Quick Links

Note: Figures are subject to swift changes concerning the inherent volatility of digital assets

Fairly nascent, and competitive enough to challenge and disrupt centralized finance, Defi is your next-gen money market minus the hassles of banking. With ~8 bn USD worth of digital assets staked as collateral, Defi platforms are creating an interactive and highly connected ecosystem of unsecured borrowing and lending. Open to everyone, the Defi ecosystem addresses and mitigates the long-standing inefficiencies such as improving financial inclusion, increases liquidity, and reduces costs. We are looking at the best Defi protocols that are playing a central role in decentralized, highly-scalable, open finance protocols.

If you were to avail a loan in the traditional world, your collateral would be identified as your house or valued land, and a loan would be your borrowed asset. The swift smart-contractual mechanism of lending and borrowing in Defi has simply omitted the painstaking process of compiling heaps of documents and legal papers to get your loan approved. In Defi’s case, you don’t have to put your house or land at stake, instead, you can allocate your crypto holdings as collateral and borrow your loan or start earning interest. All this happens underneath a pool of reserve crypto assets governed by smart contracts. The inherent Defi governance maintains the ecosystem’s integrity and liquidity which in turn ensure the safety of the funds locked in the reserve pool.

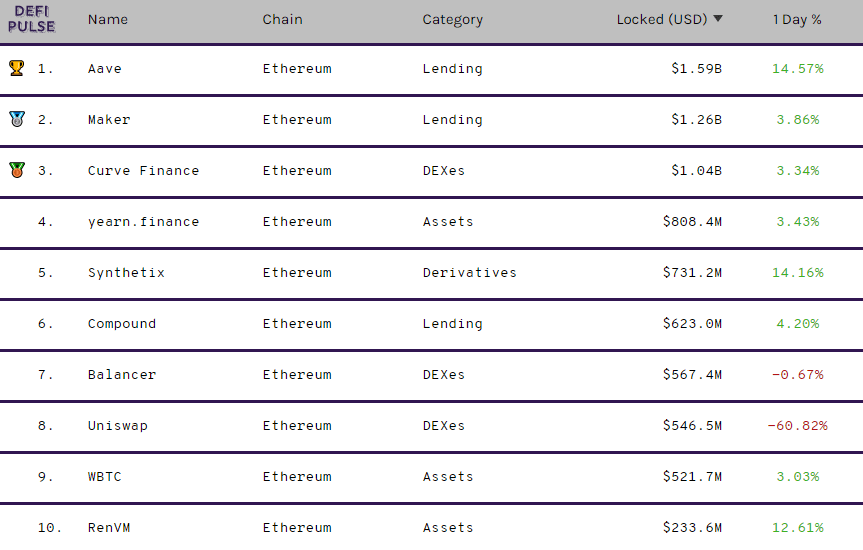

Funds locked in Defi are just climbing

Defi enables access to a borderless alternative to every financial service imaginable — from savings accounts to insurance, loans, trading, and more. Let us explore the top 10 Defi projects gathering steam in 2020

