Quick Links

Harvesting the best crypto crops through patience and effective strategies

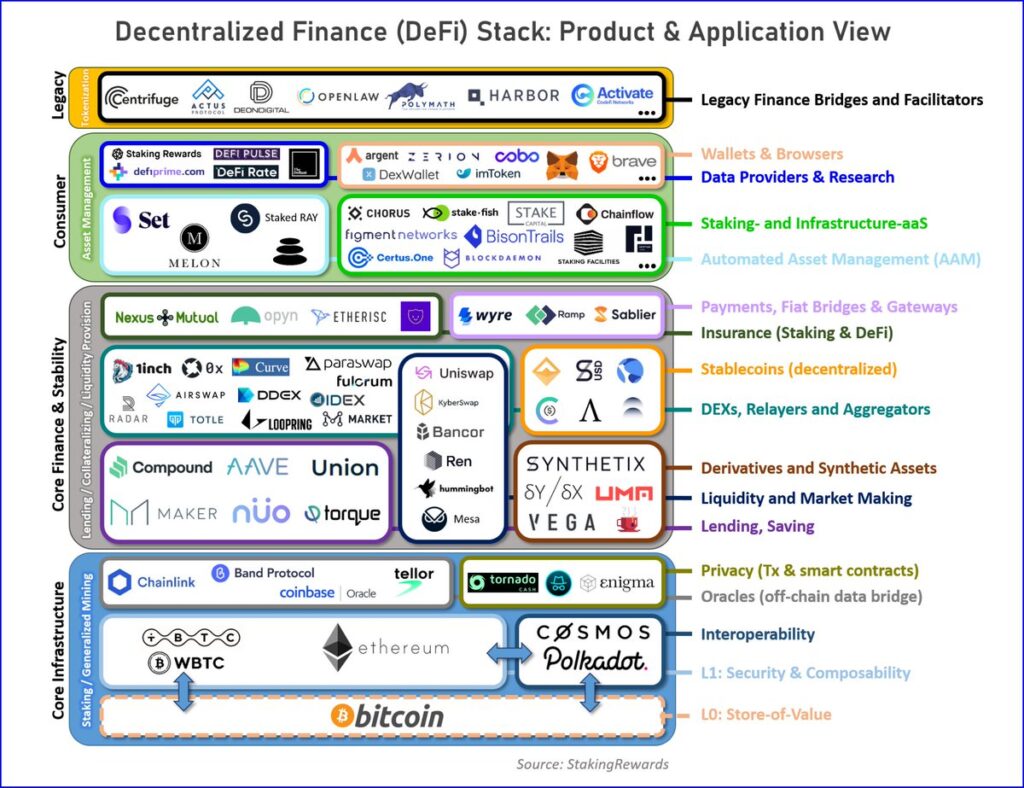

The concept of HODL has changed since the emergence of DeFi. Now hodlers can utilize their holdings to earn passive income by either providing liquidity to DeFi liquidity pools or make money by staking their cryptos in different smart contracts. Yield farming is a similar concept- to put your money to good use and make constant returns through Annual Percentage Return or APR provided by pools operating in the DeFi domain.

What is Yield Farming?

Yield farming, in essence, is a method to make more crypto with the crypto you own. It is also called Liquidity Mining whose concept spun out of DeFi to help yield farmers harvest their cryptos and earn rewards with their cryptocurrency holdings using permissionless liquidity protocols. Farming implies crop rotation or the process of moving funds across protocols for maximising returns on capital. It requires multiple confidential strategies that play a vital role in grabbing the best APR or concentrating the funds in the protocols that are generating more yield.

