Quick Links

In a rapidly evolving landscape where the lines between physical and digital assets are becoming increasingly blurred, we are witnessing the dawn of a captivating era of real-life monopoly. The advent of tokenization for real-world assets is revolutionizing once-stagnant markets, fueling a surge in wealth creation and unprecedented investment opportunities. In this blog, we will learn more about tokenization, explore its benefits and challenges, and examine its potential impact on the financial landscape.

Introduction

Since November 2021, the total value locked (TVL) in decentralized finance (DeFi) has experienced a significant decline of more than 72%. This decrease in TVL has been closely associated with a reduction in transaction volume and investor participation, reaching a two-year low. As a result, the current situation highlights the interdependent and self-repeating nature of DeFi yields. However, a promising solution is emerging to address this challenge: using Real-World Assets (RWAs) as a new source of tangible yield. The recent bear market has witnessed significant advancements and expansion in RWAs. Prominent traditional financial institutions like Goldman Sachs, Hamilton Lane, Siemens, and KKR have publicly expressed their intentions to bring their real-world assets onto blockchain platforms. Additionally, leading DeFi protocols such as MakerDAO and Aave are adapting their crypto-native platforms to accommodate and integrate RWAs. This growing interest and integration from traditional and crypto-native players indicate a substantial period of development and growth for RWAs in the market.

Understanding Real World Assets

The term “real-world assets” has gained prominence to distinguish traditional financial holdings from cryptocurrencies. While cryptocurrencies exist solely in digital form, real-world assets (RWAs) are typically tangible and associated with physical entities or organizations. RWAs are physical assets with intrinsic value, including real estate, corporate debt, fine art collections, precious metals, etc. However, these assets often suffer from limitations such as illiquidity, high transaction costs, limited market access, lack of transparency, etc.

What is Tokenization?

Tokenization refers to converting tangible or intangible assets into digital tokens that can be represented and traded on a blockchain or distributed ledger technology (DLT) platform. These tokens can represent various types of RWAs, as discussed above.

The tokenization process involves creating a digital representation of the asset on a blockchain, assigning it a unique identifier, and establishing rules or smart contracts that govern its ownership, transferability, and other associated rights. This process is explained in detail in the next section of this blog. Each token represents a fraction or whole unit of the underlying asset, allowing for fractional ownership and enabling easy divisibility and transferability. By leveraging blockchain’s decentralized and immutable nature, tokenization ensures transparency, security, and traceability throughout the asset’s lifecycle.

The Process of Tokenizing Real World Assets

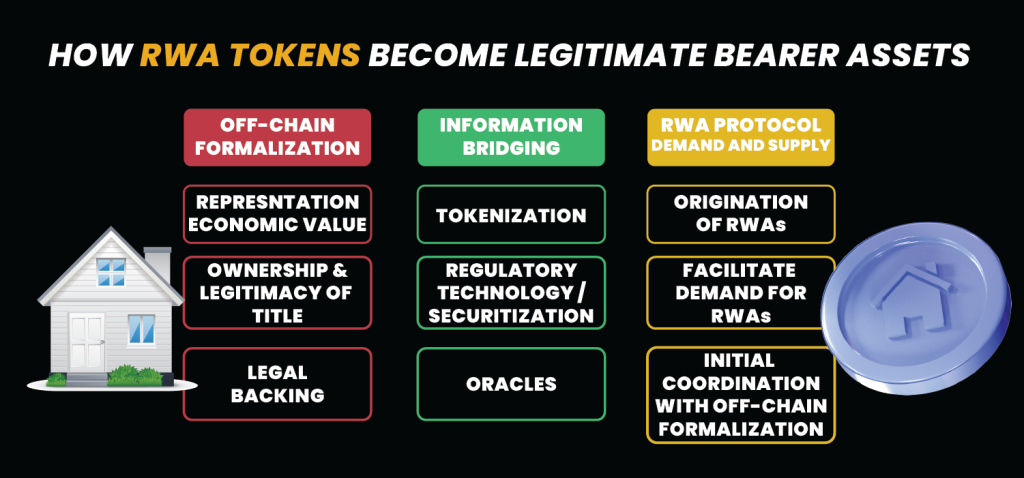

(Source – beincrypto.com)

Off-Chain Formalization

It ensures clear documentation regarding the asset’s value, ownership, and legal processes safeguarding associated property rights. This off-chain formalization process provides transparency and clarity, setting the foundation for a seamless and secure asset integration into the DeFi space.

Information Bridging

In this step, an asset’s economic value and ownership details are stored on the blockchain by translating off-chain information into digital token metadata. This metadata provides transparent access to the asset’s value and ownership information, ensuring complete transparency on the blockchain.

RWA Protocol Demand and Supply

DeFi protocols specializing in RWA offerings are pivotal in driving the entire process. These protocols oversee the creation of RWAs, acting as the supply side. Simultaneously, they facilitate investor demand for RWA opportunities, serving as the demand side. As a result, these DeFi protocols function as the starting point for new RWA originations while also serving as the marketplace for the end products of RWAs.

