Crypto markets have demonstrated to be more interesting and high yielding than any other traditional indices. Decentralized Finance (DeFi) is another region of protocols on blockchains built to provide uninterrupted access to decentralized financial services. The DeFi industry is valued at $24.85 bn at the time of writing and projected to double that in the coming time. So let’s talk about DeFi, its origins, how to add liquidity to high-yield pools, earn interest through lending and borrowing, and gain yield farming opportunities in this Uniswap tutorial.

Visit Wild West of DeFi to understand how Liquidity pooling, yield farming and Automate Market Maker mechanism work. Read on to learn how to buy tokens in this Uniswap tutorial.

What is UniSwap?

Uniswap is a fully decentralized exchange (DEX) that has no order books or any centralized body required to make trades. Users can swap ERC20 tokens without the need for buyers sellers creating demand. The mechanism works via an equation that auto sets and balances the values depending on the available demand. Uniswap uses a pricing mechanism known as ‘Constant Product Market Maker Model’ that redefines liquidity provisioning for market-making and allows democratized access to pools of capital.

Going further, let’s show you how to access Uniswap and trade (swap) your first token!

Since Uniswap is based on Ethereum, you will need an Ethereum wallet in order to start trading. You can trade and swap your preferred ERC20 tokens by either going straight to Uniswap or using Dextools that aggregates pools, pairs and trading information in Uniswap and Idex.

Watch out for our upcoming blog on Uniswap of the same series.

Step 1

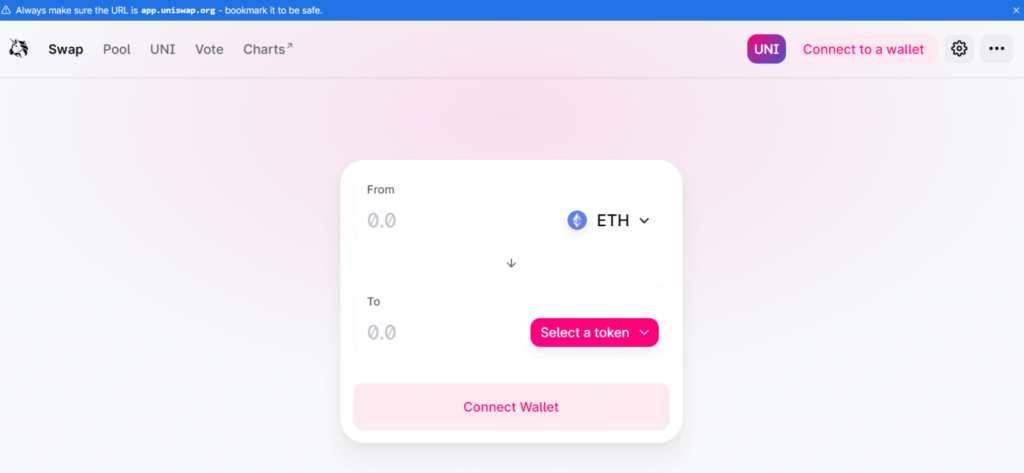

Visit the site app.uniswap.org on your preferred browser that is not only safe to access but also has Metamask installed.

The first page after visiting this link will appear like the image below.

Once on this page, you can start swapping the token by choosing the token where the prompt “Select a token” is placed. But before you do that, you have to connect your wallet to proceed with the transaction.

Please note that sometimes your token won’t show up in the process above in the image. You can always find your token by clicking on the “Select a token”, and paste your token’s contact address in the search bar, your token will be available by doing so.

See also- How to secure your online wallet, and prevent hacking

Step 2

Click on “Connect to a Wallet”

On the next prompt, you will find several options to choose from. The most used method is to connect to Ethereum’s Metamask but you also get other options too in the likes of WalletConnect, Coinbase Wallet, Fortmatic, Portis. Choose your preferred option and connect it to Uniswap.

We are giving the walkthrough of Metamask here as it is one of the first Ethereum wallets

Make sure you have downloaded the Metamask extension on your browser.

Step 3

Click on Metamask

Connect your Ethereum wallet to Uniswap and you made it!

Step 4

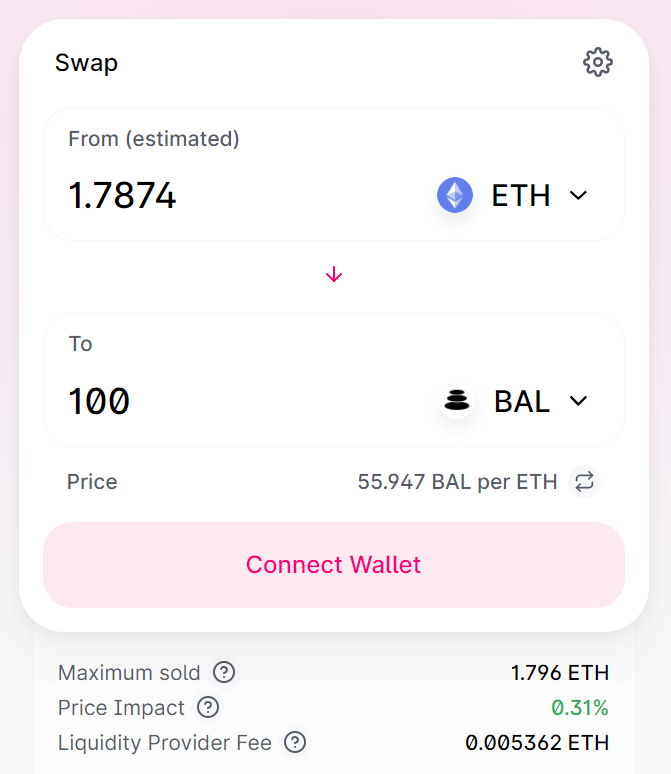

Now put in the value of the token you are buying and the ETH value above will auto change to the price depending the amount of token you want to buy, let’s say BAL (Balancer) as in the image above. In order to buy 100 BAL tokens, you need to swap 1.78 ETH with BAL to complete your order.

If you do not find your token on the list, you can search it by pasting the contract address of the token in this list. Most users do not know what a contract address is, it looks something like this 0xba100000625a3754423978a60c9317c58a424e3d. You can find any contract address by simply typing the Tokens ticker name on etherscan.io.

Refer to this video to see the complete Uniswap tutorial.

Once you’ve purchased your new BAL tokens, you can go ahead and view its market performance right into the Uniswap dex. Go to info.uniswap.org/home and search your new token by typing BAL in the search bar. From the dropdown menu select the pair and you will find many statistics such as liquidity, price, volume, etc. related to BAL.

Now that you have found and swapped your crypto assets with that token, you can start trading or holding, and make constant gains if that platform has enabled earning interest, liquidity provider rewards and Yield farming.

The crypto economy is breaking every preconceived notion of distrust and scepticism. With the meteoric rise of digital assets and their phenomenal return, almost everybody who has access to the internet is planning to invest as soon as possible. But proper information and intelligence on how to enter the crypto markets safely are elusive. The retail investor community is mostly focussed on stock and forex trading. They know about crypto-only through random ads or word of mouth from a friend who either lost his wealth or made fortunes by going all-in crypto. The crypto markets are huge with over $1tr market cap split across 8,281 cryptocurrencies, 34,224 markets, and thousands of asset pairs such as the most popular BTC/USD. It gets increasingly tough for investors to pick one investment from this huge ecosystem to start making profitable trades.

Sign up on tradeDog to get regular email updates such as absolute market intel, forecast, tips, technical analysis, research and more, and find the best possible intelligence to make sense of the trends and sentiments.