Quick Links

A crypto exchange token is a digital asset native to a cryptocurrency exchange. A crypto exchange may launch its token for various reasons, and exchange owners often give tokens to users as incentives. Generally, most exchange tokens are designed to increase an exchange’s liquidity, incentivize trading activity, or facilitate an exchange’s community governance process. This blog will explore how exchange tokens are used, how to buy them, their risks and advantages, and how to get them. We will also look at the top 10 exchange tokens in the market.

How are exchange tokens used?

Exchange tokens are primarily used as a means of payment on the respective exchange platform. Users can use them to pay for trading fees, withdrawal fees, and other charges on the exchange. Some exchanges also offer discounts on trading fees for users who hold a certain amount of their exchange tokens. Moreover, holding exchange tokens may give users access to exclusive services or products, such as initial exchange offerings (IEOs).

Let’s explore some examples:

Payment for Trading Fees

The primary use of exchange tokens is to pay for trading fees on the exchange platform. For example, Binance Coin (BNB) can pay trading fees on the Binance exchange, and Huobi Token (HT) can be used for trading fees on the Huobi exchange. Users can enjoy discounts or other incentives by using exchange tokens to pay for trading fees.

Access to Exclusive Services

Some exchanges offer exclusive services or products to users who hold a certain amount of their exchange tokens. For instance, Binance offers a Launchpad service that enables users to participate in initial exchange offerings (IEOs) if they hold a certain amount of Binance Coin.

Airdrops and Rewards Programs

Some exchanges offer airdrops or rewards programs that allow users to earn exchange tokens by completing specific tasks, such as trading or referring new users. For example, KuCoin Shares (KCS) holders can receive daily bonuses based on the trading fees generated by the exchange.

How do you get exchange tokens?

Exchange tokens can be purchased on cryptocurrency exchanges that offer them. Users can typically buy them with other cryptocurrencies or fiat currencies. Some exchanges also provide the option of earning exchange tokens through rewards programs or airdrops.

Buy on an exchange

The most common way to buy exchange tokens is through a cryptocurrency exchange. Users can purchase exchange tokens using other cryptocurrencies, such as Bitcoin or Ethereum, or fiat currency, such as US dollars. Many exchanges offering exchange tokens also allow users to store them on the exchange platform.

Participate in an Initial Exchange Offering (IEO)

Some exchanges offer initial exchange offerings, which are similar to initial coin offerings (ICOs). In an IEO, a new project issues tokens, and the exchange platform hosts the sale on their platform. Users can participate in the sale using cryptocurrency or fiat currency. In exchange for their investment, they receive the project’s tokens, which can then be traded on the exchange.

Earn exchange tokens through rewards programs or airdrops

Some exchanges offer rewards programs or airdrops, where users can earn exchange tokens by completing specific tasks, such as trading or referring new users. In some cases, users may receive exchange tokens for free, while in other cases, they may need to complete certain requirements to be eligible for the tokens.

What are the risks of exchange tokens?

Like any investment, exchange tokens carry risks. The most significant risk of exchange tokens is their value volatility, which can fluctuate significantly based on market conditions and the exchange’s performance.

Here are some of the key risks to consider:

Market Risk

Exchange tokens, like other cryptocurrencies, are subject to market risk. Their value can fluctuate rapidly and unpredictably based on supply and demand, investor sentiment, and other factors that affect the broader cryptocurrency market. There is no guarantee that the value of an exchange token will appreciate over time.

Regulatory Risk

Regulatory uncertainty is a significant risk for exchange tokens. As cryptocurrencies and their related markets continue to evolve, governments and regulatory bodies are likely to enact new laws and regulations that may affect the value and liquidity of exchange tokens. A regulatory crackdown could lead to a sharp decline in the value of exchange tokens, and new regulations may make it more difficult to trade or hold them.