Top 10 DeFi projects picking up heat in 2020

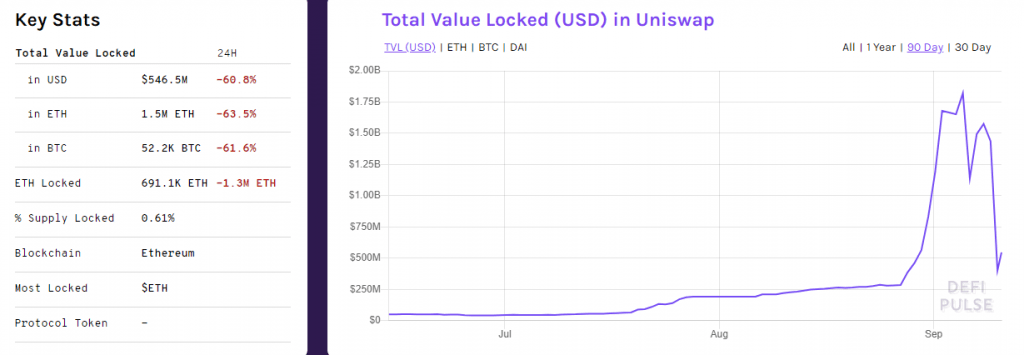

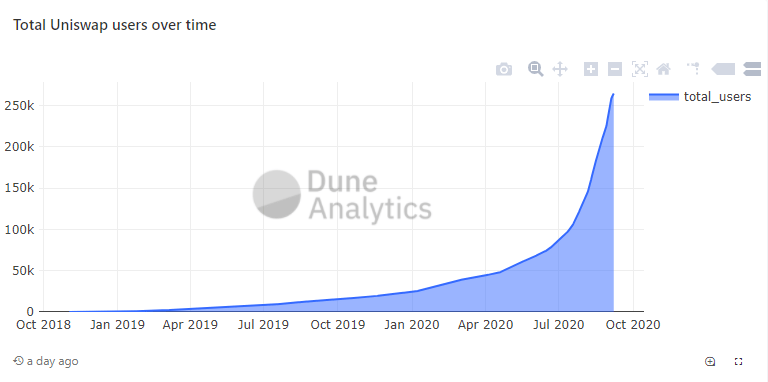

Uniswap

Uniswap is the largest pool in Defi. With more than $500 mn value locked in Uniswap, it is an open lego protocol whose core concern lies in solving the liquidity problems in decentralized exchanges using the Ethereum swapping mechanism. Uniswap uses a pricing mechanism known as ‘Constant Product Market Maker Model’ that redefines liquidity provisioning for market-making and allows democratized access to pools of capital. The popularity of Uniswap can be determined by the fact that it had once surpassed the trading volume of Coinbase Pro.

The Uniswap protocol invites almost any token to pool itself in the ratio of 1:1, for instance, if one wants to create a pool of a bitcoin, they need to launch a new Uniswap smart contract for bitcoin and then create a liquidity pool comprising $100 worth of bitcoin with $100 worth of Ethereum. A simple constant equation x*y=k fosters balance between ERC20 tokens and demand and supply in the new pool. X and Y represent the quantity of ETH and ERC20 tokens whereas the K is a constant.

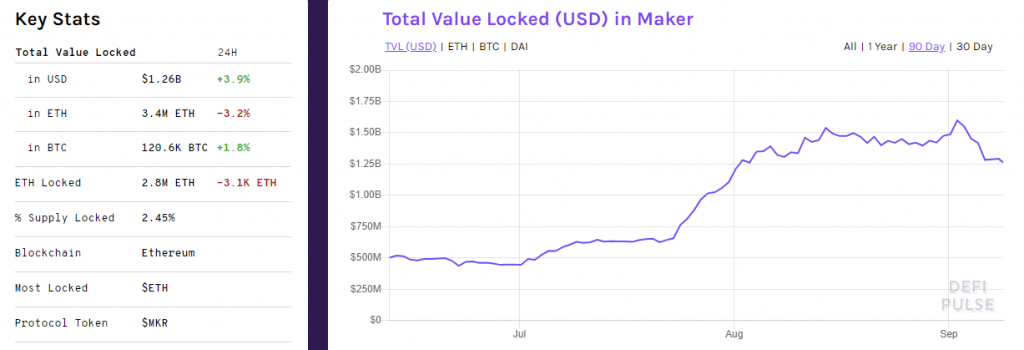

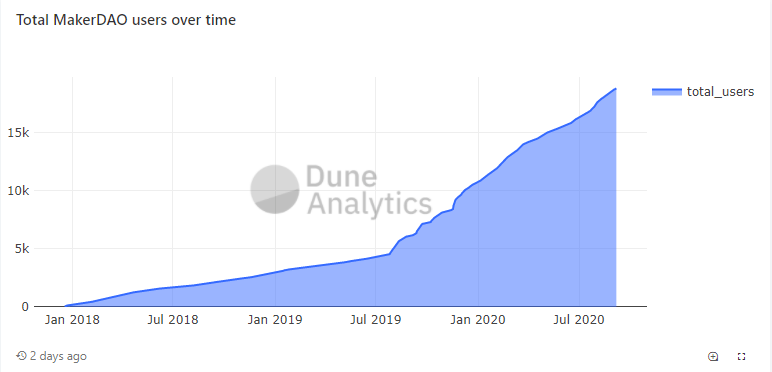

Maker

Maker inhabits two of its tokens namely Dai and MKR that support and enable the governance of the Dai credit system. Maker holders have the power to make decisions on the basis of the amount of MKR they possess. Dai is a stablecoin pegged to the value of MKR and acts as a counterweight to price fluctuations, thus always maintaining Dai’s stable value. MKR tokens can be created and destroyed according to Dai price fluctuations to maintain its dollar-equivalent value. The holders act as a part of the controlling mechanism to help manage the network feeding the system with digital assets as collaterals.

