Quick Links

Everybody is interested in crypto trading ever since the COVID-19 pandemic has hit the traditional markets hard, but many may not be aware of the pitfalls crypto trading entails. There are normally thousands of crypto traders active on crypto exchanges who bring in millions of dollars of trade volume in a day. This count is expected to grow since the world is slowed down by the recent pandemic which has restricted the world’s movement and confined everyone to the comfort of their homes. With more time to ponder on investment decisions amid the poor performance of stock markets, interest in crypto trading is rising in investors from all walks of life. But before foraying, it is important to understand how the markets behave in bear and bull seasons.

There are many governing factors as to how the crypto markets will likely perform in a given timeframe and its repercussions can be quite disheartening to the new investors and traders. Due to its infamous volatile nature, cryptocurrencies have been a no-go for many people who fear that their investment will likely turn to dust. Scepticism is good especially when you don’t know much about how crypto markets do what they do, but acting wisely is better. Let us talk about the five important aspects which are quite a deterrent in the way the entire crypto trader and investment ecosystem should be wary of.

The 5 of the defining factors in the crypto markets.

1. Market correction

Capital flow, demand and supply, and technical analysis are some of the key indicators that cryptocurrency traders use to make trade decisions whilst trading and investing, but crypto’s market factors have been given special attention as opposed to other social influences that have been largely neglected. One of the factors is a market correction. Price corrections impact crypto traders in different ways. Protecting your funds from dramatic price falls while trading becomes very important than the goal itself.

A price correction takes place when the price of a digital asset or security drops by 10% or more from its most recent high. Bitcoin along with other coins has done it in the past, wherein at one point, it crashed by as high as 23% last year and gain back a consolidated price of $2000 in June last year in less than 24 hours. So as you can see, this is an extraordinary event in crypto markets, and it could happen at any moment, and traders lose a lot of capital in it. But these corrections are not always bad for the markets and traders. Price corrections are a mechanism to adjust overvalued assets, and investors who understand crypto markets well can leverage this instance and make a good amount of profits.

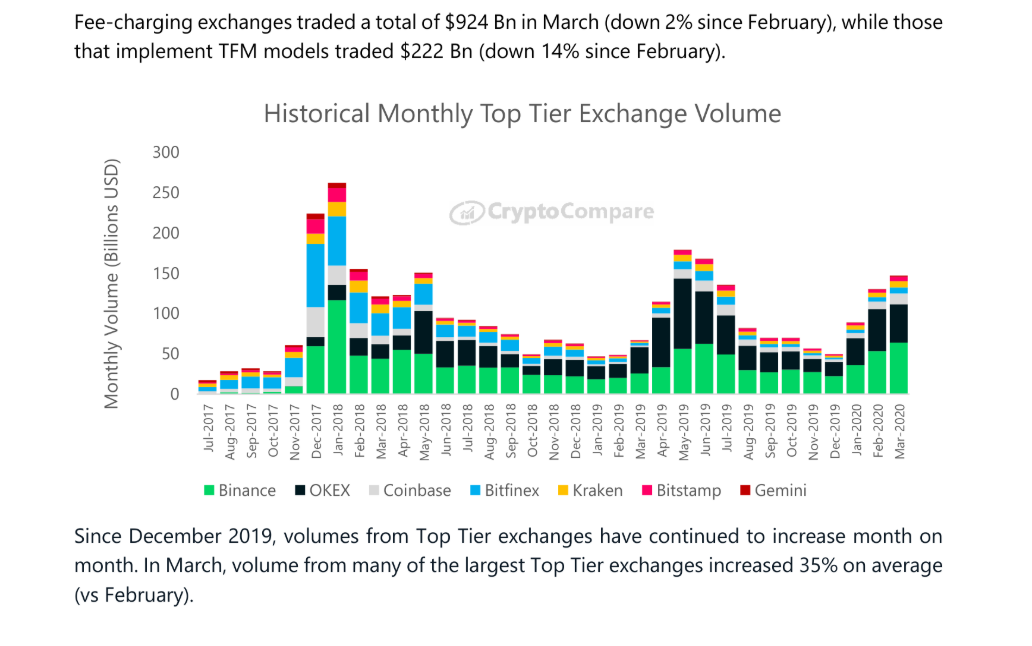

Here are a few stats that tell us that crypto exchanges have been experiencing a surge in trade volumes in the last 4 months despite fear and uncertainty.

