Quick Links

Uniswap v4 is a non-custodial, permissionless AMM protocol. It is an extension of the Uniswap V3 that allows for a concentrated liquidity model. Uniswap V4 has introduced hooks enabling anyone to deploy new concentrated liquidity pools with custom functionality.

Structural changes include replacing the factory/pool pattern, where the factory creates separate contracts for new token pairs with singleton contracts where one contract holds all pool state, and flash accounting, which would reduce the gas cost of trades that cross multiple pools and supports more complex integrations. Some other upgrades are native ETH support, customization and governance updates.

I know you have been through a lot of wordiness by now. Let’s simplify it and try to understand it in easy language.

What were the major upgrades of Uniswap V3?

Range Orders: Range orders were introduced in Uniswap v3, enabling users to place limit orders within specific price ranges. This provides more control over trade execution and allows users to specify the price range they want to trade within.

Concentrated Liquidity: Uniswap v3 introduced the concept of concentrated liquidity, allowing liquidity providers to concentrate their funds within a specific price range. This enabled more efficient use of capital and reduced impermanent loss. You deploy your liquidity in a range and earn the fees only when the asset trades within your range. Simple!

Now, Uniswap has come up with their v4 version. Non-crypto people believe that crypto is all about making some quick bucks. On the contrary, here we have Uniswap delivering new product upgrades while the token is trading at its lows.

We have created a detailed report on Uniswap which covers its version V1,V2 and V3. Check it out Here

What are the major upgrades in Uniswap V4?

Uniswap v4 is an automated market maker (AMM) focused on customization and architectural changes for gas efficiency upgrades. Let’s have a look at new advancements in the Uniswap V4.

Hooks

Hooks are externally deployed contracts that allow developers to customize and add additional functionality to the pool. These hooks allow developers to customize how the exchange works and add new functionalities. For example, they can help execute large orders gradually, implement on-chain limit orders, adjust fees based on market volatility, and more.

Hooks seem to make the Uniswap protocol composable. Think of it like the Zapier integration or the external extensions that we generally use to save us hours of work. One of the customizations that Hooks would bring to the table will be Customizable fees.

Customizable Fees: Uniswap charges fees for swapping tokens and withdrawing liquidity. With hooks, these fees can be customized. For example, the hook contract can allocate some fees to itself or distribute them to liquidity providers, swappers, or other parties. The pool creator can determine the fee settings and include static or dynamically managed fees.