Dai is issued when investors buy CDP or collateralized debt positions that also act as loans. CDP is purchased using Ether ETH and Dai is received in return. The ETH here acts as collateral to this loan and when the loan taken is repaid, Dai issued priorly are burnt to bring order into the system. If the collateral value is not enough to cover the value of Dai, MKR is created and sold to raise additional collateral.

Another Maker offering, the DSR or the Dai Savings Rate enables Dai holders to earn savings automatically by locking their Dai into the DSR smart contract. Maker is also updating its governance protocol with calculated measures to prevent black swan events, which is basically a forced liquidation practice to profit from the imbalances in pricing and pose huge losses to the unsuspecting investors.

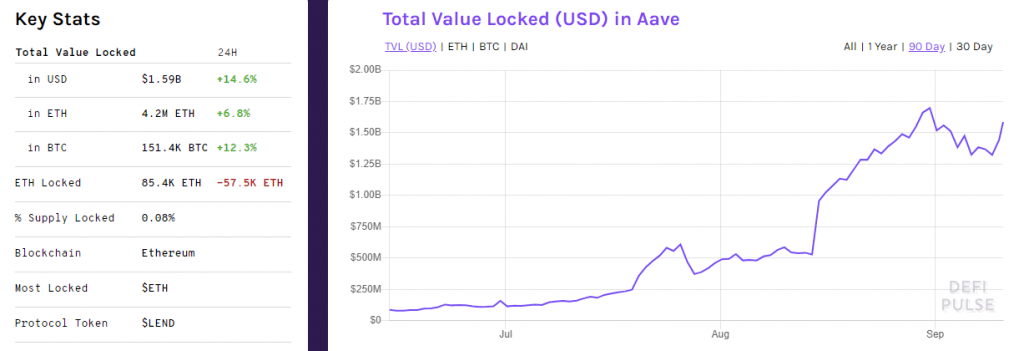

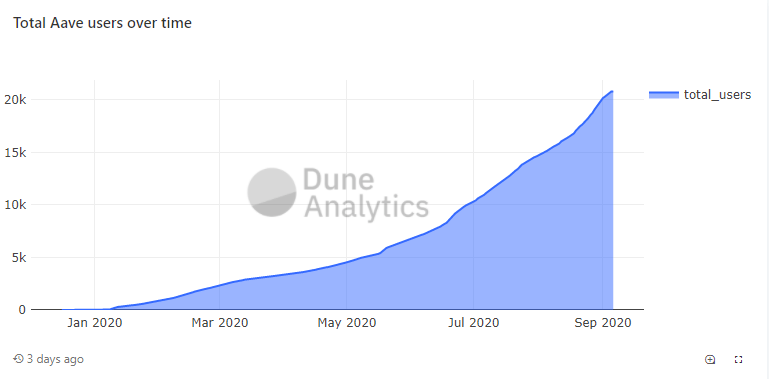

Aave

An open-source & non-custodial protocol, Aave enables the creation of decentralized money markets. Users can earn interest on deposits and borrow assets with or without collaterals. Aave’s new Credit Delegation introduction, the Aave ‘flash loans’ enable users to ask for loans without having to contribute any collateral has garnered a staggering adoption among investors.

Due to the excessive favour of the community, Aave has successfully facilitated over $300mn of flash loans to-date. A flash loan is easy & instant method to arbitrage any asset mispricing and is based on loan repayment timing. If the loan borrowed is paid back under the same transaction it was initially issued gets approved and if it isn’t, the loan gets cancelled. Flash loans have many use cases including arbitrage, collateral swapping, self-liquidation etc.

Another interesting functionality that Aave boasts is its flash loans which allow users to change their borrowed loans without having to cancel their request and ask new loans altogether. Aave’s LEND token grants voting rights to help decide on governance issues, smart contract upgrades and more. Rate switching is another tempting feature that allows borrowers to switch between stable and variable rates to achieve the most profitable return, something of great advantage in a volatility prone market.

