Quick Links

Learn about the impact of psychology in crypto trading and other market fundamentals to keep you focused while performing bets on trades.

Whenever people sit before their monitors to initiate trades, there are many feelings and thoughts that strike their heads. They get anxious, some get motivated, some fear losses while some keep their heads cool and let their strategy work for them. Your internal belief systems are highly responsible for your trade success as the crypto markets are a huge sea sweeping volatility in and out with every wave. Focusing on Moving averages, charts and trends put your assets on the line as it may get harder to concentrate on your goal. Being too aggressive or timid will not get you far.

Let us gather a basic understanding of crypto trading psychology that will help you minimize the odds and keep you focused on the important aspects.

What is trading psychology?

Madden Funds

Trading psychology is the trader’s self-awareness, rational thinking ability, and responsibility that impacts the way they trade and take decisions. To put this into perspective, it is similar to driving a car on a busy street. The driver needs to be conscious of his surroundings while also manoeuvring the car using different mechanisms to keep the car moving without engaging with other vehicles, i.e. accidents. Decisions you take while trading highly affect your trade outcome and keeping your emotions chained up, and build a systematic approach is really critical.

One should keep an eye on these decisions and tasks to prevent any detrimental effects on your trading goals. These are preemptive measures taken to forestall any threat that may arise while you are trading because one slight mistake can reduce the chances of you making desired profits. You can also switch to different potential trading strategies and styles if you think you’re not gonna make it whilst in a trade. You can refer to this article that will help your strategies work in conjunction with trading styles and psychology.

Factors working in conjunction with your psychology

Market analysis (technical and/or fundamental):

Grifco Strategy

Very important or I’d say the foremost task to carry out before choosing a trade to start with. You really need to know about the market sentiments revolving around the asset of your choice and just like to like to research about your next furniture, gadget or a new house, performing due diligence on the market trends and TA is equally important.

Position sizing:

Capital.com

Position sizing is basically how many coins or assets a trader wants to buy. Many traders like to buy as much as they can to feel confident while others like to start small which is highly advisable to beginners. This is however not a great method for determining an ideal position size. It is very important for all types of crypto traders who want to avoid the major decline in their accounts that are likely to occur during crashes or price corrections. Without proper positions, traders are more likely to lose a substantial amount of their capital. Controlling risk within each trade can be considered using a stop-loss strategy.

The idea of position sizing is simple, as you can’t certainly bet on a crypto asset’s future, traders are more likely to follow the market sentiment. For instance, a trader has a portfolio of $1000 and buys a specific coin priced at $1 at the moment as the price if going higher. They decide to buy 500 tokens worth of $500 providing they saw a bull run of that asset. If due to unknown factors, the price of the coin starts plummeting and now settles for half the price it was bought in which is $0.50. Admitting that they were wrong, traders finally close this position to prevent further losses and settle with a loss of $500. This tells us that it was a whimsical trade as risks were not evaluated and the trade was initiated. As a smart trader, you should not do the same mistake and assess risk and rewards beforehand. If you think out your positions and put in that much capital you can afford to lose, you will gradually become good at placing bets.

Loss control:

Taxation

Stop-loss is a trading strategy cum tool to limit the loss in a trade by automatically liquidating assets once its price reaches a specified value. Stop-loss can be very helpful for all types of traders as it will not let price corrections and violent crashes affect your crypto trades in progress. This is by far the best way to learn crypto trading for the inexperienced traders and thrive on the better decision before hastily initiating bigger trades. There are three types of Stop-losses namely,

Full: Liquidates all crypto assets when triggered

Partial: Liquidates a specified proportion of the digital assets when triggered.

Trailing: Adjusts according to asset’s price fluctuations

Newbies should remember that it isn’t just a failsafe strategy to prevent your capital vanishing, instead, it is a well-thought-out insurance policy to sail amid volatile price crashes. Refer to this article to know more about stop-loss.