Exchange Risk

Holding exchange tokens on a centralized exchange creates counterparty risk. If the exchange is hacked, goes bankrupt, or engages in fraudulent activities, the value of the tokens held on the exchange may be lost entirely. Additionally, some exchanges may experience technical issues or outages that can prevent users from accessing their tokens or executing trades.

Technology Risk

Exchange tokens are built on top of blockchain technology, which is still relatively new and untested. There is a risk that technical issues, such as bugs or security vulnerabilities, could undermine the functionality and security of exchange tokens, potentially leading to a loss of value or tokens altogether.

Advantages of exchange tokens

These tokens offer a number of advantages, some of which are:

Discounted trading fees

One of the main advantages of exchange tokens is that they offer discounted trading fees. Users who hold these tokens can pay reduced trading fees, significantly reducing their transaction costs. This is a popular feature among traders, as it can lead to increased profits.

Increased liquidity

Exchange tokens also help to increase liquidity on cryptocurrency exchanges. This is because they encourage users to hold and trade these tokens, increasing trading activity on the exchange. As a result, more traders are attracted to the exchange, which can lead to greater liquidity and tighter bid-ask spreads.

Staking rewards

Some cryptocurrency exchanges offer staking rewards to users who hold their exchange tokens. Staking is a process by which users hold their tokens in a wallet for a specified period to earn additional tokens as a reward. This can be a lucrative way for users to earn passive income from their holdings.

Token burns

Another advantage of exchange tokens is that some exchanges use a portion of their profits to buy back and burn their own tokens. This reduces the total supply of the token, which can lead to an increase in its value. It also helps to create deflationary pressure, which can benefit investors in the long run.

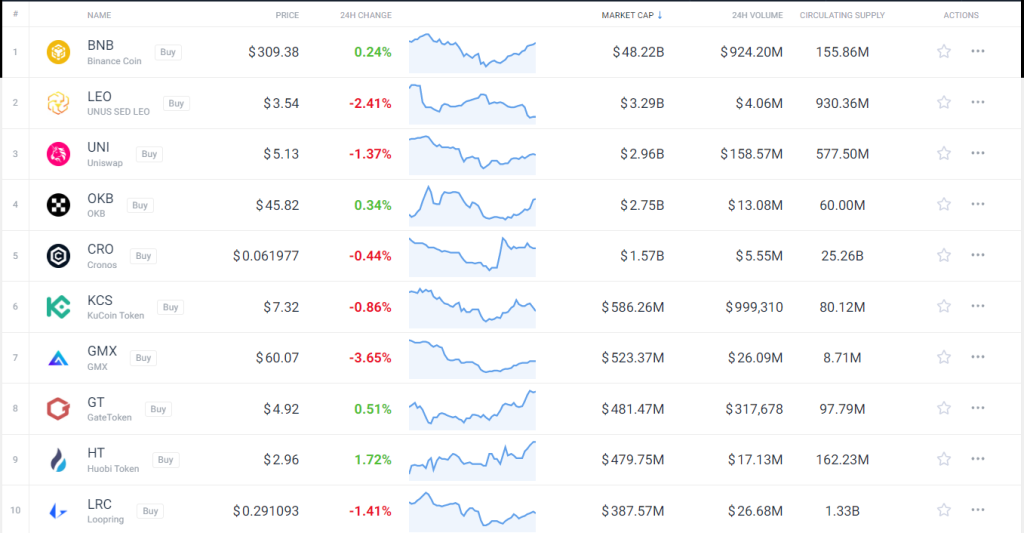

Top 10 exchange tokens (in terms of Market Cap)

1. Binance Coin (BNB)

Binance Coin (BNB) is the native token of the Binance exchange, one of the largest and most influential crypto trading platforms globally. BNB offers several benefits to users, including reduced trading fees, participation in token sales on Binance Launchpad, and access to various services within the Binance ecosystem. With its increasing popularity and widespread use, BNB has cemented its position as one of the leading exchange tokens.

