Quick Links

The cryptocurrency market has been quite volatile in recent years. While the beginning of the decade saw the market riding high on the back of a bull run, the scenario changed drastically by the end of 2021. The year 2022 proved catastrophic for the market, with many tier-A projects struggling to manage their operations and ultimately filing for bankruptcy. In this blog, we will closely examine the top 5 crypto bankruptcies in recent years.

Notable Crypto Bankruptcies

FTX

In November 2022, FTX ~ a global cryptocurrency centralized exchange and 130 affiliated companies under the “FTX Group” filed for Chapter 11 bankruptcy protection. The announcement was made to the public through a statement posted on the official Twitter channel of the company. The incident was considered as significant as the 2008 crisis that hit the US markets.

The Bahamas-based exchange (FTX) submitted a 23-page bankruptcy filing highlighting more than 100K creditors, assets, and liabilities ranging between $10 Bn to $50 Bn. Following the announcement, Sam Bankman-Fried (CEO) stepped down from his position in the company, and John J Ray III replaced his role. Following the bankruptcy, BlockFi ~ a crypto lender affiliated with FTX, also announced that it was suspending operations due to FTX’s collapse, later filing for Chapter 11 bankruptcy protection.

Following the news, the crypto market faced severe price swings and declines. Tether fell below its peg price of $1.00 to $0.97, while Bitcoin declined to its lowest level in two years. The value of publicly traded cryptocurrency companies’ shares also plummeted to steep lows, and Solana, which was linked with Bankman-Fried, also saw a price drop. Withdrawals from other exchanges increased due to the FTX situation, which led to a high liquidity crunch in the crypto markets.

Bittrex

Blaming “regulatory uncertainty” and announcing to shut down its operations, the US-based exchange recently filed its petition for Chapter 11 bankruptcy in a Delaware Court. The company estimated its assets & liabilities between $500 Mn & $1 Bn, and the bankruptcy filing also details that there are still 16 customers with atleast $1 Mn balance in their accounts; the largest depositor holds $14.6 Mn as digital assets in their wallet.

The Securities & Exchange Commission (SEC) sued the exchange in mid-April. The regulator stated that the company and its former CEO operated a security exchange & brokerage agency without any registration. Additionally, according to the lawsuit, Bittrex and its former CEO encouraged token issuers to revise their release statements to remove any language implying they were securities.

The lawsuit was filed after Bittrex was hit with a $53 million fine for money-laundering offenses by the US Treasury Department. Bittrex mentioned Treasury as the company’s largest creditor, with a $24 million claim in the bankruptcy petition.

The company needed help keeping up with rivals like FTX and Coinbase, who outspent Bittrex on marketing and provided high-yield products to attract new clients. Bittrex’s annual income decreased by 97% to $17 million between 2017 and 2022.

Genesis Global Capital

Genesis Global Capital was part of Digital Currency Group (DCG), a group of 200 crypto-based companies. The SEC charged the cryptocurrency lender on Jan 2023 for illegally selling crypto assets. The default of crypto hedge fund 3AC (Three Arrow Capital) affected the protocol in losing millions of dollars, further supported by the FTX blow, due to which the company suspended withdrawals on its platform and had to file for bankruptcy under Chapter 11 protection.

Genesis Global Capital was the partner company to the prominent US-based crypto exchange Gemini (owned by the Winklevoss brothers) for its defunct Earn program. Following the news, Gemini parted ways with the default company and announced that it would be halting the withdrawals on its program.

The bankruptcy filing indicated that the lending company had more than 100,000 creditors and between $1 billion and $10 billion in liabilities and assets in its filing. The assets and liabilities of its subsidiaries (Genesis Asia Pacific Pte. & Genesis Global Capital) were anticipated to be in the range of $100 million and $500 million, respectively.

At the time of filing, Genesis owed more than $3.5 billion to its top 50 creditors, including cryptocurrency exchange Gemini, trading firm Cumberland, Mirana, MoonAlpha Finance, and VanEck’s New Finance Income Fund.

