Quick Links

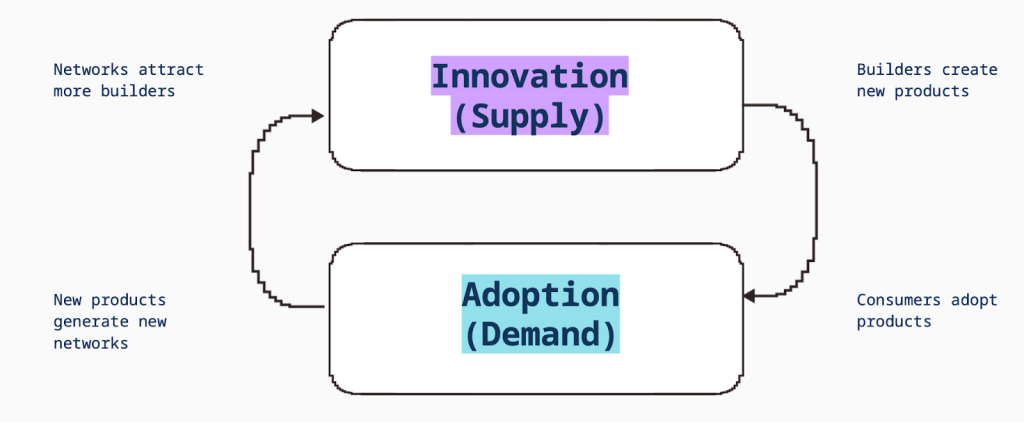

Tech markets are a function of supply and demand.

Let’s understand this with an example:

When a great tech product like Chatgpt launches, it sparks the interest of its founders to develop more innovative products. The market’s potential encourages founders to create new businesses, fostering innovation in this hyper-optimistic environment.

These founders create products that solve real-world problems, leading to increased demand and user adoption. New products are born by observing the creation of a new market and recognizing the vast opportunities it presents.

A16z report beautifully sums up this process in this infographic.

Source: a16z State of Crypto 2023 report

As we now have a good understanding of the market dynamics, let’s take a closer look at the fundamentals to gauge market trends.

To comprehend the market, it is important to examine both the supply side (product and development) and the demand side (activity).

Supply- side Parameters

A well-managed supply side is crucial for a tech product to succeed.

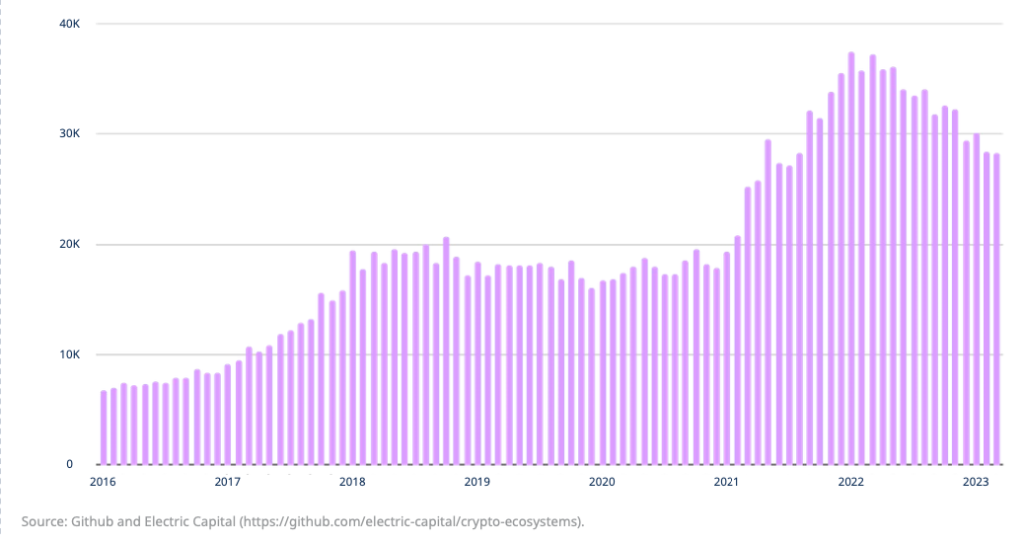

Active developers

Source: a16z State of Crypto 2023 report

The above chart represents active developers which have contacted any crypto repository. From 2018 to 2020, there were approximately 20,000 active developers each month. In 2021, developers’ interest significantly increased, and by the end of that year, the number of active developers reached 38K.

