The European Union (EU) made a significant stride forward in cryptocurrency regulation on a global level when member states gave the final approval to the world’s first comprehensive set of rules to regulate crypto-assets. These regulations, known as the Markets in Crypto-Assets (MiCA), are expected to be effective from 2024.

A Bold Step Forward 🦿

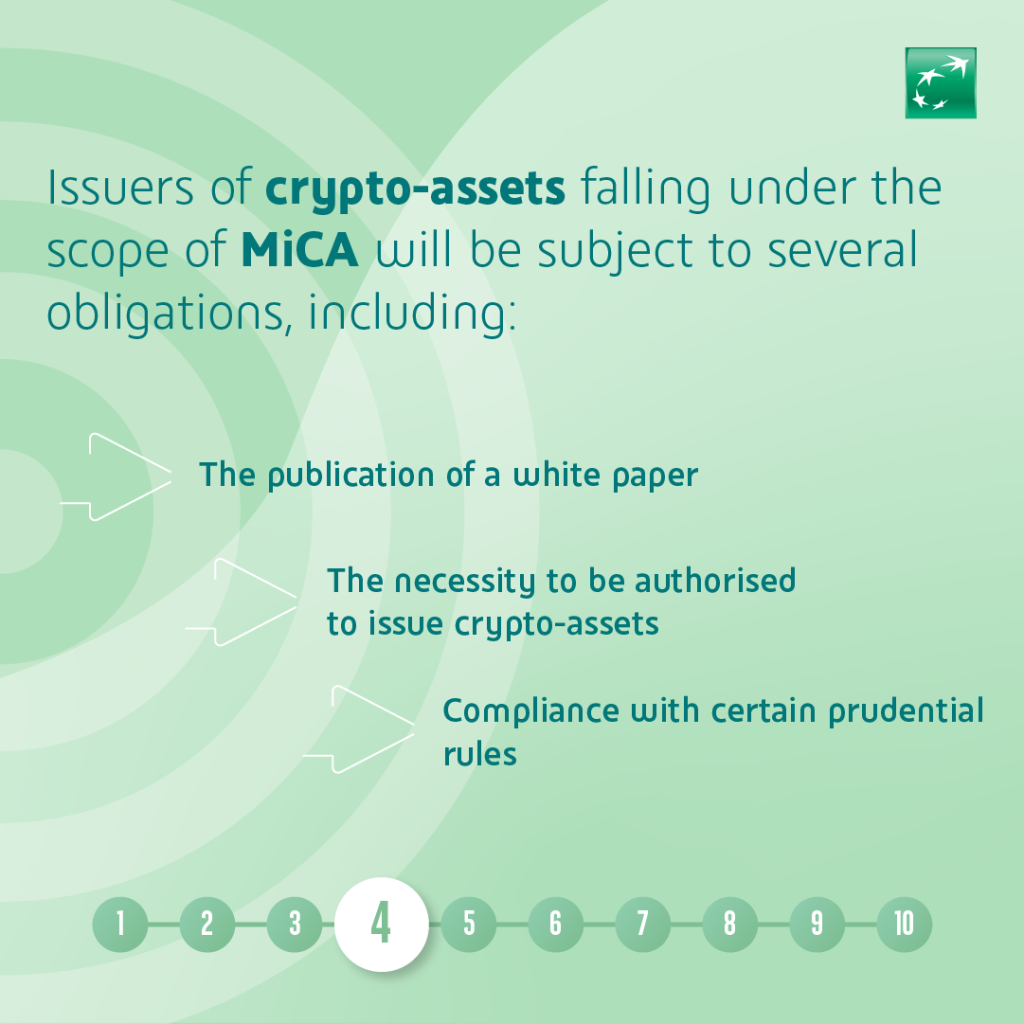

To ensure a safer environment for investments in crypto-assets and to prevent misuse of the industry for money laundering and terrorist financing, the EU has laid down strict rules that require firms dealing with the issuance, trading, and safeguarding of crypto-assets, tokenized assets, and stablecoins within the bloc to obtain a license. Furthermore, the rules have provisions to combat tax evasion and make crypto-asset transactions more traceable, which is set to take effect from January 2026.

This move places the EU at the forefront of the crypto regulation landscape. It sets a precedent for other countries, such as Britain and the United States, that are yet to establish similar comprehensive regulatory frameworks.

The Impact of MiCA

The MiCA regulation is a clear example of the EU’s evolving approach to crypto regulation, aiming to strike a balance between innovation, privacy, and regulatory compliance. It heavily focuses on consumer and investor protection, with measures to increase regulatory oversight to balance traditional and crypto-asset industries. By building trust in crypto-assets among consumers and financial institutions, MiCA could encourage more widespread use of crypto-assets and the underlying distributed ledger and blockchain technologies.