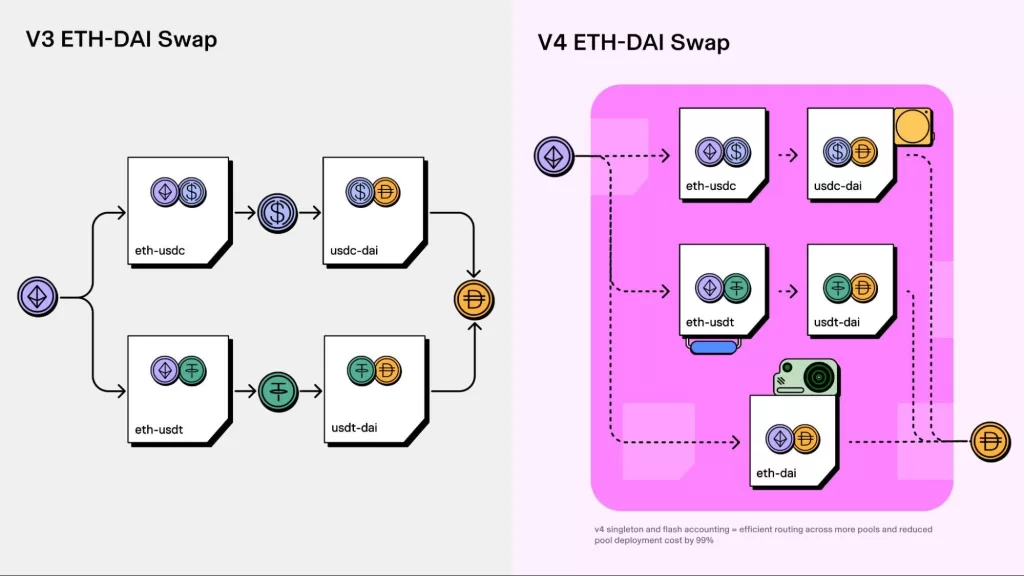

Singleton and Flash Accounting

Uniswap v4 introduces a new design pattern (singleton contract) where all pools are managed by a single contract, making pool deployment much cheaper. It also introduces a concept called flash accounting, which simplifies the accounting of token balances during pool operations. This helps perform complex functions more efficiently and allows for more cost-effective routing across different pools. This would ultimately reduce deployment costs and simplify multi-hop trades, enhancing efficiency.

Let’s try to understand it with a simple example.

Imagine a big corporate house with numerous subsidiaries operating under its umbrella. Each subsidiary functions as an independent business, requiring separate financial maintenance. Naturally, this results in higher administrative costs for the parent company.

Now, let’s transpose this corporate house analogy to Uniswap. In this context, think of the various pools on Uniswap as subsidiaries within the corporate house. When we want to make a trade, such as swapping ETH for DAI, each transaction involves multiple “hops” or intermediary trades, each incurring a gas fee.

In our analogy, these gas fees represent the administrative costs I mentioned earlier. Just as the corporate house incurs higher administrative costs due to its subsidiary structure, the gas fees accumulate as we navigate through multiple intermediary trades on Uniswap.

However, Uniswap has now implemented a new approach, akin to a consolidated business structure. This means that instead of physically moving tokens between pools, there are debit and credit transactions recorded in a ledger. This consolidated ledger allows for more efficient routing among pools, significantly reducing the costs associated with deploying and managing each individual pool.

Source: Uniswap Twitter

Native ETH

Uniswap v4 returns the option to trade native ETH directly with other tokens. In previous versions, only wrapped ETH (WETH) was used, which required extra steps and gas costs. With the improvements in Uniswap v4, both WETH and ETH pairs are supported, making it easier and cheaper to trade ETH. This means that fewer steps would be required, cutting-off gas costs.

These new features and improvements will enhance flexibility, efficiency, and cost-effectiveness.

Comparison: Uniswap V3 Vs Uniswap V4

Customizability: Uniswap v4 offers more flexibility and customization options through hooks, allowing for tailored functionality. Uniswap v3 focused more on capital efficiency and fee tiers.

Efficiency and Cost Reduction: Uniswap v4’s support for trading native ETH, singleton design and flash accounting reduce deployment costs, simplify operations, and enable more cost-effective trading. Uniswap v3 concentrated on improving capital efficiency and reducing impermanent loss.

Native ETH Trading: Uniswap v4 reintroduces native ETH trading, making it easier and more cost-effective for users to trade ETH directly. Uniswap v3 required users to wrap and unwrap ETH into WETH.

Fee Customization: Uniswap v4 allows for dynamic fee structures and flexible fee allocations through hooks, while Uniswap v3 has set fee tiers.

Governance Updates: Uniswap v4 has separate governance fee mechanisms for swap and withdrawal fees. In v4, if hooks (customizable contracts) enable withdrawal fees for a pool, governance can also take a capped percentage of that withdrawal fee unlike Uniswap v3. This provides more flexibility and control over fees for governance.

Conclusion

Overall, while Uniswap v3 focused on concentrated liquidity, multiple fee tiers, and range orders, Uniswap v4 expands on these features by introducing hooks for customizability, native ETH trading, and efficiency improvements through flash accounting and the singleton design. The upgrades in Uniswap v4 will enhance the user experience, reduce costs, and offer more options for traders and liquidity providers while offering more flexibility and control over fees.