With the bear markets being active in 2022, Monthly developers count is on a smooth decline. Since 2021, there has been at least a 25% increase in active developers, despite the unfavorable market conditions. The developers’ exploration into Web3 and the creation of decentralized products is a positive sign.

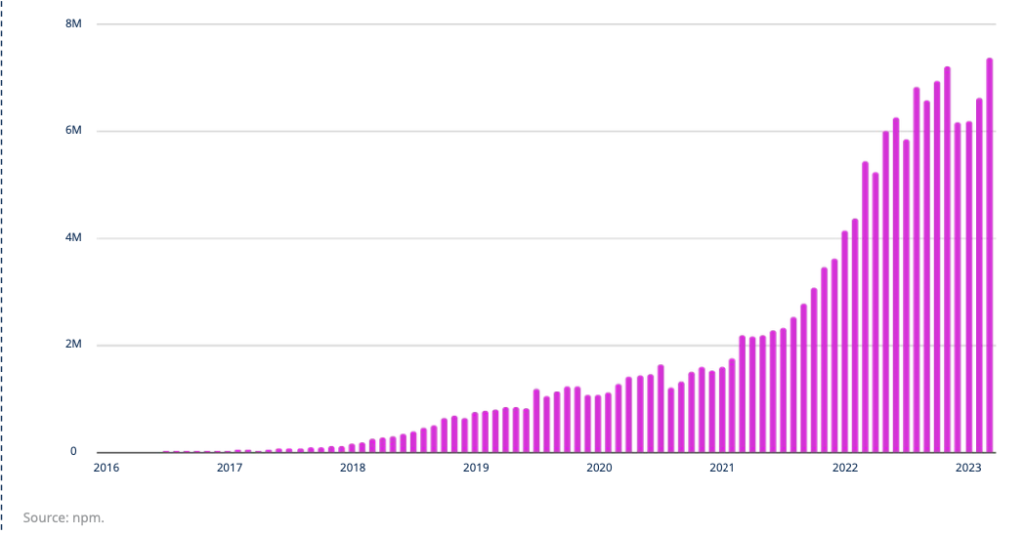

Developer Library Downloads

Source: a16z State of Crypto 2023 report

Since 2016, this chart shows the npm download (a package manager for Node.js packages) count of developer libraries for web3.js and ether.js. Explanation

We can clearly see that the crypto library usage is on a fast paced growth. The chart above shows that Web3 has a smaller influx of developers due to limited resources. However, there is a larger developer community interested in advancing into Web3.

Demand side

Active Addresses

Source: a16z State of Crypto 2023 report

The above chart highlights the number of unique active addresses across blockchain networks. Clearly, since 2020, active addresses have been on a rising streak. We must remember that while the market corrected by over 50% in 2022, active addresses did not decrease in activity. In fact, there was a slight increase instead. This is a great positive sign that depicts the resilience and trust of the users.

On-Chain Transactions

Source: a16z State of Crypto 2023 report

Blockchain transactions as depicted above are settling close to a billion transactions monthly. Since 2021, the sheer activity has witnessed a drastic increase, with nearly a billion transactions. Despite market fluctuations, the transaction count has remained steady.

DEX Volume

Source: a16z State of Crypto 2023 report

The above chart highlights the total on-chain DEX volume. Despite a slight decline, DEXs still generated over $100B in trading volumes in March. This indicates a renewed interest in on-chain trading. With the advent of advanced blockchain technology and lower transaction costs, we can expect to see record trading activity.

Conclusion

In conclusion, the tech market operates on the principles of supply and demand, creating a dynamic ecosystem. Innovative tech products encourage entrepreneurs to create new businesses and drive user adoption. This creates a positive environment and spurs demand for new products.

The success of tech products depends on the developer community. The growth of active developers and crypto library downloads shows an expanding Web3 community seeking new opportunities.

On the demand side, the growth of active addresses, blockchain transactions, and DEX volumes showcases the resilience and trust of users in the technology, despite the market downturns. The development of highly advanced chains and reduction in transaction costs are surely going to fuel the on-chain trading activity.

It is clear that Web3 is evolving rapidly, and it will be exciting to see how it continues to grow and shape the future of technology. As users and developers alike embrace new opportunities, we can expect to see even more innovation and growth in the years to come.