Quick Links

Programmable tokens are most widely found on the Ethereum platform and in late 2017 a new class of tokens called the NFT was introduced to the blockchain with a slightly different ERC-721 standard. Those who are well versed with the crypto ecosystem may have come across the term Non-Fungible Assets, but for those oblivious, this blog is for you.

NFT usually work in conjunction with dApps and has grown exponentially this year. The total number of Non-fungible token sales has surged to 24,574 and $1,506,776.75 USD in volumes past week. Nike’s patent to issue its own blockchain-based tokenized NFT sneakers gives an inkling of how popular these non-fungible assets are becoming due to their broader use cases. Being non-divisible and provably scarce, let’s delve into their performance as tokens and the impact they have on the crypto ecosystem.

So, what are Non-Fungible Tokens actually?

NFTs are programmable, cryptographic tokens that represent ownership of goods, digital art, cards, or collectable items. Non-Fungible tokens have their own independent universe of marketplaces, gaming, and collectible platforms on the blockchain. They have been around for decades with low recognition before crypto kitties incorporated them into their platform in 2017 (It was literally an epic introduction).

Since NFTs create verifiable digital scarcity and represent digital ownership. They make asset interoperability across multiple platforms a possibility. NFT adds authenticity to a claim of ownership of digital art, collectibles and represents in-game assets that are controlled by the user and not the developer. Unlike bitcoin which can be interchanged, NFT usually cannot be interchanged. They have unique individual properties and characteristics that help them to appear distinct and cannot be mistaken for one another.

NFT or ERC721 tokens are majorly used as collectibles while anticipating that they will grow in popularity, and utility and get more expensive and desirable.

To build a firm grasp on the concept, let us first know about fungibility in the first place.

Fungibility

Fungibility refers to the interchangeability of a unit of a commodity with other units of the same thing. For example, two people can exchange the same amount without losing or gaining anything as money or commodity. This ability of something to be exchanged in equivalent amounts of another is called fungibility.

If you have a $10 bill with you, it will always be exchanged with the equivalent amount of another $10 no matter if it’s in your possession or in your bank account. Thus, this ability to be exchanged is what makes a currency fungible. So if it’s getting difficult to wrap your head around how digital assets become fungible, they are coded to be fungible in the first place.

Non-Fungibility

From toothpaste to the device you’re using comes under the non-fungible band. Goods and stuff that cannot be interchanged such as a house, car, or bike are referred to as non-fungible items. If you can virtually sell it on the internet, then it is non-fungible which means you are selling it in return for money but each has its own unique properties that make them desirable in different ways.

Now that we’ve drawn background on Non-fungible assets, let’s head further.

Understanding Token Standards

Token standards are basically an attribute of a token that helps it interact with its blockchain. The most notable token standard is ERC-20 on which most of the tokens out there are developed. NFT, on the contrary, uses two different standards called ERC-721 and the recently introduced ERC-1155. Tokens on Ethereum represent virtually anything, whether it is points gained on some online platform, developing skills in a game, possession of financial assets, shares in a company, gold, in-game collectibles, etc. Tokens on Ethereum are majorly governed by the ERC-20 mechanism that codes fungibility directly into its source.

We have already understood fungibility and it is exactly the same for ethereum tokens. Now let’s talk about Smart Contracts and Token Standards, then gradually move to understand the Non-Fungible Token ecosystem.

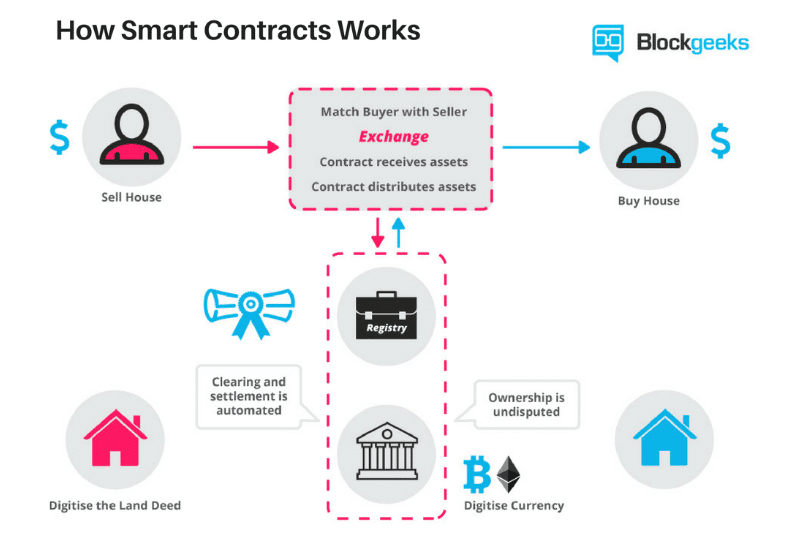

Smart Contracts

As Wikipedia puts it,

“A smart contract is a computer program or a transaction protocol which is intended to automatically execute, control or document legally relevant events and actions according to the terms of a contract or an agreement. The objectives of smart contracts are the reduction of need in trusted intermediators, arbitrations and enforcement costs, fraud losses, as well as the reduction of malicious and accidental exceptions.”