2. UNUS SED LEO (LEO)

UNUS SED LEO (LEO) is a utility token issued by Bitfinex, a prominent cryptocurrency exchange. LEO provides various advantages to its holders, such as reduced trading fees, access to exclusive features and services, and enhanced liquidity on the Bitfinex platform. Additionally, LEO holders can participate in decision-making processes and earn discounts on crypto loan interest rates, making it a sought-after exchange token.

3. Uniswap (UNI)

Uniswap (UNI) is the governance token of the decentralized exchange (DEX) platform Uniswap. As one of the pioneering decentralized exchanges, Uniswap enables users to trade a wide range of tokens directly from their wallets without intermediaries. UNI token holders can participate in platform governance, vote on proposals, and receive a share of the transaction fees generated on Uniswap.

4. OKB

OKB is the native token of OKEx, a popular cryptocurrency exchange known for its global presence and extensive range of trading options. OKB holders enjoy numerous benefits, such as discounted trading fees, exclusive token offerings, and access to advanced trading features. OKB’s integration within the OKEx ecosystem makes it an essential asset for active traders seeking a comprehensive trading experience.

5. Cronos (CRON)

Cronos (CRON) is the native token of Cronos Network, an innovative blockchain project focused on decentralized finance (DeFi) and cross-chain interoperability. Cronos aims to provide seamless integration and communication between various blockchain networks, enhancing liquidity and accessibility. CRON token holders can participate in network governance and contribute to the growth of the Cronos ecosystem.

6. KuCoin Token (KCS)

KuCoin Token (KCS) is the utility token of KuCoin, a well-established cryptocurrency exchange offering a broad selection of cryptocurrencies. KCS holders can enjoy reduced trading fees, exclusive token rewards, and participation in KuCoin’s various programs and events. With its vibrant community and commitment to innovation, KCS has become a prominent exchange token in the crypto trading space.

7. GMX

GMX is the native token of the Goma Finance platform, a decentralized exchange built on the Binance Smart Chain (BSC). As a governance token, GMX holders can participate in decision-making processes, propose and vote on platform improvements, and earn rewards for their active involvement in the ecosystem. Goma Finance’s focus on yield farming and staking opportunities make GMX an appealing exchange token for users seeking passive income streams.

8. GateToken (GT)

GateToken (GT) is the utility token of Gate.io, a leading cryptocurrency exchange known for its user-friendly interface and wide range of trading options. GT holders can benefit from reduced trading fees, participation in token sales, and access to exclusive promotions and events on the Gate.io platform. The token’s integration with GateChain, a high-performance blockchain developed by Gate.io, further enhances its utility and potential for growth.

9. Huobi Token (HT)

Huobi Token (HT) is the native token of the Huobi Global exchange, one of the largest cryptocurrency platforms worldwide. HT holders enjoy various advantages, including discounted trading fees, premium features, and Huobi Prime token sales participation. Moreover, HT plays a crucial role in the Huobi ecosystem, serving as a foundation for the Huobi Wallet and providing governance rights for Huobi Chain.

10. Loopring (LRC)

Loopring (LRC) is the utility token of the Loopring protocol, a decentralized exchange and payment protocol built on Ethereum. LRC facilitates secure, scalable, and efficient trading of digital assets while minimizing the need for trust in intermediaries. Token holders can participate in the protocol’s governance, earn staking rewards, and benefit from fee discounts—Loopring’s focus on enhancing liquidity and interoperability positions LRC as a valuable exchange token.

Conclusion

Exchange tokens have become integral to the cryptocurrency trading ecosystem, offering unique benefits and features to users of prominent exchanges. The top 10 exchange tokens mentioned above, including Binance Coin, UNUS SED LEO, Uniswap, OKB, Cronos, KuCoin Token, GMX, GateToken, Huobi Token, and Loopring, have demonstrated their value through innovation, utility, and market adoption. As the crypto industry continues to evolve, these exchange tokens are likely to play a significant role in shaping the future of digital asset trading.