Quick Links

The third week of December for DeFi faced a gradual decline as the majority of the cryptocurrencies under DeFi are showcasing negative performance on weekly basis. However, decentralized exchanges continue to receive engagement from investors in terms of investments and holdings. This is primarily because of the shaken confidence of these investors in centralized exchanges after the collapse of FTX. In this blog, we will be covering key happenings of DeFi that happened throughout the week.

DeFi Sector Total Value Locked (TVL) Analysis

During the start of the week, the total value locked (TVL) in DeFi showcased a minor positive trend climbing from $40.34 Bn to $41.50 Bn. Since then, due to the overall market conditions, there has been a steep downfall as the current figures reside around $39.54 Bn. It must be noted that the TVL has not been able to pass the $42 Bn mark in the past month.

Significant Happenings in DeFi Sector For The Week

ConsenSys Launches zkEVM Private Beta Testnet

ConsenSys has been working for several years to wrap EVM computation in zero-knowledge proofs to create a zkEVM, rather than ask-Rollups on networks separate from the EVM. Zero-knowledge technology validates transactions on a separate layer and returns computation to Ethereum without returning all data. Ethereum developers assume that rollup solutions such as Optimism can boost scalability by up to 100x by merely providing proof that everything was correctly computed on layer 2 and putting a succinct proof back on the blockchain.

Users of Ledger Hardware Now Have a DeFi Tracking Feature

Along with DEXs, hardware wallets are also having a rise in demand. In order to advantage of the situation and provide ease of accessibility to its users, Ledger and Merlin announced their new partnership during the past week to bring live DeFi analytics to Ledger Live, an app by Ledger which connects its cold storage wallets that is a service provider to over 5 million users.

Solana-Based Raydium Exchange Faced Seven-Figure Exploit

During the past week, Raydium, which is a Solana-based decentralized exchange faced an exploit that has resulted in the loss of cryptocurrencies worth $2 million. The hacker’s wallet address was identified at the time of writing and consists of $1.3 million worth of tokens

DeFi Sector Charts of the Week

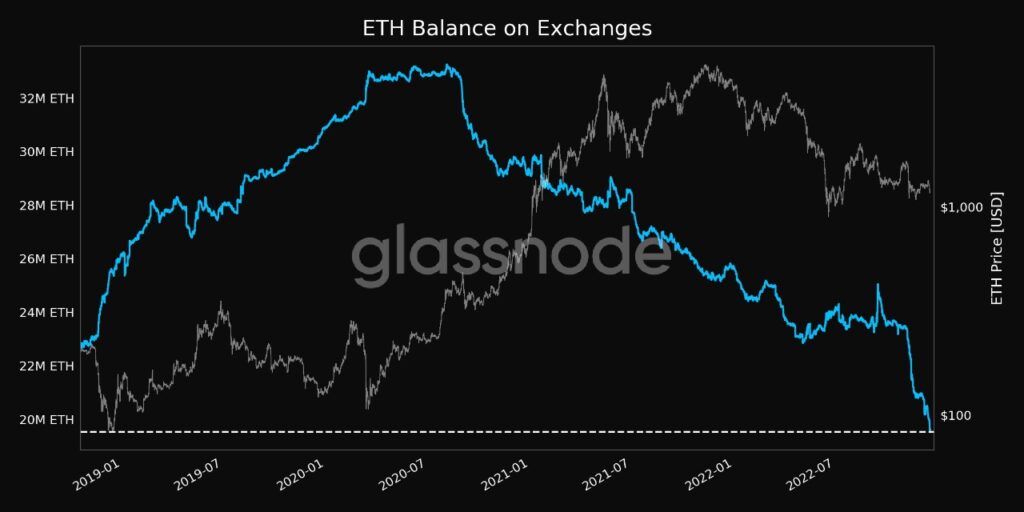

Ethereum’s balance on exchanges at a 4-year low

Ethereum’s balance on exchanges is now at a 4-year low of 19.52 billion ETH. This on-chain metric represents the number of ETHs held by exchanges. A decline in such a metric indicates that the circulating supply of ETH is in the wallets of users rather than the exchanges.

