Quick Links

Step into the exciting world of crypto arbitrage, where smart traders take advantage of price differences across cryptocurrency exchanges. In this article, we’ll explore what crypto arbitrage is, why it’s gaining popularity, and the risks and rewards involved.

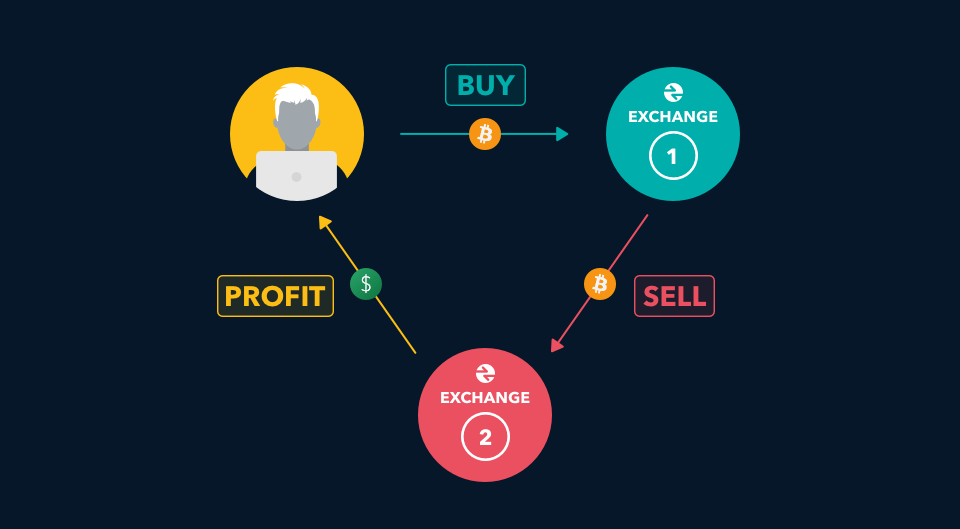

Crypto arbitrage involves profiting from price variations of the same digital currencies on different exchanges. Traders buy at a lower price on one platform and quickly sell at a higher price on another. These opportunities arise due to differences in supply, demand, and regional market fluctuations within the decentralized cryptocurrency landscape.

Exploring the Concept of Arbitrage

Let us commence our quest by grasping the essence of arbitrage. At its core, arbitrage is a clever investment strategy that capitalizes on price discrepancies across various markets. It involves exploiting the variations in prices for assets, securities, or commodities to secure a risk-free profit. In simpler terms, it is the art of simultaneously buying low and selling high in different marketplaces.

Arbitrage takes on diverse forms, each with its own unique characteristics. One such type is spatial arbitrage, where traders seize opportunities to profit from price imbalances across different geographic locations. Another variant is temporal arbitrage, which involves capitalizing on price fluctuations that occur over time. Lastly, statistical arbitrage employs complex mathematical models to identify and exploit statistical anomalies in the market.

The Mechanics of Arbitrage in Traditional Markets

Now equipped with a solid foundation, let us venture into the domain of traditional markets, where arbitrage has long been a revered strategy. Imagine stumbling upon a pair of identical sneakers priced at $100 in Store A and $120 in Store B. The moment your perceptive eyes notice this price disparity, a golden opportunity emerges.

With lightning speed, you swiftly purchase the sneakers from Store A for $100 and rush to Store B to sell them for $120. Voilà! In an instant, you have secured a risk-free profit of $20. This exemplifies the essence of traditional market arbitrage: exploiting price differences between buyers and sellers, marketplaces, or even different financial instruments.

Applying Arbitrage to the Cryptocurrency Market

Cryptocurrencies, known for their volatile nature, provide a fertile ground for astute arbitrageurs. With thousands of digital exchanges operating worldwide, price discrepancies arise more frequently than ever before. Picture this: Bitcoin is valued at $28,000 on Exchange A and $28,500 on Exchange B. Aha! Once again, you spot the gleaming opportunity.

With agility, you swiftly purchase Bitcoin on Exchange A and dash to Exchange B to sell it at the higher price. In a blink of an eye, you have secured a handsome profit. The beauty of cryptocurrency arbitrage lies in the rapidity of transactions, thanks to the instantaneous nature of digital assets.

