Quick Links

Ethereum liquid staking refers to the process of staking Ethereum (ETH) tokens while still maintaining their liquidity and the ability to use them in other decentralized finance (DeFi) applications. Let’s first look at staking and Ethereum’s PoS (Proof of Stake) mechanism to understand it.

The concept of liquid staking gained momentum with the development of Ethereum 2.0, which led to the transition of Ethereum from a PoW (Proof of Work) to a PoS consensus mechanism. Ethereum 2.0 is being implemented in multiple phases, and the Beacon Chain, the first phase, went live in December 2020, and the merge in September 2021.

Liquid staking addresses this issue by introducing a layer of abstraction. It allows users to stake their ETH and receive a tokenized representation of their staked assets, often called staked ETH (stETH). These tokenized assets can be freely traded and utilized in DeFi applications, providing liquidity while still participating in the staking process.

Since then, various projects and protocols have emerged to enable liquid staking on ETH. These projects, such as Lido, Ankr, and Rocket Pool, allow users to stake their ETH and receive tokenized representations that can be traded on decentralized exchanges or utilized in DeFi platforms. They typically operate by pooling users’ staked assets to increase efficiency and reduce barriers to entry, as the minimum requirement for staking ETH in Ethereum 2.0 is relatively high.

Benefits of Liquid Staking

- Firstly, it provides liquidity to staked assets, allowing users to access the value of their holdings without waiting for the staking period to end.

- Secondly, it enables users to participate in DeFi applications, earn additional rewards, or utilize their staked assets for various purposes.

- Lastly, as more and more users will stake to get higher returns than the traditional assets, it will further increase the security and decentralization of the Ethereum chain.

Current landscape in the Liquid Staking Sector

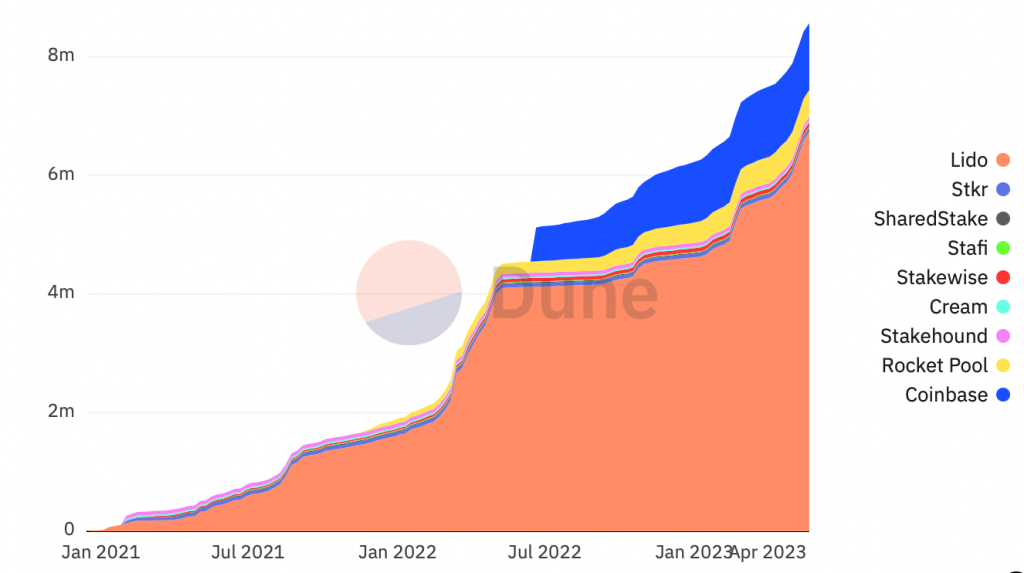

The total Ethereum staked has reached a TVL of $16.85 Bn with ~9,052,101 ETH staked on 19 liquid staking derivative protocols.

Source: Dune Analytics

ANKR was the first protocol to allow liquid staking. Still, in a short period, Lido took over the whole LSD industry with its new model and higher profits, and today has a 75% dominance with a TVL of $12.3 Bn, which climbed by a phenomenal 1,314% CAGR from 2021 to 2023.

Source: DeFi Llama

The same story goes for Frax’s LSD protocol. Its unique two-token design differentiates it from incumbent staking derivative models. Frax LSD is the 4th largest LSD protocol with more than $402Mn TVL. Frax’s LSD TVL rose by an impressive 383% CMGR.