Benefits of Tokenizing Real-World Assets

- Increased Liquidity: Tokenization transforms traditionally illiquid assets, such as real estate or private equity, into digital tokens that can be traded on blockchain-based platforms. This enhances liquidity by allowing fractional ownership and enabling investors to buy and sell tokens more quickly and efficiently.

- Fractional Ownership: It opens up investment opportunities to more individuals. Fractional ownership enables investors with limited capital to participate in high-value assets which were previously inaccessible. This inclusivity promotes financial democratization and diversification of investment portfolios.

- Market Accessibility: It also facilitates cross-border investments by removing geographic barriers. Digital tokens can be traded globally 24/7, allowing investors from different countries to participate in markets previously restricted by local regulations or market limitations.

- Enhanced Efficiency: Using blockchain technology and smart contracts streamlines transferring ownership and managing transactions. It reduces the need for intermediaries, eliminates manual paperwork, and automates compliance procedures, resulting in faster, more cost-effective, and transparent transactions.

Challenges and Considerations

- Legal and Regulatory Compliance: The tokenization of RWAs may face regulatory hurdles, as existing financial regulations may not fully encompass blockchain-based assets. It is necessary to ensure compliance with relevant laws in the jurisdictions where the assets are being tokenized and traded.

- Security and Fraud Risks: As with any digital asset, tokenized assets are susceptible to cybersecurity threats, hacking, and fraud. Robust security measures and standards are necessary to mitigate these risks.

- Market Volatility: The digital asset market can be volatile, which may pose risks to investors. Appropriate risk management strategies such as diversification and comprehensive due diligence are essential to protect the capital invested.

- Asset Valuation and Standardization: Establishing accurate valuation methods for tokenized RWAs can be challenging. Standardization of valuation methodologies is crucial for creating liquidity and facilitating transparent price discovery in tokenized asset markets.

Leading RWA protocols

MakerDAO

It operates on the Ethereum network and is a platform for collateralized debt that has potentially achieved the most significant advancement in adopting RWAs. It enables borrowers to deposit collateral assets into designated “vaults” to acquire debt in the form of DAI, a stablecoin tied to the US dollar, native to the protocol. Vaults are smart contracts that securely hold the borrower’s Ethereum-based collateral until the borrowed DAI is fully repaid.

Inveniam

It offers a platform that leverages blockchain technology to enable the secure and efficient tracking, verification, and trading of various RWAs, including private securities, real estate, loans, and other alternative investments. Inveniam aims to bring transparency and liquidity to traditionally illiquid markets by providing a trusted infrastructure for managing and exchanging digital assets.

BlockEstate

It aims to facilitate the tokenization and fractional ownership of real estate assets, allowing individuals to invest in properties with reduced barriers to entry. By tokenizing real estate assets, investors can buy and trade tokens representing shares in real estate holdings. This approach aims to increase liquidity, accessibility, and diversification within the real estate market.

Ondo Finance

This platform introduced institutional-grade financial products, including government and high-yield bonds, to the decentralized finance (DeFi) space. To achieve this, Ondo has established three separate investment funds: OUSG (Short-term US Government Bond Fund), OSTB (Short-term Investment Grade Bond Fund), and OHYG (High-Yield Corporate Bond Fund). These funds hold the actual institutional assets, and Ondo tokenizes them into RWAs, referred to as “fund tokens.”

The Future of Tokenization and Adoption

- Rapid Growth and Adoption: With increasing interest from institutional investors, advancements in blockchain technology, and the emergence of decentralized finance (DeFi) platforms, the adoption of tokenization is expected to grow significantly.

- Expansion of Asset Classes: Tokenization enables the representation of various asset classes on the blockchain, such as real estate, artwork, intellectual property, and personal belongings. This trend is likely to expand the range of investment opportunities and allow for the creation of new markets.

- Integration with Traditional Finance: Tokenization is likely to converge with traditional financial systems, leading to hybrid models that combine the advantages of both centralized and decentralized approaches. This integration will facilitate the adoption of tokenization by institutional investors and regulatory bodies.

Conclusion

The concept of tokenizing RWAs in the cryptocurrency sector is gaining traction as investors aim to connect traditional financial systems with the rapidly growing digital asset market, unlock new investment opportunities, enhance liquidity, and overcome the limitations of conventional assets. Tokenization offers numerous benefits, including increased liquidity, fractional ownership, market accessibility, and efficiency. However, it also comes with challenges such as legal and regulatory compliance, security risks, market volatility, etc.

Looking ahead, the future of tokenization seems very promising. The adoption of tokenization is expected to proliferate, driven by increasing interest from institutional investors, advancements in blockchain technology, and the continued development of DeFi platforms. It represents a fundamental shift in the financial landscape, offering unprecedented possibilities for wealth creation, investment diversification, and global market participation. It is an exciting development that has the potential to reshape traditional finance and unlock new avenues of economic growth in the digital age.