Quick Links

The Ripple Vs SEC legal battle has remained one of the most important issues in the legal landscape for cryptocurrencies for a couple of years. On December 22, 2020, the United States Securities and Exchange Commission (SEC) announced it had filed suit against Ripple Labs Inc. and its current and previous CEOs Brad Garlinghouse and Christopher Larsen, respectively.

The SEC alleges that the executives violated securities law when they raised over $1.3 billion through an initial public offering (IPO) of XRP, which was unregistered security at the time. If found guilty, the executives could be fined and subject to jail time.

The SEC’s lawsuit is just one of many challenges Ripple is currently facing; on December 21, 2020, the U.S. Department of Justice (DOJ) filed suit against the company alleging that it had violated anti-money laundering laws. Ripple has denied all allegations of wrongdoing and has vowed to fight the SEC’s lawsuit “to the end.” The case is ongoing.

Ripple Vs SEC Legal Battle: Riding Tough Tides

Several cryptocurrency exchanges suspended and delisted XRP trading immediately after the SEC filed its lawsuit against Ripple. At the time, the crypto asset was one of the top four digital assets in terms of market capitalization.

Following the lawsuit, XRP’s market cap fell to $9.98 billion, according to CoinMarketCap data. However, the asset recovered during the 2021 bull run, peaking at $83.42 billion in April 2021.

During the litigation, XRP briefly traded above $1, peaking at around $1.80. However, the asset’s price has dropped to $0.39 at the time of writing due to the current bear market conditions.

Community Support Remains a Key Factor

During the Ripple Vs SEC legal battle, Ripple received massive public backing from the crypto community. Crypto companies such as Coinbase and others have filed several amicus briefs. Aside from that, approximately 70,000 XRP holders filed a brief in support of the company.

Ripple also won minor victories, such as gaining access to the emails of former SEC Director William Hinman. Meanwhile, several analysts have claimed that the result of this case will have ramifications for the entire crypto industry.

Ripple Vs SEC Legal Battle Coming to An End

The legal battle between the U.S. Securities and Exchange Commission (SEC) and Ripple is nearing its end, with Ripple filing its final submission in the case on Dec. 2. In its latest filing, Ripple argues that the SEC’s lawsuit is “fundamentally flawed” and that the agency has “failed to meet its burden of proof.” Ripple also argues that the SEC has failed to show that investors were misled by the company’s sales of XRP. The final outcome of the case is far from clear, but it could have major implications for the cryptocurrency industry.

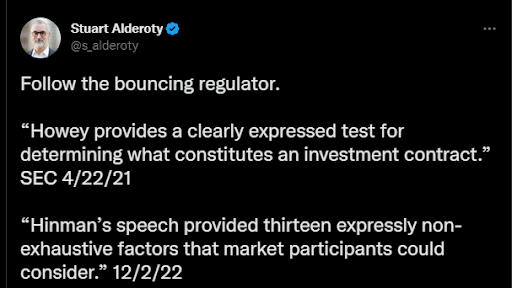

Ripple‘s General Counsel, Stuart Alderoty, said on Twitter on December 3 that this is the company’s “final submission,” requesting the court to “grant” judgment in its favor. He also mentioned that Ripple is proud of its defense on “behalf of the entire crypto industry,” noting that Ripple has “always managed to play it simple with the court,” taking a subtle jab at the SEC, saying he “can’t say the same for our adversary.” On December 5, Alderoty persisted to slam the SEC, referring to it as a “bouncing regulator” and citing two points that he believes contradict each other.