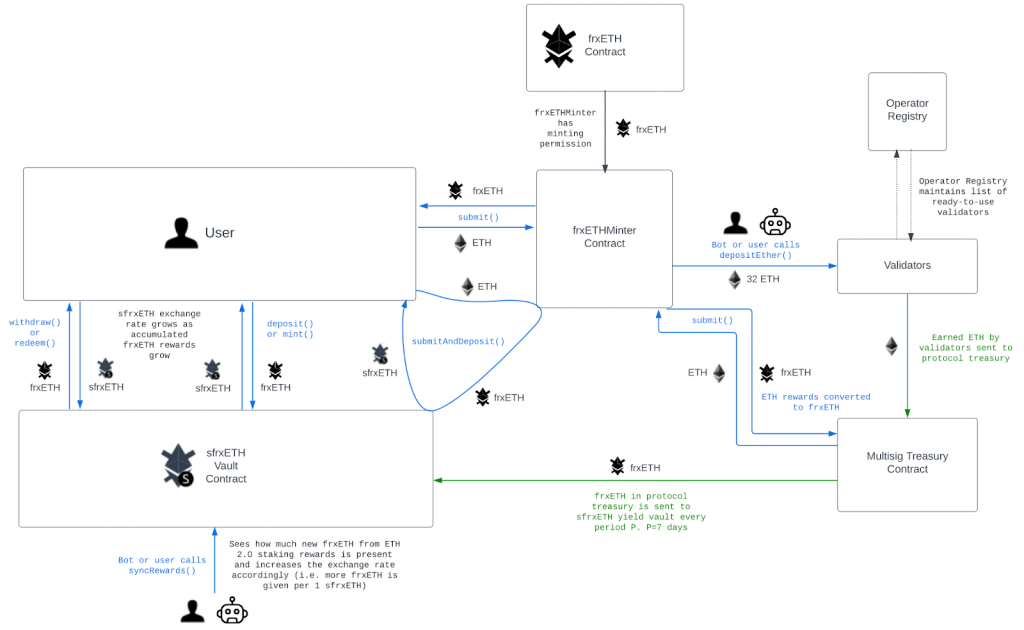

Frax introduced ETH staking services in late October 2022 with a unique approach. Instead of traditional staking models, Frax uses a two-token system. When users stake their ETH through Frax, they receive a token called frxETH as proof of their deposit; similar to when we put our liquidity in any pool, we receive an LP token representing our share of liquidity.

Unlike other similar tokens, frxETH doesn’t gain value from staking rewards. Instead, it acts as a stablecoin loosely pegged to ETH, functioning similarly to wrapped ETH (WETH) and benefiting from gas optimizations.

Source: Frax Docs

Frax also offers sfrxETH, which is a variant of frxETH. The difference is that sfrxETH allows users to earn staking rewards. It represents a deposit receipt in a specialized vault, i.e., the ERC-4626 vault, that receives all the profits of Frax’s Ethereum validators.

In simpler terms, Frax provides a way to stake ETH and receive frxETH tokens as proof of the deposit. These tokens act like stablecoins and can be used similarly to regular ETH. Additionally, users can stake through sfrxETH to earn additional rewards from Frax’s validators.

Frax’s Unique Approach: Higher APY

In this design, it’s important to note that when people deposit ETH, they don’t automatically receive staking rewards. Frax gives frxETH holders a choice: they can either get a share in the staking rewards through the sfrxETH vault or explore other opportunities to earn higher returns on their frxETH.

Source: Frax Analytics

And this is all done on Curve Finance. Frax is the largest holder of Convex Finance’s token, CVX, which provides it with an outsized influence over Curve’s gauge system. Frax can influence the distribution of CRV and CVX rewards within the Curve ecosystem. By directing these rewards to the frxETH/ETH Curve pool, Frax creates an alternative option for frxETH holders who prefer not to use the sfrxETH vault. When more users deposit their frxETH in Curve, those who choose to stake in the sfrxETH vault receive a larger share of the ETH staking rewards the Frax protocol provides.