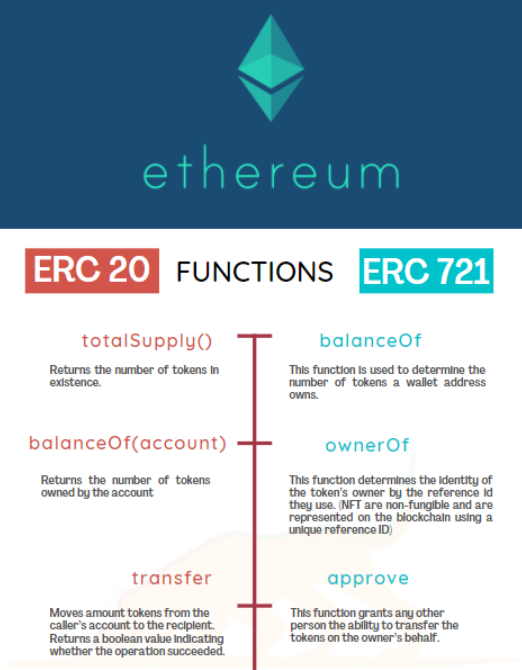

ERC-20 and ERC 721 Standards

Both the ERC20 and ERC721 have similar structures and functions but the most important difference is Fungibility. These tokens are generally used as a fee, voting rights, value exchange, and currency. ERC stands for ‘Ethereum requests for comments. ERC is basically a set of rules and regulations that create a prototype for Ethereum smart contracts to build tokens on top of it. To qualify as an ERC-20 standard, a token needs to have some mandatory parameters like Token Name, Token Symbol, and decimal points (up to 18) and some specific parameters like token supply, the balance of, transfers from, and many more, refer to the infographic below.

Follow Tradedog blog to find more information about the token standards.

ERC20 Token Functions

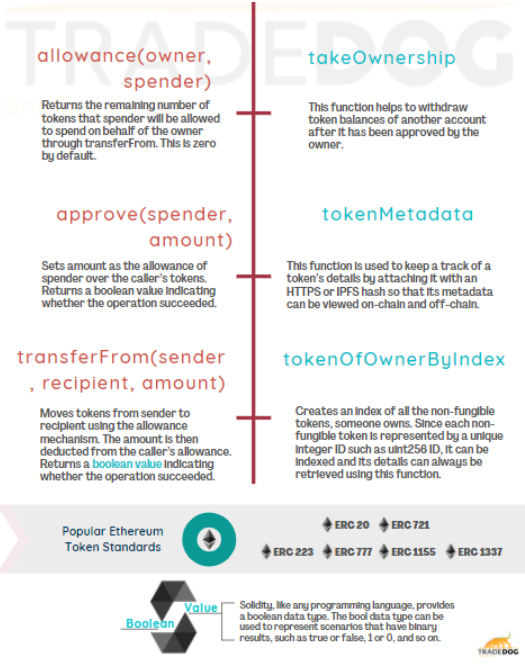

The most recent introduction of the improved standard ERC-1155 enables a single contract to represent both fungible and non-fungible tokens at once. The functions such as balance of and transferFrom works differently in both the standards and ERC1155 has distinct balances for each ID and NFTs are added by minting them one at a time.

The new ERC1155 token standard opens up a whole new world of possibilities that make transactions less gas-intensive by reducing deployment costs and complexity. ERC20 has to approve and allow each transaction and can only ID one unique token at a time. But with ERC1155, there is no need to deploy new smart contracts for individual tokens that make it possible to operate on multiple tokens in just one transaction.

A Contract Application Binary Interface (ABI) is needed to create an interface to any ERC-20 Token. Those who actually want to build one can head to this article to know the depths of how it is done.

Use Cases of Non-Fungible Tokens

Apart from being simply referred to as collectibles, NFTs do have a broad use case. The most important use cases are software Licences to tackle piracy and guarantee privacy, and transferability. Moreover, NFTs can be used in the sports industry to prevent counterfeit items, Ethereum name service domains to buy and sell crypto addresses, identity and certification, media and entertainment, real estate, and more. NFTs ERC721 does have the ability to innovate since the protocol embeds a token to have unique properties that make them rare and very desirable.

Chainlink, a project that builds price oracles, has its own outlook as to how NFTs can interact outside of the blockchain they operate on. NFTs are now destined to move from static tokens to dynamic tokens which will allow them to use external data/systems as a mechanism for minting/burning NFTs, trading peer-to-peer, and checking state. For example, a smart contract that automates the minting of a limited edition digital soccer card if the oracle informs it that a player scored a hat-trick.

Final Thoughts

Digital collectibles are a young yet innovative idea that changes the way we see ownership. Thriving on ethereum and backed by robust smart contracts and functions, NFTs are opening up a whole new decentralized economy by ensuring digital ownership. The constant development, innovation and the community are together challenging the conventional financial apps. From ERC20 to ERC1155, we look up to the developers to bring innovation to the NFT space and create an independent ecosystem of real-world value.

In the upcoming article, we’ll talk about NFT market places, well-performing tokens, and dApps. Keep checking Tradedog for further updates and sign up now to receive these articles.

For those who are really into coding and are inspired by blockchain technology, you can head to this book which imparts all the skills vital to Mastering Ethereum