Quick Links

Find out the key takeaways from our Bitcoin Halving analysis and our verdict on how this event will shape the future of the cryptocurrency

The Effects of Halving

Halving will be followed by reduction in inflation rate from 3.68% to 1.80%. After May 2020, the block reward will pay less for network security. This will heavily impact the economics of the mining business. The cost to mine one BTC depends on a variety of factors, such as electricity costs, mining difficulty and hash rate per unit of power.

The time after the first halving also marked the advent of the ASIC (application- specific integrated circuits) mining area, leading to immense efficiency gains over older methods such as CPU, GPU or FPGA (fieldprogrammable gate arrays) mining — a fact which left its footprint in the hash rate chart. A block reward halving drastically changes how much the protocol pays out to miners irrespective of network usage (i.e. transaction fees) — next time from 1’800 BTC per day to 900 BTC per day. Currently, transaction fees only account for about 2 % of the total miner revenue. Since the total miner revenue is tightly correlated with the hash rate and hence the overall network security, there are three possible outcomes.

Scenario 1

The first is that the Bitcoin price will rally as it did after the first two halving — in this case, miners will remain profitable and hash rate will continue to go up.

Scenario 2

The on-chain transaction volumes and total transaction fees would strongly increase leads to the same outcome.

Scenario 3

If neither of the two happen, however, then the hash rate could be expected to decrease due to miners with the highest production costs per BTC becoming unprofitable

Another interesting fact to note is that both Bitcoin Cash and Bitcoin SV are projected to undergo their block reward halving in April 2020 — one month earlier than Bitcoin. Since all three chains also share the same hashing algorithm, much of the hash rate of BCH and BSV will most likely switch over to Bitcoin for a month (until its halving has also happened)

Supply and Demand

The supply / demand equation states that if everything else remains constant, the price of a particular product will differ in a competitive market until it reaches an economic equilibrium in which the quantity produced is equivalent to the quantity supplied. Therefore, this leads to two situations:

High supply and low demand resulting in a decrease in asset / product price.

The supply is low, and the demand is high, leading to an increase in the asset/product price..

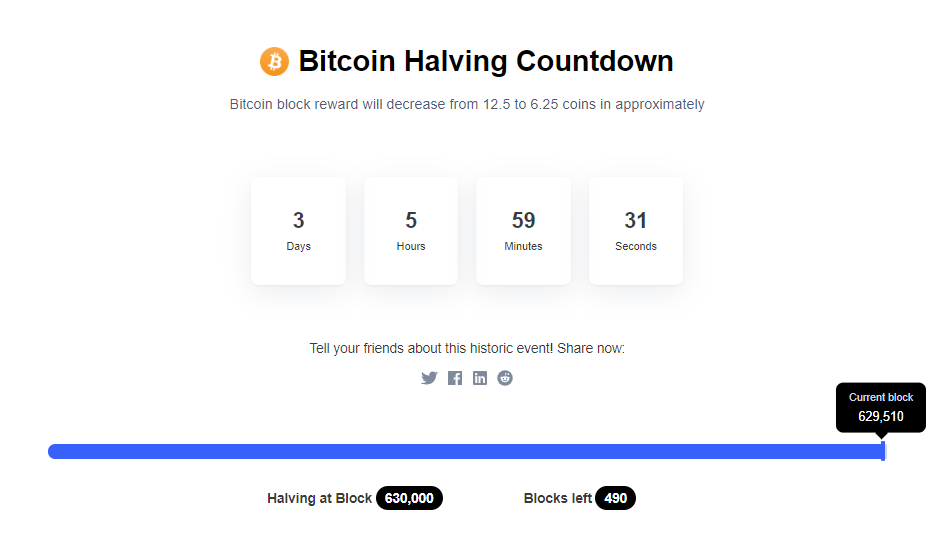

Bitcoin Halving is a major event in the crypto domain as only the bitcoin is a might digital currency that has some correlation with its counterparts as well. Just a few days to the Halving event, the crypto space is hit with great enthusiasm and doubts as to what will the reward halving bring.

To get a detailed analysis of our Halving report, please visit our website login.tradedog.io and download the report. You will get detailed perks of research and analysis and get insights on bitcoin’s Supply and Demand, Analysis of Previous Halvings, Market Sentiments, correlation in Bitcoin halving and Alt-coins, Inferences from the past, and the conclusion. Make sure you login and download the report for a better experience.