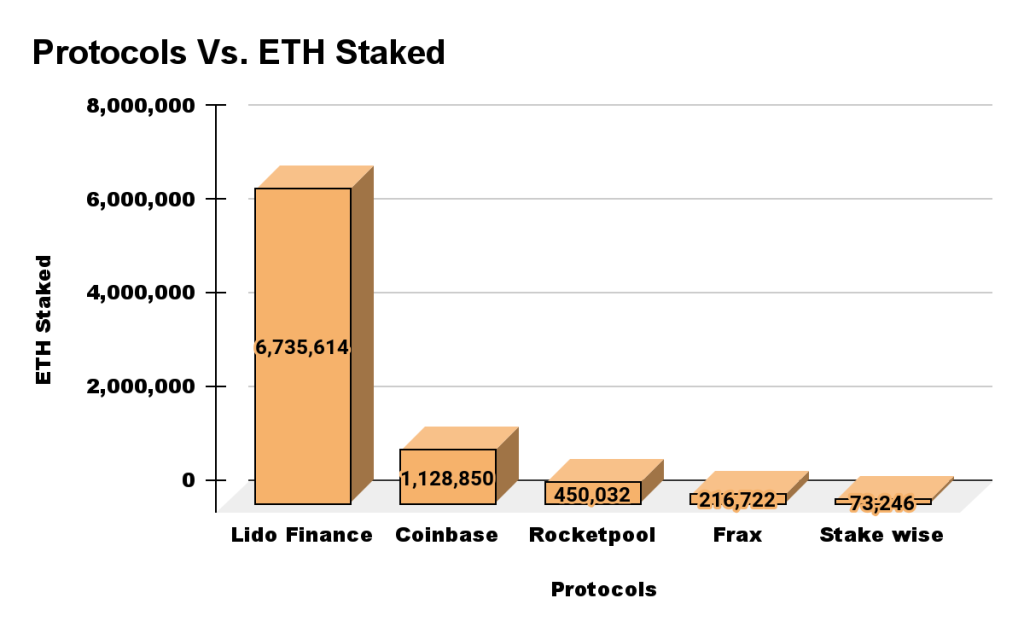

Current Liquid Staking Landscape

| Protocols | ETH Staked | Market Share | TVL(in $) | Total depositors | Average ETH deposit | Fees charged of all the rewards generated |

| Lido Finance | 6,735,614 | 77.10% | $12,479,610,739 | 147,632 | 46 | 10% |

| Coinbase | 1,128,850 | 12.90% | $2,091,511,499 | 10,152 | 111 | 25% |

| Rocketpool | 450,032 | 5.20% | $833,810,289 | 7,857 | 57 | 14% |

| Frax | 216,722 | 2.50% | $401,539,108 | 1,398 | 155 | 10% |

| Stake wise | 73,246 | 0.80% | $135,709,322 | 5,531 | 13 | 10% |

Source: Token Terminal

Comparison: Cumulative fees, Revenue Ave. DAU and Code commits

| Protocols | Cummulative Fees(in $ mns) | Revenue(in $) | Ave. Daily Active Users | Code commits(in last 365 days) |

| Lido Finance | 405.6 | 40.6Mn | 354 | 6,332 |

| Frax | 6.2 | 486.9K | 29 | 274 |

| Stake wise | 3.9 | 618.3K | 5 | 290 |

Source: Token Terminal

Quiet evident from the chart above, Lido is leading the LSD pack considerably. The reasons for Lido Finance’s potential dominance include factors such as early entry into the market, a well-designed user interface, a robust infrastructure, attractive staking rewards, less fees, and strong community support. On the preliminary level, all these factors paved the way for Lido’s success.

When comparing the timelines and performance of Lido Finance and Frax in the liquid staking derivative sector, notable differences emerge. Lido Finance introduced its liquid staking services in January 2021, while Frax entered the market in October 2022. Despite this substantial head start, Lido has amassed ~$405 million in cumulative fees collected over the past 365 days. On the other hand, Frax has accumulated $6.2 million in fees during the same period. However, what truly stands out is the remarkable growth achieved by Frax in just six months, surpassing Lido’s growth over 30 months. This rapid progress demonstrates the impressive performance of Frax in a relatively short time.

Conclusion

One of the main reasons behind Frax’s rapid success is its ability to provide higher APY than its competitors. The below chart depicts the Median APY of Lido, Coinbase, Rocketpool, Frax, and Stakewise, it clearly shows that Frax and Lido are the two highest APY providers, but if we take the mean of these Median APYs of Frax and Lido, Frax has the highest APY of 6.55% as compared to 6.36%.

Source: Token Terminal

Currently, the staking ratio for ETH sits at ~15%, which is relatively low compared to other PoS chains. For example, Solana and Avalanche currently boast staking ratios of over 60%. Given the higher market cap of ETH, ~$235B at the time of writing, we could see multibillion-dollar growth in assets staked over the coming quarters.

Frax Ether has emerged as the fastest-growing player in the liquid staking market sector, primarily attributable to the high APY yields provided by its LSD product. The increased yield stems from additional returns generated through Curve and Convex liquidity mining rewards.

Also, With the successful implementation of the Shapella upgrade, the liquid staking market sector is poised for accelerated growth and heightened competition. As a result, we might see liquid staking projects implement lower take rates, meaning they could pay out a more significant share of the rewards to stakers in the future. Overall, we are optimistic about this sector and the Frax Ether, owing to the expanding scale of the Ethereum staking industry and the Frax’s phenomenal rise over the last 6-7 months.