, they make a higher figure, as represented in the table below.

ETHx home stakers have to deposit 4 ETH, and the other 28 ETH is contributed from the deposited pool by Stader to make a whole 32 ETH and become an eligible validator on Ethereum. A total of 10% is charged from depositors for staking services, of which 5% is given to node operators, and Stader directly reserves the rest. Stader further incentivizes the node operators from their commissions, calculated here as around 1.75%.

- DeFi Integrations

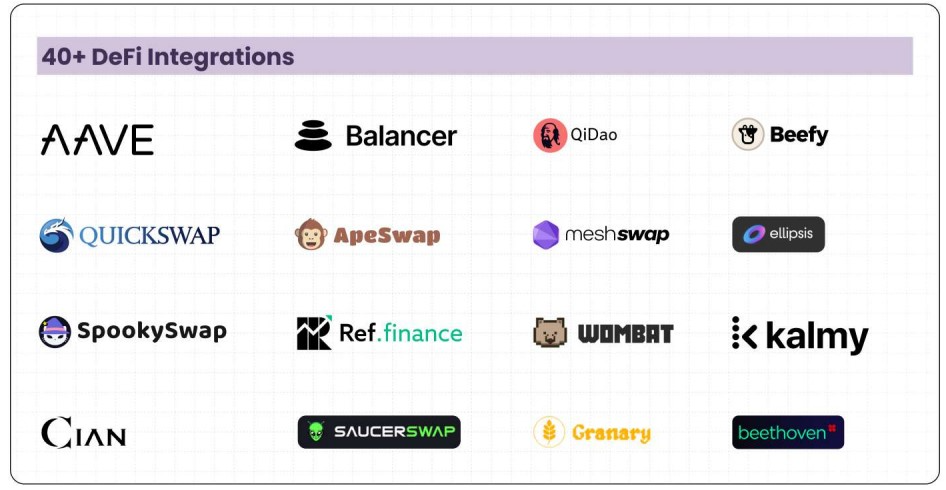

The LSD tokens allow users to trade or use them as collateral in DeFi protocols. This utility will only be fruitful for stakers if the protocol has integrated with popular DeFi protocols allowing them to make maximum yield. Stader is connected with 40+ protocols, including AAVE (v3 on Polygon), Balancer (on Polygon), Beefy (across chains), QiDAO (on Polygon), Apeswap (BNB), BeethovenX (Fantom), Ref Finance (Near) and more.

Comparative Analysis of ETHx and Top LSD

| Basis | Stader Labs | Lido Finance | Rocket Pool |

| Node Operator Type | Hybrid (Both Permissioned and Permissionless) | Permissioned | Permissionless |

| Node Operator Number (As of Dec’22) | In Process | 29 | 1410+ |

| Bond Requirement | 4 ETH | – | 16 ETH | Minimum Pool – 8 ETH |

| Minimum bond in protocol governance tokens (in ETH) | 0.4 | – | 1.6 Minimum Pool – 2.4 |

| Staking Yield | – | 6.36% (Mean of Feb-May) | 4.53% (Mean of Feb-May) |

| DVT Pool | Test Mode | Test Mode | Test Mode |

- Node Operator

Lido Finance has Ether worth more than $12.45 billion locked in the protocol for staking but managed by only 29 operators. In comparison, Rocketpool has $1.7 billion locked and being managed by more than 1400 operators. It clearly shows the current system of Ethereum staking is highly centralized, and the hybrid pool system by StaderLabs can make the staking more decentralized.

- Bond Requirement

Though Rocket Pool offers an option of a mini pool with a minimum requirement of only 8 ETH, Staderlabs has further eliminated the barrier to becoming a node operator with a minimum deposit of only 4.4 ETH.

- Staking Yield

The yield generated by the pool is essential when liquid stakers consider the protocol they want to stake in. While Lido Finance has earned an average return of 6.36% for the depositors, Rocketpool has generated a yield of 4.53%. ETHx is in Beta Stage now and will launch soon on the mainnet.

Conclusion

An efficient liquid staking protocol must ensure decentralization to the blockchain network and the best available staking yield and DeFi opportunities to its users, which the ETHx token aims to achieve. In just two years, Stader has gained significant traction through other chains with a Total TVL of $108.9M. Backed by renowned investors such as Coinbase Ventures, Amber, Jump Capital, Pantera Capital, and Three Arrows Capital, among others, it will be interesting to observe the user sentiments, rate of adoption of ETHx, and the impact on Ethereum Staking system for decentralization.