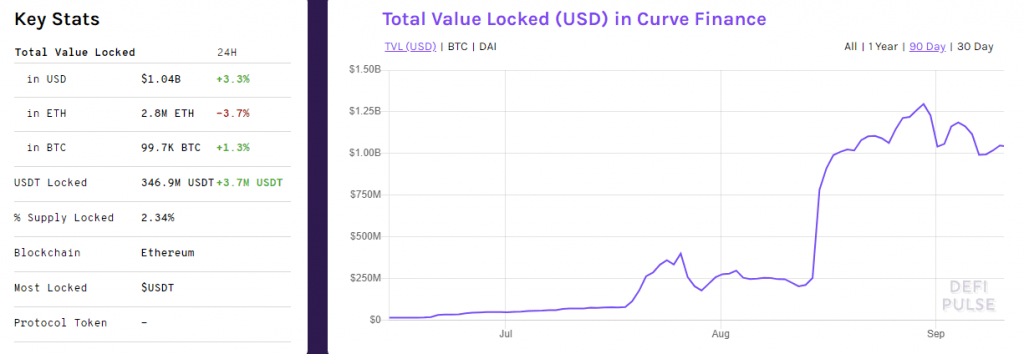

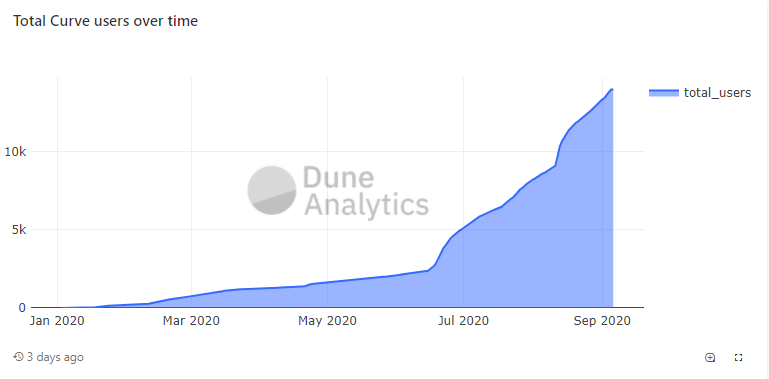

Curve Finance

Curve is a liquidity aggregator and a non-custodial exchange for stablecoin trading. It uses its liquidity pool to reward the liquidity providers in various ways which include; trading fees, interest, incentives and bonuses. Curve presently has 7 liquidity pools differentiated across lending protocols (Compound, Pax, Y, BUSD), incentive pools (sUSD and sBTC) which offer Synthetix and Ren as incentives, and two bitcoin pools (ren and sBTC). Each of these pool segments have their own characteristics and benefits to the pool member.

Curve supports DAI, BUSD, USDC, USDT, TUSD, and sUSD, and it lets you trade between these pairs quickly and efficiently. The Curve protocol works like a lego building block and has the ability of integrating with many other protocols as well. Its governance token CRV acts as an accrual and has a voting mechanism built right into it for decision making.

Curve’s Automated Market Making Algorithm sets it apart from other similar protocols and exchanges. Using this algorithm, Curve can provide 100-1000 times higher market depth than Uniswap or Balancer at the same locked value. This removes the reliance on other less plausible protocols and helps both traders and liquidity providers to make fundamental returns and gain access to market depth.