Three Arrows Capital

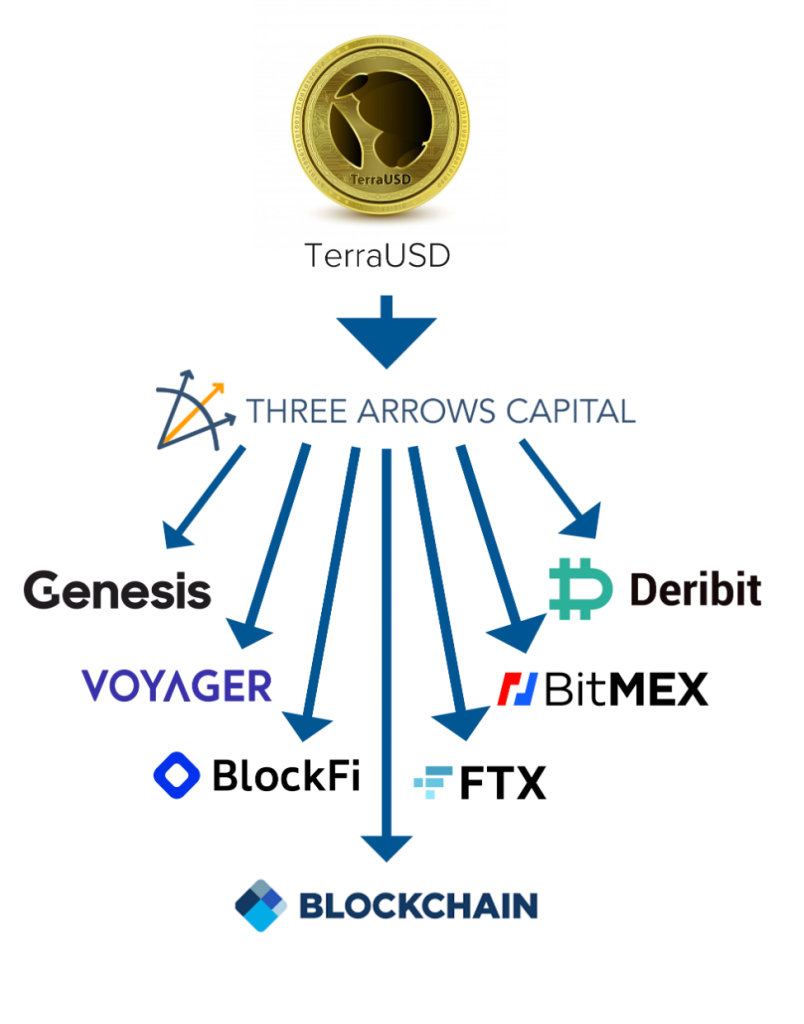

Three Arrows Capital (3AC), the first big crypto hedge fund to go bankrupt in 2022, was driven down by the May crash of cryptocurrencies Luna and TerraUSD. The impact of the Terra Luna meltdowns that roiled crypto markets worldwide and wiped out $42 billion in investor value eventually led the company to file for bankruptcy on July 22′.

The Singapore-based company 3AC, rumored to hold $10 billion in Bitcoin on March 22′, sank to $3 Bn on April 22′. Professionals in charge of 3AC’s liquidation also stated that the company’s founders went overseas and refused to cooperate with efforts to retrieve assets for creditors.

Celsius

Celsius Network is another crypto lender that filed for bankruptcy in 2022. The lending company boomed during the COVID-19 pandemic phase when it attracted investors & depositors with lucrative interest rates & easily accessible loans. The company benefited greatly from the differences by lending tokens to institutional investors. Following the Terra Luna crash on May 22′, the lenders failed to manage the funds, and the business model collapsed.

In June 2022, the company announced that it would stop all swaps, withdrawals & transfers between customer accounts on its platform. Following the announcement, the company and its affiliates volunteered for Chapter 11 bankruptcy proceedings in the US Bankruptcy Court (NY) on July 13, 2022.

The decentralized platforms Aave, Compound, and MakerDAO received more than $900 million in debt repayment from Celsius. The Southern District of New York petition listed Sam Bankman-Fried as one of the principal creditors.

The documents also highlighted that the platform had around $4.3 Bn in assets & $5.5 Bn in liabilities when it filed for bankruptcy. The Department of Financial Regulation (DFR) of Vermont warned consumers on July 12 about the faltering crypto-lending platform, advising them that it needs a permit to conduct business in the state.

The DFR also pointed out that the company was “seriously insolvent” and lacked the “assets and liquidity” required to fulfill its client obligations. It also charged that the company had mismanaged consumer funds by investing them in risky endeavours.

Factors Contributing to crypto bankruptcies

The prolonged crypto winters are a fundamental factor that contributed majorly to the companies mentioned above filing for bankruptcy. However, the Terra-Luna crash impacted major companies as most of these companies were holding big chunks of $UST in their respective treasuries.

Source: CNBC

The FTX fiasco, on the other hand, is also considered the major contributor to notable crypto bankruptcies. The FTX default led to distrust for many investors, both retail & institutional, and they eventually started pulling out their funds from the markets. The massive pullout of funds from the ecosystem fueled an operational crisis due to a liquidity crunch for the lenders like Voyager and Celsius, which eventually closed down and declared bankruptcy.

Role of Regulations in preventing crypto bankruptcies

One of the main reasons why crypto bankruptcies occur is the lack of proper regulatory oversight. Without clear guidelines and regulations, companies and individuals can engage in fraudulent or irresponsible behaviour, leading to significant financial losses for investors and users.

Regulations can help mitigate these risks by imposing transparency, security, and accountability standards in the crypto industry. This includes mandatory disclosures, anti-money laundering (AML) and know-your-customer (KYC) requirements, and consumer protection rules.

In conclusion, regulations play a crucial role in preventing crypto bankruptcies. The recent incidents involving Celsius Network, FTX, and Voyager demonstrate the need for regulations to ensure crypto companies operate transparently and securely. As the cryptocurrency industry continues to evolve, governments and regulatory bodies need to work together to create a regulatory framework that protects consumers and fosters innovation in the industry.