Profit-taking:

This is a profit-taking strategy wherein traders balance their profits in terms of 50% crypto and 50% fiat. Always keep this ratio in mind if you’re a beginner and if your profit goes up by 10%, sell 5% for fiat. This way you will be back again on the 50% crypto 50% fiat ratio. If your crypto tanks, you need to buy back again to keep the ratio intact. This will help you learn how to manage your crypto and calculate the risk to reward ratio effectively thus making you a composed and patient trader. The idea here was you always have to sell higher and buy lower to avoid any panicky situation. It depends on how much risk you’re willing to take and can change this ratio to any number for example 70%:30% and whatever’s feasible. In the beginning, you just need to focus on scalping profits by watching smaller trends with the help of the candlesticks. You can resort to aiming for larger profits once you have successfully learned how to take profits from smaller trends. Proft taking strategy has helped many traders learn their way to target bigger profits thereafter.

Evaluation of trading results

The process of judging and assessing of all the actions you took over the course of a trade life spanning from days, weeks and months. You won’t be needing to trade for weeks and months since you’re a beginner so you can stick to day trading and scalp trading as mentioned here.

Evaluation is a psychological phenomenon that consists of analyzing everything from your trade results and your trading strategy to your mood and the market conditions you were trading in. These are basically several metrics you can take leverage of while gradually learning what could have gone wrong and what actually did. This is an important feature in your crypto trading psychology that will teach you key insights such as profitability, maximum drawdowns, slippage, Sharpe ratio, annualized return, annualized volatility and more which will help you realize the strengths and weaknesses in your crypto trading.

Key Takeaways:

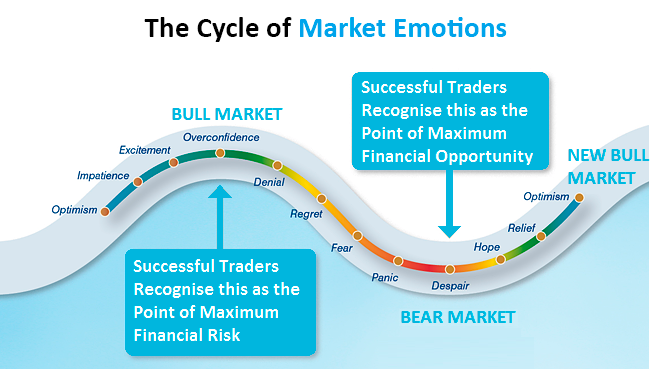

Overtrading can often lead to bad decisions and mental fatigue. Set specific times and do not check your trades repeatedly. Perform thorough market research as to where the market sentiments lie at the moment and then initiate trades.

To avoid huge losses and inadvertent situations traders should focus on these following mentioned factors which are of grave necessity.

Don’t be too emotional

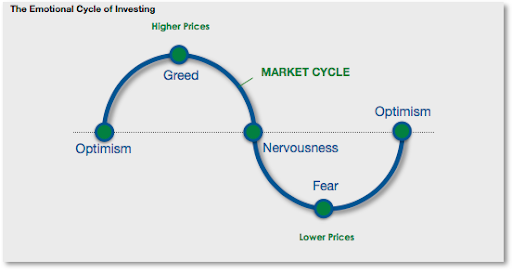

Don’t let fear and greed sink in

Don’t stress out

Overcome negative emotions while trading

Don’t speculate just follow your strategy and exit on time

Trade as if it were your profession

Trade during favourable market conditions

Don’t trade more than what you are not willing to lose

Practise, practise and practise

Don’t be overconfident

Don’t be too sure

Don’t get impatient

Don’t let outside influence such as social media, phone calls and disturbance dictate your presence while on an active trade.

Help is available

If you are new to crypto trading and still think you won’t be able to make it, TradeDOG has your back. We are helping newbies and beginners leverage proper knowledge of the markets and see potential doorways to safer and secure trading through our 101 series present on medium. You can also create an account on our website tradeodg.io to learn more about crypto markets by utilizing in-depth crypto market research reports, trading help and trade advice. We are determined to guide people by fostering them to become the best crypto traders.

This article will help you give a sound understanding of crypto candlesticks and other major factors required to have a sense of where the crypto market sentiments lie at the moment. Once you learn reading the candlesticks, you can couple your understanding with TA, market analysis, different trading styles and strategies to become a formidable crypto trader.

You can find our videos pertaining to crypto trading on our Youtube channel.

Visit our twitter page for daily insights on our research reports and trends in the crypto economy.

Follow our other channels to broaden your understanding of what we do and how we do.

Find us here-

Website Telegram Twitter Facebook Reddit Youtube Instagram