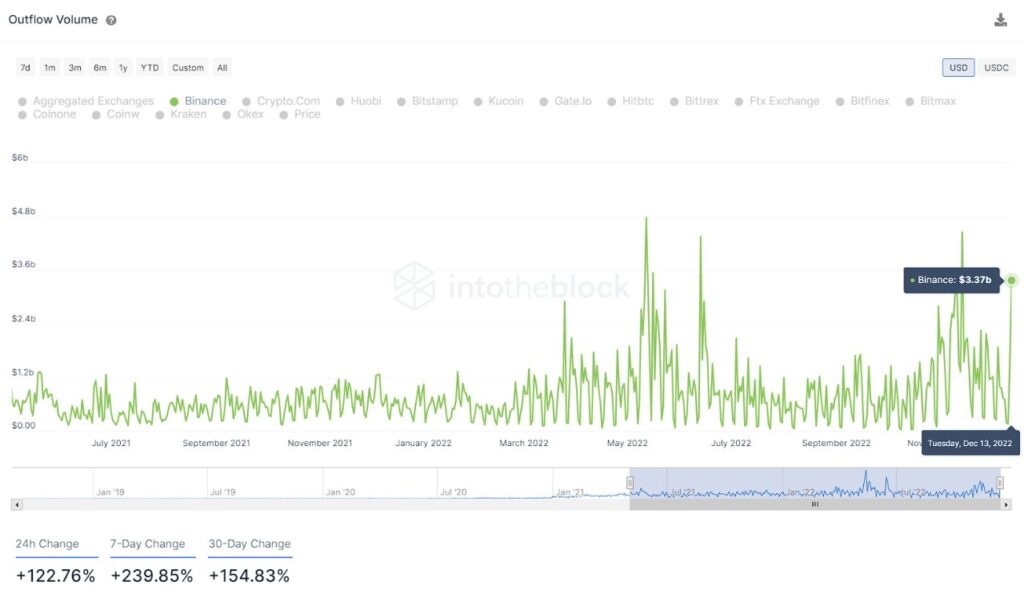

Binance faced the fourth-largest USDC outflow ever

On December 13th, Binance temporarily halted the withdrawals of USDC. The reason behind the halt was mentioned by CZ in his tweet. As soon as the withdrawals got resumed, the world’s largest exchange had the fourth-largest outflow ever for USDC with a volume of $3.37 billion.

Trending DeFi Protocols of the Week

The trending DeFi protocols of the week mentioned are based on the news and attention caught by these protocols. This means that the weekly performance of these protocols might be negative and should not be taken as a piece of investment advice.

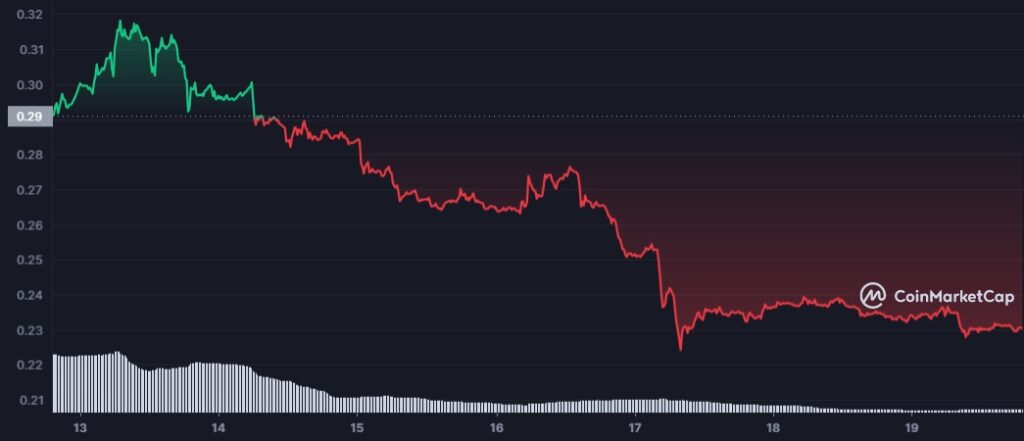

Serum (SRM)

Serum has faced significant selling pressure since the past week as it is down nearly by 30%. Serum, being one of the leading decentralized exchanges for Solana is facing continuous selling pressure since the collapse of FTX considering the close association of Solana with the bankrupted exchange. However, the recent exploit of Raydium gave additional reasons to its investors for selling SRM tokens.

Yearn.Finance (YFI)

Yearn.Finance also faced significant selling pressure during the past week. The price level has broken below the crucial mark of $6K. It must be noted that the value of the YFI token during the start of the month was around $7.5K. The CMP is $5.6K with a market cap of $207 million. Based on the technical chart, the support zone for YFI token is around $5.3K and if the level goes below, it can face further downfall.

Stacks (STX)

Another victim of the DeFi downfall during the past week was Stacks (STX) token. The weekly performance of STX token is down by nearly 20%. Based on the technical chart, Stacks is having strong support zone around the price level of $0.20 and is expected to have a bounceback if the level is tested.

Overall DeFi Sector Analysis

The overall market conditions that prevailed over DeFi tokens during the past week caused the downfall among the majority of them. On the positive side, we witnessed some positive developments as hardware and non-custodial wallets continued to increase in demand while adding relevant DeFi features onto their respective platform. But at the same time, the exploit of Raydium exchange suggests that DeFi is also prone to hacks and exploits as much as a centralized exchange prone to bankruptcy. In the end, it’s the user who has to suffer the damages caused by both scenarios.