The Mechanics of Crypto Arbitrage

Imagine two neighboring markets, each with its distinctive supply and demand dynamics. Now, envisage a scenario where the price of a particular cryptocurrency varies between these markets. This intriguing occurrence, known as a price discrepancy, serves as the foundation for crypto arbitrage opportunities. These disparities may arise due to factors such as variations in trading volumes, regulations, or the swiftness with which information spreads across different exchanges.

As an arbitrageur, your task is to detect these gaps and seize the moment. The key lies in vigilantly monitoring multiple exchanges and studying their order books to identify the discrepancies. By closely observing price charts and order depths, you can gauge market sentiment and uncover potential arbitrage windows eagerly awaiting exploitation.

Timing and Liquidity: The Ultimate Allies

Once a price discrepancy is spotted, timing becomes your faithful ally. The crypto market operates at lightning speed, constantly evolving, making it essential to strike while the iron is hot. Bear in mind that price gaps can narrow swiftly, leaving little room for hesitation. Prompt and decisive action is the name of the game.

Moreover, liquidity plays a pivotal role in successful crypto arbitrage. Liquidity refers to the ease with which an asset can be bought or sold without causing significant price fluctuations. Optimal arbitrage opportunities often arise when liquidity is abundant, ensuring seamless transactions and minimizing slippage. To assess liquidity, keep a watchful eye on trading volumes and order book depths across the exchanges you’re monitoring. The higher the liquidity, the greater the likelihood of executing profitable arbitrage trades.

Executing Astute Arbitrage Trades

Now equipped with the knowledge to identify opportunities, let’s dive into the intricacies of executing profitable arbitrage trades. As an arbitrageur, you possess two primary strategies at your disposal: simultaneous arbitrage and sequential arbitrage.

Simultaneous arbitrage entails purchasing an asset at a lower price on one exchange and swiftly selling it at a higher price on another exchange. This strategy demands prompt execution and a reliable trading infrastructure to ensure timely order placement.

On the other hand, sequential arbitrage involves a series of trades aimed at capitalizing on price disparities. Here, you may need to acquire a cryptocurrency on one exchange, transfer it to another, and then sell it at a higher price. While sequential arbitrage may require more time to execute, it can yield substantial profits when executed adeptly.

Risk Management and Mitigation

As with any investment venture, effectively managing risks is paramount in crypto arbitrage. Volatility, exchange risks, and transaction costs are among the hazards to consider. It is crucial to conduct comprehensive research and exercise due diligence when selecting exchanges to trade on, ensuring they possess a reliable track record, robust security measures, and transparent fee structures.

Furthermore, implementing appropriate risk mitigation strategies such as diversification, setting stop-loss orders, and closely monitoring market trends can safeguard your arbitrage endeavors. Remember, the goal is to maximize profits while minimizing potential risks.

Steps to Conduct Crypto Arbitrage

Create accounts on multiple exchanges:To kick-start your crypto arbitrage journey, the initial stride is to create accounts on multiple exchanges. Picture exchanges as gateways to the expansive crypto world, with each offering its distinctive array of cryptocurrencies and trading pairs. By diversifying your exchange portfolio, you amplify the likelihood of uncovering lucrative arbitrage opportunities.

Conduct diligent research to select reputable exchanges that align with your trading requirements. Proceed with signing up, completing the verification process, and fortifying your accounts with robust passwords and two-factor authentication. Remember, a diversified exchange presence forms the bedrock of your arbitrage strategy.

Establishing a Trading Capital and Risk Management Plan: Striking a balance

prior to plunging headlong into arbitrage, establish a trading capital and formulate a comprehensive risk management plan. Your trading capital denotes the funds you allocate specifically for arbitrage purposes. Determine an amount that you are comfortable investing, ensuring it is disposable income separate from your essential finances.

Next, craft a risk management plan to safeguard your capital. Consider variables such as position sizing, diversification across various cryptocurrencies, and the implementation of stop-loss orders. By prudently managing risk, you shield your capital and mitigate potential losses.

Executing Arbitrage Trades: With your accounts established and risk management plan in place, it is time to execute arbitrage trades. You have two primary strategies at your disposal: simultaneous arbitrage and sequential arbitrage.