Traders may face the lack of reliable statistics and market indicators, which is very important in these corrective states of the crypto markets. Harder to predict price drops, crashes, and rise affect day traders the most as opposed to long-term traders who can sit through market movements and wait for the price to recover.

To help beginners tackle violent crashes and uncertain movements, Tradedog has devised efficient risk-mitigation strategies for everyone to take benefit from. What we do lies at the core of our values that every trader and investor should be empowered with right market knowledge, trading styles, and strategies. To help retail investors and traders, Tradedog is defining a new paradigm of research material to capitalize on optimum liquidity and hold profitable trading positions. Users can visit our website tradedog.io and find many research reports and trade advice to play safe amid uncertain market timings and grow their capital safely.

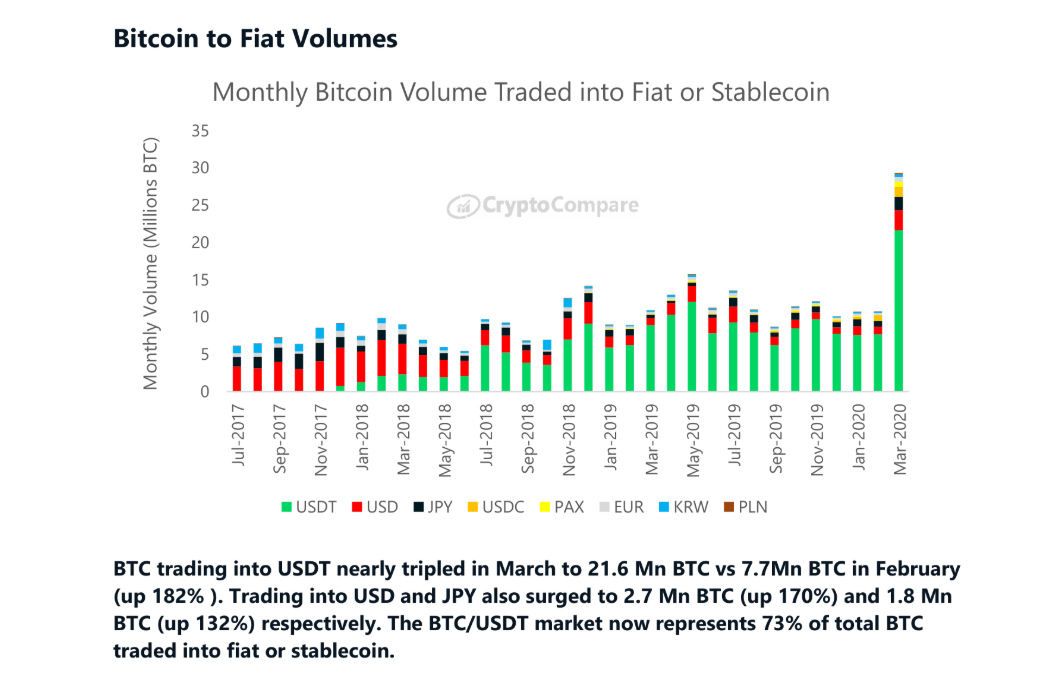

Unlike the stock markets, equities and other traditional markets where traders can calculate risks and rewards based on the underlying companies financial value, or gauge the position of a country’s growth by assessing their economic statistics, crypto traders face limited data to zero in on the best trade channels and moments thanks to high volatility. User sentiment in this condition is subject to shift at an enormous rate. One thing that every trader must remember that user sentiment can wreak havoc in the crypto markets as crypto may rebound, but the sentiment may remain diminished. Cryptocurrencies are speculative assets, and much of their price is determined by hype and FOMO. It takes feasible market intelligence to speculate with a higher degree of assurance that the market will go in a certain direction, which is very important to determine if you’re a beginner. Using data and statistics like in the image above, one can tell that the markets nearly tripled in terms of bitcoin to UDST trade, which tells us the trend is likely to continue for a time.