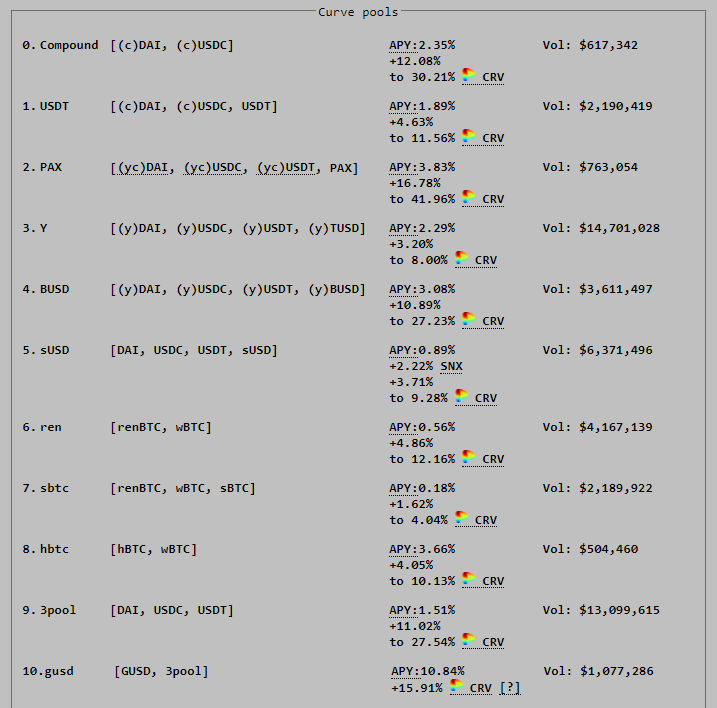

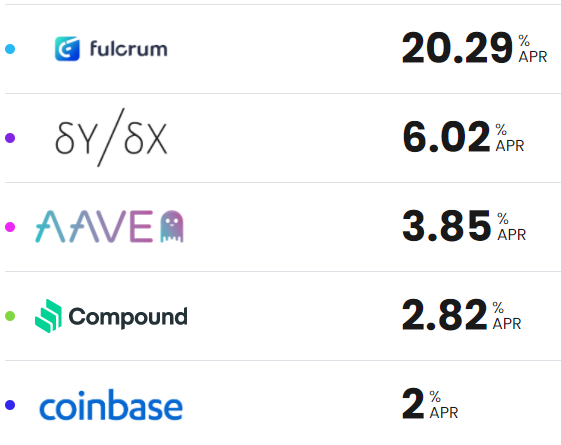

Yield Farming implies tracking the best rates to maximize returns. One can skim through the website Defirate.com to find the highest lending rates. Compound.finance, the second-largest lending protocol currently has $887.7 mn of assets earning interest across 12 markets. Participants in yield farming earn an equivalent amount of governance tokens which give them special rights to vouch for the software and voice their concerns about proposed changes to the protocol. The number of governance tokens they possess represents their authority to exercise their voting, the more the better.

The compound is dubbed as the community-built interface integrating the protocol has many advantages with respect to lending.

- Users can earn compounding interest when lending their assets or adding liquidity.

- Interest is paid in the lent asset which is paid every 15 seconds.

- The fee is paid in ETH but one can withdraw or lend anytime.

Adding Liquidity to Start generating Yield

Select the pair of your choice to deposit such as DAI/ETH on let’s say Uniswap. For every asset you deposit, you need to allocate the equivalent amount of the other to bring balance. So, if you’re putting 10 DAI valued at $1 each into the pool, you have to put in $10 worth of ETH too. Once you have successfully added to the pool, you will receive a proportional amount of pool tokens. These tokens will monitor your shares of this pool’s reserves which are also used to withdraw your deposits.

What is the APR?

Yield farming returns are calculated in APR which is a metric used to calculate the annual return a user could make on her farming. There is no other metric in the open finance for calculating accurate returns as of now due to the space being nascent yet highly competitive. The APR is borrowed from traditional systems and DeFi needs to narrow down on its own metric to simplify the calculations. The fast-paced ecosystem of liquidity mining, farming, lending and borrowing is just speculative and rewards tend to fluctuate rapidly.

The APR is based on a strategies individual might use on a given scale. But if a particular mining strategy is known by more participants, its overuse may diminish returns overall and the strategy won’t be useful anymore, thus it would limit gains and the APR won’t yield as many returns.

Automated Market-Making Mechanism

Kyber Network was the first Automated market-making mechanism to innovate automated liquidity pools for the crypto ecosystem in 2018. AMMs are smart contracts that create liquidity pools of ERC20 tokens. Liquidity is governed automatically by an algorithm rather than an order book as found in centralized exchanges.

The necessity of order books and market makers has restricted exchanges to rely heavily on these aspects for maintaining liquidity. If it were not for order books and market makers, the exchanges would instantly go illiquid. Market makers are entities who always participate in buying or selling a digital asset to facilitate trading and maintaining good liquidity. But order books have a major setback, and that is its dictation of an asset’s price. Sometimes the trader doesn’t want to buy a certain stock at the given price. The exchanges then utilize the market maker phenomenon to provide liquidity.

