Quick Links

In the dynamic and rapidly expanding realm of cryptocurrencies, Binance has emerged as a prominent player, boasting the world’s most extensive cryptocurrency exchange title. However, recent claims have cast a shadow over the firm’s operations, inciting inquiries about its compliance with financial regulations and the security of its client’s assets. This blog post will delve into these claims, comprehensively analyzing their potential repercussions for Binance and the broader cryptocurrency industry.

Key facts

- Binance, the world’s largest cryptocurrency exchange, has been accused of merging customer funds with company revenue in 2020 and 2021, a breach of U.S. financial rules.

- The sums involved reportedly ran into billions of dollars, with the merging happening almost daily in accounts the exchange held at U.S. lender Silvergate Bank.

- Despite these allegations, no evidence suggests that Binance client monies were lost or taken.

- Binance has denied these allegations, stating that the accounts in question were not used to accept user deposits but were used to facilitate user purchases of crypto.

- The company faces civil charges from the CFTC of willful evasion of U.S. commodities laws. It is also under investigation by the Justice Department for suspected money laundering and sanctions violations.

- Despite these challenges, Binance remains a dominant player in the cryptocurrency market, accounting for as much as 70% of world cryptocurrency trading.

- The allegations against Binance underscore the need for robust regulatory oversight in the rapidly evolving cryptocurrency market.

Claims of Merging Client and Company Funds

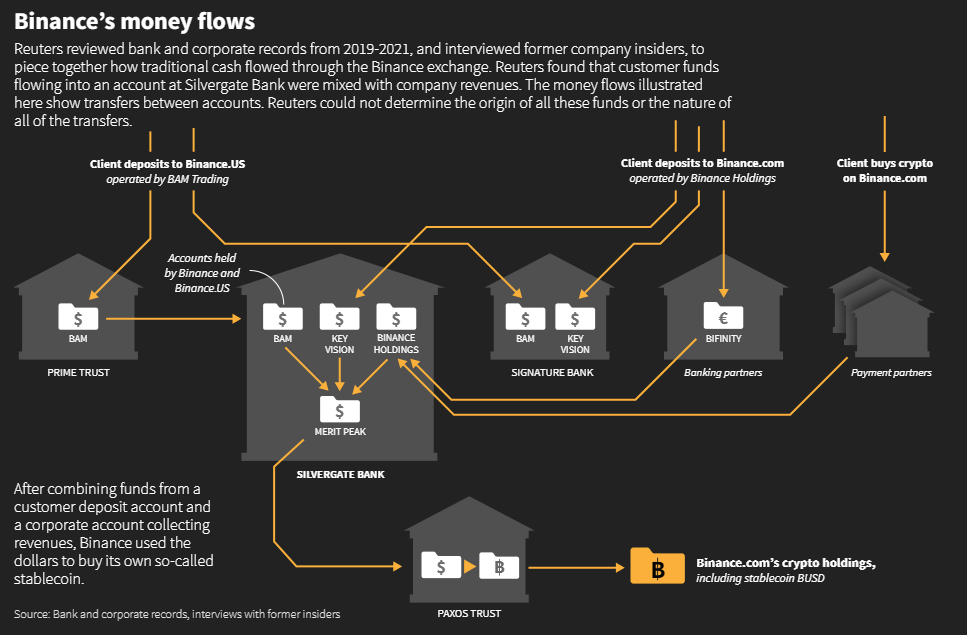

A detailed investigation by Reuters has brought to light allegations that Binance merged its clients’ funds with its revenue during 2020 and 2021. This action contradicts U.S. financial regulations, which mandate the separation of client money. The investigation suggests that the amounts involved could be in the billions of dollars, with the merging of funds allegedly occurring almost daily in accounts Binance maintained at U.S. lender Silvergate Bank.

The investigation also highlighted an apparent absence of internal controls at Binance to ensure the clear identification and separation of client funds from company revenues. This merging of funds could jeopardize client assets by making their location indistinct. However, despite these allegations, no evidence suggests that any Binance client funds were lost or misappropriated.

Binance’s Counterclaim

In response to these allegations, Binance has categorically denied any wrongdoing, asserting that the accounts in question were not used for receiving user deposits but instead to enable user purchases of cryptocurrency. The company has compared this process to purchasing a product from an online retailer like Amazon. However, former U.S. regulators have countered Binance’s explanation, arguing that it contradicts the exchange’s previous assertions to customers that the transfers were deposits, thereby creating the expectation that clients’ funds would be protected like traditional cash deposits.

