Quick Links

What is leveraged yield farming

Leveraged yield farming is a tool used by DeFi users to maximize their profits and get higher returns on their investments.

In yield farming, users are granted incentives when they provide liquidity to the liquidity pools.

Imagine it as a pot wherein you deposit tokens and as you deposit more and more and fill the pot, you get rewarded with tokens as APY. Adding on to that, Leveraged Yield Farming is a system by which users can increase their yield farming position and multiply their yield by borrowing funds.

All this works on the simple concept of being able to invest more as you borrow, resulting in increased earnings, having only the cache that interest needs to be paid on the extra capital.

This system enables better capital efficiency for both yield farmers and lenders. This is achieved because of a higher utilization rate of the liquidity pools, which leads to more lender gains. To simplify, it can be understood that at 80% utilization, the borrowing interest paid to lenders will be much higher than that at 10% utilization, thus being more profitable for the lenders. However, with a high interest rate, lenders face more risk of defaults by borrowers when prices fluctuate.

How does leveraged yield farming work

Leveraged yield has two integral components:

Lender who deposits tokens to earn yield

To understand how lenders can have better APYs in leveraged yield farming platforms, we need to understand the utilization of the lending platforms. In traditional DeFi lending platforms, the loans are collateralized. It means that you need collateral to borrow the tokens, limiting the borrowing power of a user.

Let’s take a scenario where a lending platform has 100 ETH, and the farmer can borrow only 10 ETH due to the limited collateral. The utilization of the platform would be 10%. In the case of leveraged yield farming platforms, the borrower might borrow 60 ETH, hence making the utilization of 60%.

This higher utilization is important for lenders because most lending platforms have an interest rate model that slopes upwards at higher utilization, using the concept of supply and demand where higher demand for loans leads to higher rates for borrowing.

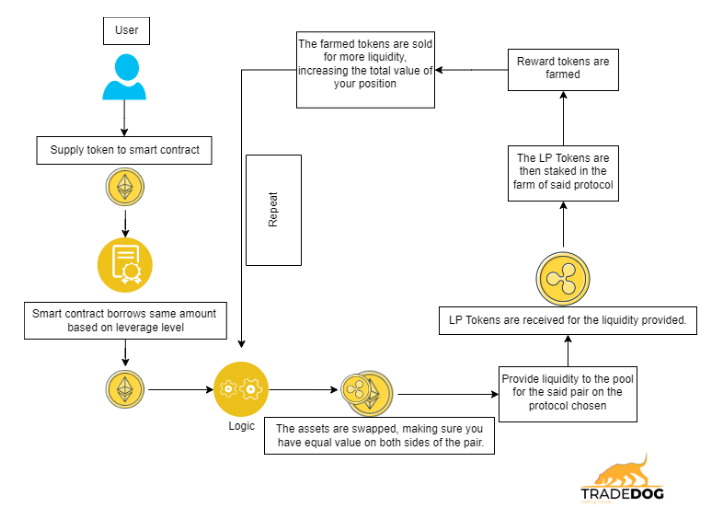

Farmer who borrows tokens from these pools to yield farm with leverage

In a leveraged yield farming protocol, users first deposit any proportion of the two tokens. So taking the example of ETH and USDT, the users could deposit one of the two or a combination of both. The underlying protocol will do optimal swaps in the background to convert the tokens into a 50:50 split for the LP tokens.

Then, to get leverage, farmers can borrow the token up to maximum leverage (1.25x to 6x depending on the pair and protocol). The protocol then uses an integrated DEX to convert all deposited and borrowed tokens into a 50:50 proportion for creating the LP tokens for farming. When you stop farming, you just return the borrowed tokens.

How to Start Leveraged Yield Farming for Beginners

Types of positions

Leveraged Long

If you have a bullish view on a token, you can consider farming it at more than 2x leverage, borrowing the token opposite your held token.

Leveraged Short

Leveraged yield farming offers you profit-making opportunities in a bearish market by using shorting as a tool.

Pseudo Market-Neutral Strategy (Delta-zero Position)

If you want to play it safe but still maximize profit, you can achieve a delta neutral position by borrowing the exact value of non-stablecoin and stablecoin assets in a leveraged position.

Popular leveraged yield farming projects

Apricot Finance (Solana)

Apricot Finance is a next-generation financing protocol which supports farming with cross-margin leveraged yields. The goal is to protect consumers’ downsides while assisting them in maximising production. Users can deposit assets to earn interests, borrow assets for trading, or for cross-margin leveraged yield farming and pre-configure when and how automated deleveraging takes place.

Quickswap (Polygon)

QuickSwap is a layer-2 decentralised exchange (DEX) and automated market maker (AMM). It is a fork or clone of Uniswap, which is a leading AMM. Except for the unicorns being replaced by magic dragons, the user interface is nearly same. The difference is that QuickSwap utilises the Matic/Polygon Layer-2 platform, whereas Uniswap utilises the Ethereum Network.

Alpaca Finance (BSC)

Alpaca Finance is one of the largest loan protocols offering leveraged yield farming on the BNB Chain. It gives borrowers under-collateralized loans for leveraged yield farming positions and increase their profits, while assisting lenders in generating safe and consistent yields. Alpaca serves as a facilitator for the whole DeFi ecosystem, amplifying the liquidity of integrated exchanges and enhancing their capital efficiency by bringing together LP borrowers and lenders. Alpaca has established itself as a key component of DeFi because of this powerful feature.

Do’s and Don’ts of Leveraged Yield Farming

Do’s

- If done correctly, leveraged yield farming can be highly profitable. It enables both lenders and farmers to increase their earning capabilities when compared to the regular-yield farming process.

- Leveraged yield farming can enable a user to farm profitably even in the bear market. It gives the user capabilities to create smart strategies via shorting and hedging and be safe from market downturns.

- The leverage utilization in this process increases the capital efficiency of both the farmer and the lender.

Don’ts

- It is a double-edged sword and with the increase in returns, it massively increases the risk as well.

- Wrong predictions can result in a situation when you end up paying a lot more than regular yield farming.

- In addition to market unpredictability, leveraged yield farming suffers from the traditional risks of yield farming, protocol vulnerability, hacks and much more.

Conclusion

To conclude it can be said that, leveraged yield farming as a tool is very beneficial for those users who want to maximise their returns. However, with its benefits come various shortcomings like high risk, protocol vulnerability along with the usual shortcomings of DeFi like unpredictability and lack of regulations. If a user is willing to work with the high risks of this system, leveraged yield farming can act as a tool wherein the user can anticipate having huge gains on the initial investment made.