TradeDOG’s past research and analysis on specific crypto assets have been proving to be near accurate every time with a high degree of certainty. You can read our lite and in-depth research reports to understand how important it is to perform a rigorous due-diligence prior to investing. Our trade efficiency in spot, futures, and options markets has been close to 66% for Q1 2020 and it keeps getting better as we employ state of the art infrastructure to extract potential data from market indicators, Technical analysis, and trading strategies. You can find our advice and research reports once you log in to the website tradedog.io

3. Organized market influence

Organized market influence is a kind of deliberate market pressure that ensues after a planned pump or dump scheme. It has happened many times in the past and has cost investors their fortunes, but not to the smart ones. Investing in crypto markets is just like buying fruits, you don’t know if it is ripe inside, but you buy anyway, and the vendor takes no responsibility. You have to have a keen sight of telling the fake ones from the ripe ones, and the same is with crypto. You don’t have to fall for hyped news as they meant to capture the investor sentiment and by manipulating public perception. Many digital assets including bitcoin have suffered severe price fluctuations after FOMO news and market influence, which then induces huge selling frenzy amid investors and traders. The most infamous instance of this manipulation could be attributed to China banning its crypto exchanges in 2017. Many coins toppled in value, and investor sentiments were lowered in Asian markets. These conditions deprive new traders of confidence and cause them to make mistakes. Haphazard buying and selling frenzy often twist the market forms and make uninvited corrections.

4. Economics

Economic factors such as currency devaluation and inflation have been responsible for market stagnancy, but the same global economic crisis in the late 2000s gave birth to the bitcoin. Gold which is the largest store of value for the whole world, saw a decline of 12% of its value while bitcoin suffered a sharp decline of 40% in the wake of coronavirus economic instability. The unstable economic activities have a ripple effect on financial markets as investors turn to other alternatives and pull out their investments from the bets which they consider unlikely to succeed. The same happens with cryptocurrencies; the irregular market corrections, correlations with other assets, and imminent volatility impact the crypto sphere negatively, and traders and investors who don’t have a perfect exit strategy can incur losses.

In the wake of this pandemic, something which has taken a huge hit is the oil sector, which fell at an enormous pace. BTC dropped to a low of $3,800 on March 12 but gained 90.78% in value relatively quicker than its counterparts. Even though the global economy is stumbling, digital assets have surpassed equity and precious metals markets by a long shot, and that’s a good sign that crypto markets are formidable even in pandemics, which has the half of the world’s population on lockdown.

To avoid such hassles whilst trading and investments, TradeDOG provides productive research reports that are helping our 50k+ strong community to trade safely and wisely. Any whimsical trade initiation in these times can lead to serious losses of funds and an imminent heartbreak for many. To learn how you can capitalize on safer trades and investments it is highly advisable you check out our in-depth and lite reports coupled with our advanced trading strategies which can be found on our website’s dashboard

5. FUD

Almost every corner of the traditional and crypto investment sphere is inundated with fear and panic at the moment. Nobody is sure whether their investment appetite will be quenched, and investors are getting overly concerned about their tradeable assets. Investors and traders should remember that they should not allow fear to creep in, or they could end up lamenting over losses. FUD represents the market sentiments especially when the prices are plummeting, and there is no credible resource to act upon. This fear induces a bear market, and no investor buys that assert any more. The rest of the HODLers see the price plunge and decide to sell off their assets as well.

TradeDOG advises individuals and the retail-investors that they should apply additional risk management strategies and market intelligence prior to their investment. You can read this article where we mentioned how crypto markets are faring amid coronavirus outbreak wherein we correlated crypto markets to the traditional markets. We found that the latter was heavily influenced by fear and doubts, and people started selling off their traditional assets. This poses an additional problem of liquidity or liquidity crisis, which results in low liquidity and trading volumes.

Another factor that could lead to devastating effects on a coin’s price is crowd sales, which are heavily influenced by fake news and pump and dump schemes. Promotion and celebrity endorsements rallied investors to cash in the opportunity but all in vain as it turned out that it was a sham. Though ICOs and crowd sales are heavily scrutinized now, there weren’t any stringent policies back in 2017- the golden era of ICOs.

Many ICOs duped their own investors in the name of hype and profits and contributed nothing to the community except a token and an inconsiderable roadmap. According to leading sources and research, as high as 81% of ICOs failed before they reached on exchanges to trade and only 4% of the total ICOs managed to get listed on exchanges and provided optimum ROIs to their investors. That’s the stark reality of the crypto markets, but new laws and policies are creating a more resilient and safer crypto environment for traders and investors.

If readers continue to use our learning material present across channels, they can significantly improve themselves in making decisions amid uncertainties and risks. Please check out our other channels as well to find credible resources to get you started on your crypto investment journey.