Quick Links

As the cryptocurrency world navigates the uncharted territory of the 2023 liquidity crunch, it has left even top-tier exchanges and market makers reeling, which has particular implications for Bitcoin and Ethereum, the two largest cryptocurrency market capitalization. This article explores the details of these effects and how they change the landscape of these leading digital assets.

Understanding the Liquidity Crunch

Before delving into the impact on Bitcoin and Ethereum, it’s essential to understand the liquidity crunch itself. In financial parlance, liquidity signifies how easily an asset can be bought or sold without causing drastic price changes. As the name suggests, a liquidity crunch is a scenario where the number of willing buyers or sellers drastically reduces, leading to volatility in asset prices and hampering the ease of trading.

The Bitcoin Scenario

Bitcoin, as the premier and most prominent cryptocurrency, has been a significant casualty of the liquidity crunch. Despite its widespread acceptance and high market cap, Bitcoin has yet to be immune to this crisis.

Market data from 2023 shows a marked drop in Bitcoin trading volumes, even on prominent exchanges like Binance, Coinbase, and Kraken. This reduction in trading volume indicates that many Bitcoin holders choose to hold onto their assets rather than trade them, contributing to the liquidity crisis. This hoarding tendency worsens price volatility, leading to more significant price swings that can happen in brief periods.

Ethereum and the Liquidity Issue

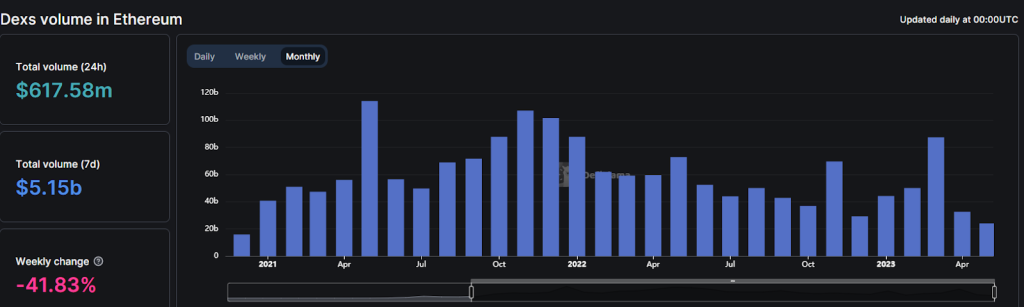

Ethereum, the second-largest cryptocurrency by market cap, also feels the liquidity crunch’s sting. Known for its smart contract functionality, Ethereum has nurtured a thriving ecosystem of decentralized applications (dApps). Yet, the liquidity crunch has led to similar challenges as Bitcoin faces.

Ethereum’s trading volumes have also significantly dipped, and transaction execution has become more complex. The reduced trading activity also impacts the broader ecosystem, as many Ethereum-based tokens suffer from a liquidity perspective. The volatility of Ethereum’s price has also been on the rise, leading to unexpected price movements and an overall sense of uncertainty.

The Causes

Several factors have contributed to the 2023 crypto liquidity crunch. The primary cause has been the large-scale withdrawal of cryptocurrencies from exchanges. This trend was observed across multiple exchanges, as evidenced by on-chain data.

According to the data provided by Savvy Trader AI, the total amount of Bitcoin held on exchanges has decreased by 20% since the beginning of the year. Similarly, Ethereum holdings on exchanges have seen a reduction of 25%. This withdrawal of assets from exchanges has resulted in a reduced supply available for trading, thereby contributing to the liquidity crunch.

Another contributing factor has been the increasing adoption of decentralized finance (DeFi) applications. As more users lock their assets in DeFi protocols for yield farming and other purposes, the amount of liquid assets available on centralized exchanges decreases.

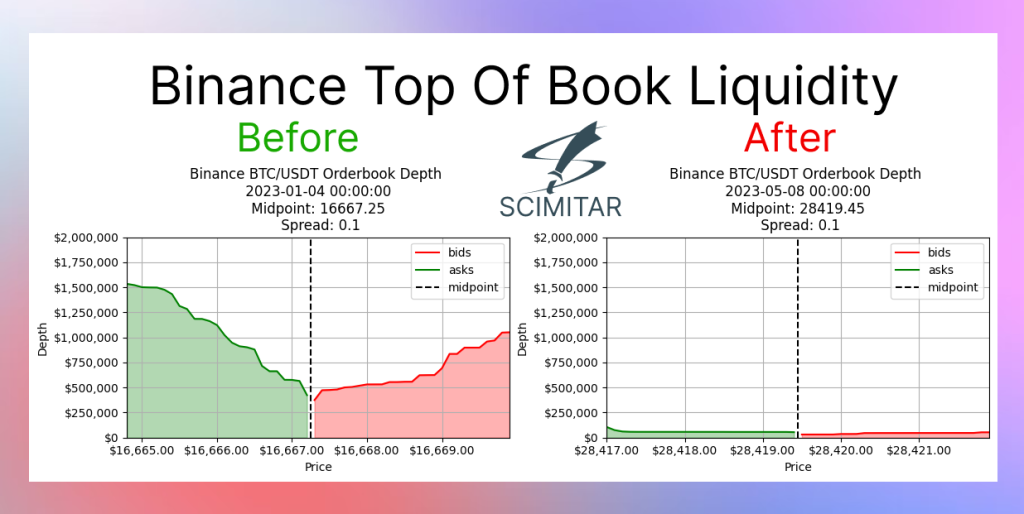

Market Makers’ Predicament

Market makers, who play a crucial role in providing liquidity, are in a precarious position. In the face of tighter spreads, heightened regulatory pressures, and decreased trader confidence, their ability to add liquidity to the Bitcoin and Ethereum markets is significantly reduced. This change has further deepened the liquidity crisis, creating a cycle that’s difficult to break.

Looking Ahead

Navigating through this liquidity crunch requires a concerted effort from all market participants. Clear and balanced regulatory guidelines, incentives for market makers, and initiatives to bolster trader confidence are just some of the steps that could alleviate the current crisis.

While the liquidity crunch presents challenges, it also offers opportunities. The reduced liquidity and increased volatility can create profitable trading opportunities for those who can effectively manage risk.

Moreover, the liquidity crunch may also spur innovation in the cryptocurrency market. Exchanges and other market participants may develop new solutions to increase liquidity, such as incentivizing market makers or creating new financial products.

Additionally, for Bitcoin and Ethereum, building upon their unique strengths could also help. For Bitcoin, promoting its potential as ‘digital gold’ and a hedge against inflation could encourage more liquidity. For Ethereum, the continued development of its dApps ecosystem and the upcoming Ethereum 2.0 upgrade could provide the boost needed to navigate through these rough waters.

In conclusion, the liquidity crunch of 2023 presents a complex challenge for the entire crypto sphere, including Bitcoin and Ethereum. However, this crisis also serves as a rallying point for collective action and strategic initiatives to foster a robust, resilient, and liquid cryptocurrency market.