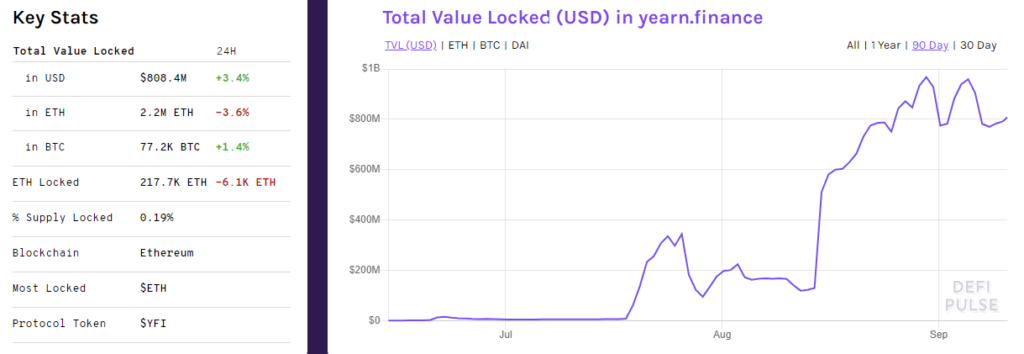

Yearn Finance

Yearn Finance is a liquidity aggregator providing automated yield farming through many lending pools for easy passive income. It is basically a portal to other prominent Defi protocols that help investors derive the best value against their collateral without having to pay unnecessary gas fees every time. Thanks to the brilliant algorithm absent on other protocols, users can gain access to numerous protocols and unlock their benefits through yearn and farming YFI tokens by moving their capital to the places with the highest return.

How it works under the hood is all the more interesting and efficient. Yearn’s ‘APR Oracle’ (Annual Percentage Return) constantly seeks the highest yield pools and moves the funds right where they should be. The smart contract interacts with APR Oracle to check the volatility, the rate of interest, and return, post which it sends the user’s funds to the pool with the highest offering. Automatic withdrawal of assets and deposits on high offering pools has made it the game changer in all of the Defi ecosystem.

The protocol provides the lenders with the best return on liquidity by shifting capital between big Defi protocols such as Compound, Aave, and dydx. Yearn’s token, YFI is earned through liquidity mining or staking the proof of liquidity on a few supported pools. Each of these pools is capped at 10,000 YFI until there is an immediate need to initiate governance checks for adjusting inflation using on-chain voting.

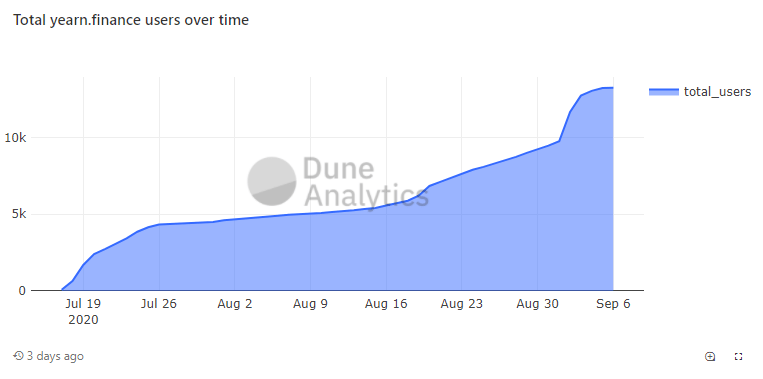

With a rise of over 4285.92% in just 42 days, Yearn Finance has broken all previous records of the biggest contenders in the crypto market. Outperforming even bitcoin, YFI shot upwards in a meteoric rise from $761.86 on July 21, 2020, to $33,376.86 on September 1, 2020. Hailed as the Defi gateway, Yearn Finance has no founder reward and a fixed supply of just 30,000 tokens which makes it extremely valuable for investors considering defi as a potential investment.

YFI unlocks numerous possibilities for its users through 3 of its products namely:

Vault: Beta Phase

Vaults follow a unique strategy to maximize the yield of the deposited asset and minimize risk

Earn: Beta Phase

Earn enables profit switching for lenders that enables moving your funds between dydx, Aave, and Compound autonomously

Zap: Beta phase

Lets you zap into the Curve pools for stablecoin lending from DAI/USDT/USDC/TUSD in one transaction and allows users to hedge smart contract risksThe APY or Annual Percentage Yield is calculated by comparing the interest rate of yEarn with other protocols.

This was the pretty innovative world of Defi protocols that allow easy passive income against your collateral. The swift and agile smart contracts that seek the best interest rates across numerous protocols is something that will appeal to all the digital asset users out there. Access to simple intuitive interfaces to borrow, lend and earn is strikingly innovative in our perspective but it comes with relative risks such as exit scams and funds lock.

This is not investment advice, users should evaluate the risks beforehand.

Follow TradeDog’s updates to align your investment goals with our institutional grade market and technical analysis.

Follow our social channels here

Website Telegram Twitter Facebook Pinterest Youtube Instagram