Binance’s Financial Operations

The investigation also unveiled that Binance utilized Silvergate Bank as the central hub of its financial operations. Client dollars were funneled into a Silvergate account of a Seychelles-based firm controlled by Binance CEO Changpeng Zhao. It is alleged that Binance merged client money and company revenues in a third Silvergate account under the control of a Cayman firm that Zhao owns.

Regulatory Oversight and Future Prospects

With the cryptocurrency sector facing heightened scrutiny and regulation, the future trajectory of Binance’s operations is still being determined. The company is confronting civil charges from the CFTC for allegedly evading U.S. commodities laws deliberately. It is also under investigation by the Justice Department for suspected violations of money laundering and sanctions laws.

Despite these hurdles, Binance remains a formidable force in the cryptocurrency market, accounting for up to 70% of global cryptocurrency trading. As the company grapples with these allegations and navigates regulatory challenges, the question that looms large is: what lies ahead for this cryptocurrency titan?

🚨 New Updates 🚨

The U.S. Securities and Exchange Commission (SEC) has initiated legal proceedings against Binance Holdings Ltd., its U.S.-based associate BAM Trading Services Inc., and their founder, Changpeng Zhao, with a total of thirteen charges. The allegations include the operation of unregistered entities such as exchanges, broker-dealers, and clearing agencies, misrepresentation of trading controls and oversight on the Binance.US platform, and the unauthorized offer and sale of securities.

In more detail, the SEC’s charges involve:

- The accusation that Binance allowed high-value U.S. customers to trade on Binance.com, despite public statements to the contrary that U.S. customers were restricted from doing so.

- Claims that Binance maintained secret control over Binance.US operations while asserting to the public that it was a distinct and independent trading platform for U.S. investors.

- Allegations that Binance and Zhao had control over customer assets on their platforms and could mix customer assets or divert them at will, including to a Zhao-owned entity named Sigma Chain.

- The charge that BAM Trading and BAM Management US Holdings, Inc. made false claims about the existence of trading controls on the Binance.US platform, while Sigma Chain was involved in trade manipulation that falsely boosted the platform’s trading volume.

- The assertion that Binance and BAM Trading were operating as unregistered securities exchanges, broker-dealers, and clearing agencies.

- The charge that Binance and Zhao deceived investors about risk controls and manipulated trading volumes while hiding who was running the platform, the affiliated market maker’s manipulative trading, and the whereabouts and custody of investor funds and crypto assets.

- The allegation that Binance and Zhao knowingly skirted the rules and put their customers and investors in danger to increase their own profits. They are accused of engaging in numerous unauthorized offerings and failing to register while simultaneously combining the roles of exchanges, brokers, dealers, and clearing agencies, thus imposing significant risks and conflicts of interest on investors.

- The claim that Binance.com and Binance.US, under Zhao’s control, acted as exchanges, brokers, dealers, and clearing agencies since at least July 2017, and generated at least $11.6 billion in revenue from transaction fees from U.S. customers. Zhao is also alleged to be responsible for the registration violations of Binance and BAM Trading.

- The charge that Binance conducted unauthorized offers and sales of BNB, BUSD, and crypto-lending products like “Simple Earn” and “BNB Vault,” and that BAM Trading conducted unauthorized offers and sales of Binance.US’ staking-as-a-service program.

- The accusation that Zhao and Binance established BAM Management and BAM Trading in September 2019 as part of a plan to circumvent U.S. federal securities laws by asserting that BAM Trading independently operated the Binance.US platform and that U.S. customers could not use the Binance.com platform. However, it is alleged that Zhao and Binance maintained significant involvement and control of the U.S. entity.

- The charge that BAM Trading and BAM Management gave false information to Binance.US customers and equity investors about the presence and adequacy of market surveillance and controls to detect and prevent manipulative trading on the Binance.US platform’s crypto asset trading volumes

Conclusion

The allegations against Binance underscore the necessity for stringent regulatory oversight in the rapidly evolving cryptocurrency market. As the world’s largest cryptocurrency exchange, Binance’s actions significantly affect the broader market. Therefore, how the company addresses these allegations and adapts to increasing regulatory scrutiny will be of keen interest to investors, regulators, and other stakeholders in the cryptocurrency arena.