However, some criticisms have arisen, particularly around Article 68 of MiCA, which addresses the rules for operating a trading platform for crypto-assets. This provision could limit the growth and innovation of the blockchain industry by restricting certain types of transactions, thereby impacting the privacy and security of stakeholders.

To address these concerns, some suggest a more flexible and dynamic regulatory approach that fosters continued growth and innovation in the blockchain industry while ensuring compliance with regulatory requirements and protecting privacy and security. This could involve allowing crypto asset service providers (CASPs) to continue facilitating confidential transactions while ensuring regulatory compliance.

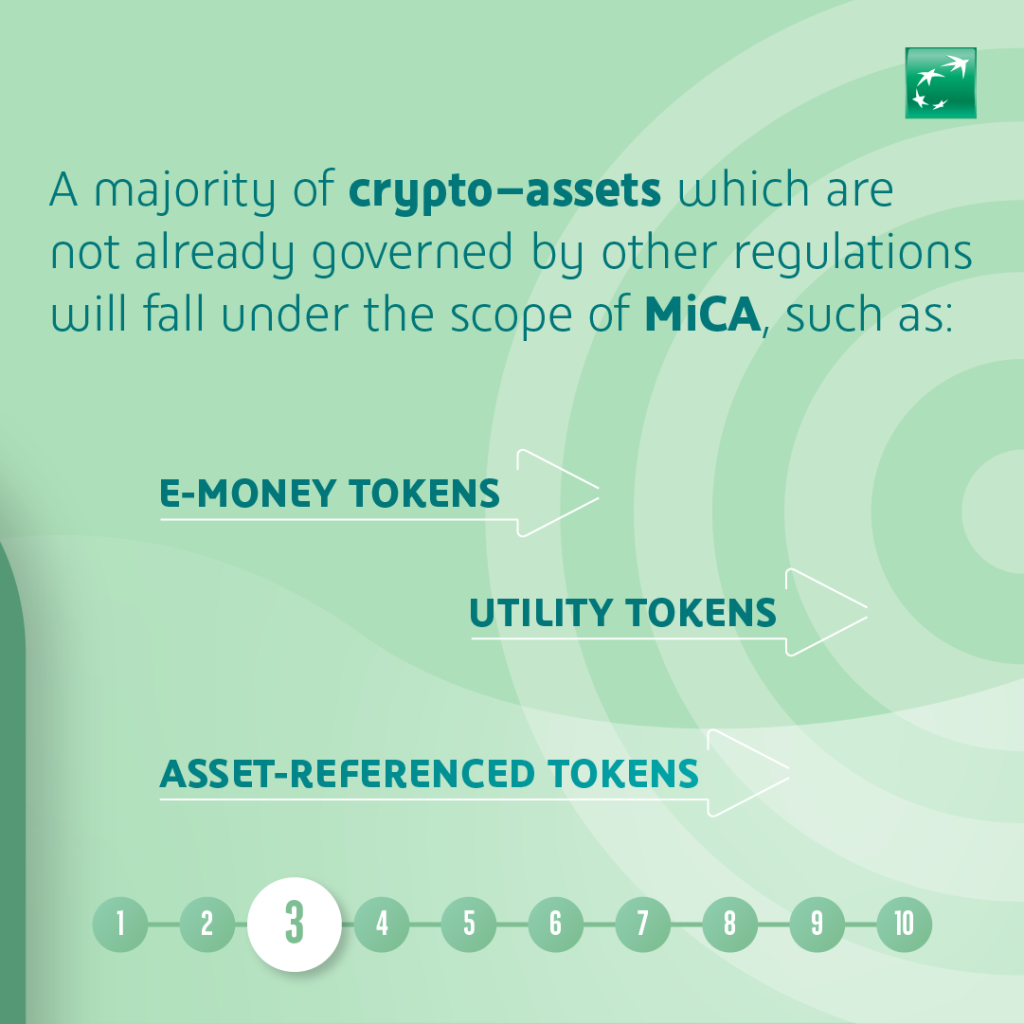

The MiCA regulation also establishes uniform requirements for offering and marketing most crypto-assets and sets extensive compliance requirements for CASPs operating within the EU. This aims to enhance transparency, minimize market contagion, and reduce user risks.

A Model for Others

As the impact of MiCA extends beyond the EU’s borders, it could serve as a model for other jurisdictions developing their regulatory frameworks for crypto-assets. By providing clear rules and expectations, MiCA enables a level playing field for innovation while ensuring consumer protection and market integrity. The EU’s balanced and flexible approach to regulating crypto-assets could serve as a useful example for the rest of the world.

While the EU’s move towards a comprehensive crypto regulatory framework is a significant step, its impact will depend on how effectively it is implemented and enforced and how the rest of the world reacts to it. As the crypto landscape continues to evolve rapidly, maintaining a balance between innovation and regulation will be vital in ensuring the sustainable growth of the crypto industry.