Decentralized finance (DeFi) is a dynamic domain, constantly witnessing the advent of innovative platforms and technologies. One such groundbreaking platform is SmarDex, a decentralized exchange (DEX) set to redefine the DeFi ecosystem.

An Introduction to SmarDex

SmarDex is a decentralized exchange built on an open-source smart contract. It allows users to trade decentralized tokens without the intervention of a centralized authority. As an automated market maker, SmarDex encourages users to contribute liquidity, rewarding them with a portion of fees or tokens.

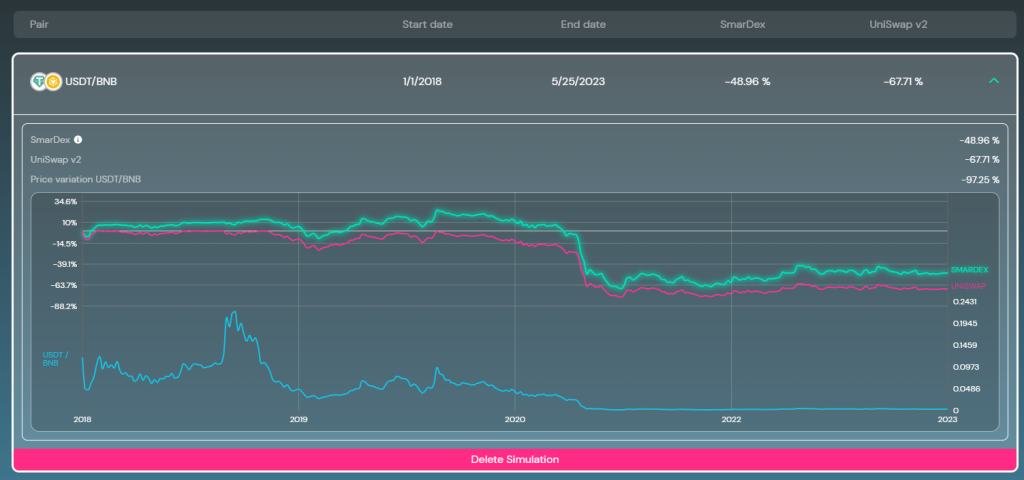

A standout feature of SmarDex is its unique strategy to tackle a significant hurdle in DeFi: impermanent loss. Impermanent loss is a potential risk arising due to the price fluctuation of tokens when deposited in the pool. While most DEXs attempt to offset this risk with trading fees and other rewards, the threat persists for market makers in a DeFi system.

The Functioning of SmarDex

SmarDex addresses the impermanent loss issue by managing liquidity through a fictive reserve (FR) concept. By altering the k constant rule of the traditional DEX model, SmarDex handles liquidity in a novel way. It aims to sustain long-term balance while minimizing impermanent loss and potentially creating impermanent gains.

SmarDex’s liquidity pools enable users to contribute liquidity by depositing tokens. Like other DeFi protocols, it also allows users to earn passive income via staking and farming. When users purchase tokens from a pool at a specific price and sell them in another pool at a different price, it leads to an imbalance between the pools. In such a scenario, the fictive reserve employs two distinct liquidity reserves. SmarDex’s pools automatically determine which token’s price increases and initially sell less of it. By selling the appreciating token at a higher price later, liquidity providers can reduce losses and may even experience impermanent gains.

The Role of SDEX Token

The primary token of SmarDex is SDEX. Users can stake SDEX to earn passive income from farming rewards and protocol fees. A 0.05% fee on each SmarDex transaction is assigned to liquidity providers contributing to the respective trading pair. In comparison, an additional 0.02% is converted into SDEX and distributed as rewards to all stakers based on their stake’s weight.

The total supply of SDEX is 10 billion tokens, with 50% allocated to the initial liquidity pool, 37.5% reserved for long-term farming yield and staking rewards over the next decade, and 12.5% distributed to early adopters during a boost period. Furthermore, SDEX is set to become deflationary soon, as a portion of the supply will be burned for each transaction on every chain except Ethereum.

Wrapping Up

SmarDex is all set to bring a revolution in the DeFi space. By mitigating or even reversing the issue of impermanent loss, SmarDex holds the potential to surpass all other DEXs. As the DeFi landscape continues to evolve, trailblazing platforms like SmarDex are at the forefront of innovation, offering users unique advantages that are hard to find elsewhere.