AMMs have invented a new high octane space to trade effortlessly and effectively which poses a positive effect in crypto space as a whole and sets forth many benefits such as;

Price slippage is negligible

Orders take milliseconds instead of seconds

Latency on trade calls down to milliseconds instead of seconds

Constant liquidity injection in the markets

Markets are now free of wash trading and price manipulation,

Fair and faster trading appeals to retail and institutional traders alike

Liquidity Pools

The liquidity pools ensure that the price of the locked asset does not swing dramatically even if there’s a large trade order executed. The pools also eliminate any unnatural arbitrage instances, and an automated smart contract helps the user buy or sell replacing a matching engine.

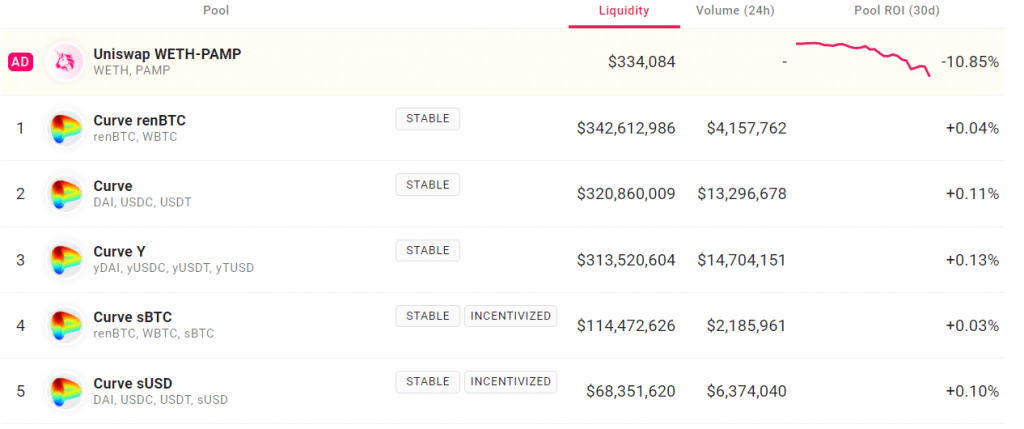

Amount of Liquidity in top pools

Decentralised exchanges offer incentives to those who bring liquidity to the pools in order to encourage participation and adoption. With just a simple deposit in the pool’s smart contract and no special eligibility requirement, one can start reaping rewards and profits unrelentingly.

The effectiveness of the pooling mechanism is that it cannot fluctuate in liquidity as the funds deposited in the pools are always in the ratio of a base asset. And when one deposits her funds in let’s say Maker (MKR), she has to do it in 1:1 proportion to the base asset of that pool. Constant pooling means constant availability of liquidity while significantly reducing abrupt price swings. Lower gas fees and the ability to add liquidity from various users adds a huge advantage to the ecosystem.

To draw a picture of how liquidity pooling works, we have to understand how to get started. Since the ratio of the tokens in a pool dictates the price, the buyer of ETH from a DAI/ETH pool reduces the supply of ETH and increases the supply of DAI. This results in increased ETH price while a simultaneous decrease in the price of DAI. The more the number of base assets in a pool, the greater the liquidity, which basically means if a pool contains 100,000 USDC and 100,000 DAI, smaller trades would have a negligible impact on the relative prices.

The fluctuation of the price depends on the size of trades with respect to the size of the pool. Liquidity providers get returns based on how much liquidity they are providing to the pool. The bigger the pool against a given trade, the lesser the slippage or the price impact.

This way bigger pools such as Uniswap can enable larger trades without affecting the price too much. Less slippage and better trading experience have had some protocols such as Balancer offer incentives to liquidity providers. This additional reward is known as liquidity mining which we will discuss in later articles. Uniswap maintains its liquidity by charging a minimal fee for every trade and adds it right into the pool. For example, if someone trades USDC, a certain amount will be deducted and introduced to the pool. If the fees deducted was 0.003-.0.005 USDC, the pool grows by this much amount. Thus, the larger the trades, the more liquidity. With current liquidity of $3.01 bn, Uniswap generates $640k of fees in 24h and boasts over 16,800 pairs but only 100 pairs with optimum liquidity.

In the next article of this series, we will talk about the top DeFi liquidity pool providers. TradeDog will guide the interested users to participate in the best liquidity pools through a walkthrough, and help then yield the best crops from DeFi. We will talk about different strategies one can use to maximise their yield and gain a competitive edge against other farmers.

All figures subject to change as per market movements and should not be taken literally after some time has elapsed. It is not investment advice as well, users should dig into DeFi liquidity and yield farming themselves to gain a broader understanding of how and where to provide liquidity and how to build favourable strategies.

Stay in the know by following our social channels here

Website Telegram Twitter Facebook Pinterest Youtube Instagram