Simultaneous arbitrage entails capitalizing on price discrepancies by purchasing an asset at a lower price on one exchange and selling it at a higher price on another exchange. This strategy demands swift execution, employing trading tools and platforms that enable you to monitor price differentials and execute trades efficiently.

On the other hand, sequential arbitrage involves a sequence of trades. You purchase a cryptocurrency on one exchange, transfer it to another where the price is higher, and subsequently sell it for a profit. While sequential arbitrage may require more time to execute, it has the potential to yield substantial gains if implemented effectively.

Monitoring and Analyzing Arbitrage Opportunities: To thrive in the realm of crypto arbitrage, it is essential to continually monitor and analyze opportunities. Remain vigilant by observing price movements, order book depths, and trading volumes across exchanges. Employ market analysis tools, price charts, and order book data to identify potential discrepancies.

Stay attuned to factors that can create arbitrage opportunities, such as market volatility, noteworthy news events, and regulatory developments. By remaining informed and adaptable to evolving market conditions, you position yourself for success.

Managing Risks in Crypto Arbitrage

Let’s uncover the secrets to effectively managing risks and safeguarding your arbitrage endeavors-

Counterparty Risk and Exchange Security: Counterparty risk refers to the potential for the other party involved in a trade to default or fail to fulfill their obligations. It is crucial to conduct thorough research and choose reputable exchanges with robust security measures in place.

Seek out exchanges that prioritize the safety of user funds through practices like cold storage of assets, strong encryption protocols, and transparent auditing. By selecting reliable counterparties and secure exchanges, you can minimize the risk of financial loss resulting from security breaches or fraudulent activities.

Transaction Speed and Confirmation Times: Time is of the essence in the fast-paced world of crypto arbitrage. Transaction speed and confirmation times can significantly impact your profitability. When executing arbitrage trades on DEX, it is important to consider the efficiency of the blockchain network and the transaction speed of the involved cryptocurrencies. Opt for cryptocurrencies with faster block confirmation times, as they enable quicker execution, reducing the vulnerability to price fluctuations. By minimizing the time between buying and selling transactions, you increase your chances of capturing favorable price differences.

Price Movements During Trade Execution: The volatile nature of the crypto market poses challenges during trade execution, especially when dealing with substantial orders. Price movements can occur rapidly, introducing the risk of slippage—the difference between the expected and executed prices. High volatility increases the likelihood of slippage, potentially impacting your profits.

To mitigate this risk, you can employ various strategies such as utilizing limit orders to set specific buy and sell prices or implementing stop-loss orders to trigger trades automatically if prices move unfavorably. By diligently monitoring market conditions and utilizing risk management tools, you can effectively manage the impact of price movements during trade execution and tame the volatility beast.

Conclusion

To sum up, cryptocurrency arbitrage offers abundant possibilities for the skilled traders to prosper. Throughout this exploration, we have revealed the mysteries behind this captivating concept and delved into the workings of arbitrage in both traditional and digital currency markets. Armed with this understanding, you are now prepared to embark on your personal arbitrage journey.

Timing and liquidity stand as the ultimate allies in the realm of cryptocurrency arbitrage. Grasping the complexities of market timing and capitalizing on moments of optimal liquidity are essential for unlocking profitable opportunities. By remaining attentive and honing your skills in executing astute arbitrage trades, you position yourself at the forefront of this dynamic market.

Of course, no journey would be whole without considering risk management and mitigation. In the ever-changing landscape of cryptocurrencies, it is vital to employ effective strategies to protect your capital. From creating multiple accounts on reputable exchanges to establishing a robust risk management plan, every step must be approached with caution and foresight.

Remember, the path to becoming a successful cryptocurrency arbitrageur begins with comprehending the concept and mechanics of arbitrage. By following the steps outlined in this guide, from conducting thorough research and analysis to seizing opportunities with accuracy, you establish the groundwork for a promising venture.

However, it is equally important to acknowledge and control the inherent risks involved. From counterparty risk and price volatility to transaction speed and security, adopting a comprehensive approach to risk management will ensure your ongoing success.