Quick Links

Is Crypto Winter Really Here? The crypto market has been hit by a storm as the world’s largest cryptocurrency had fallen below the crucial psychological mark of $20K. From the start of the week until now, the overall market cap of the crypto industry has fallen by 18%, from $1.1 trillion to $902 billion. The fear & greed index indicates market sentiment has dipped to the category of “extreme fear”.

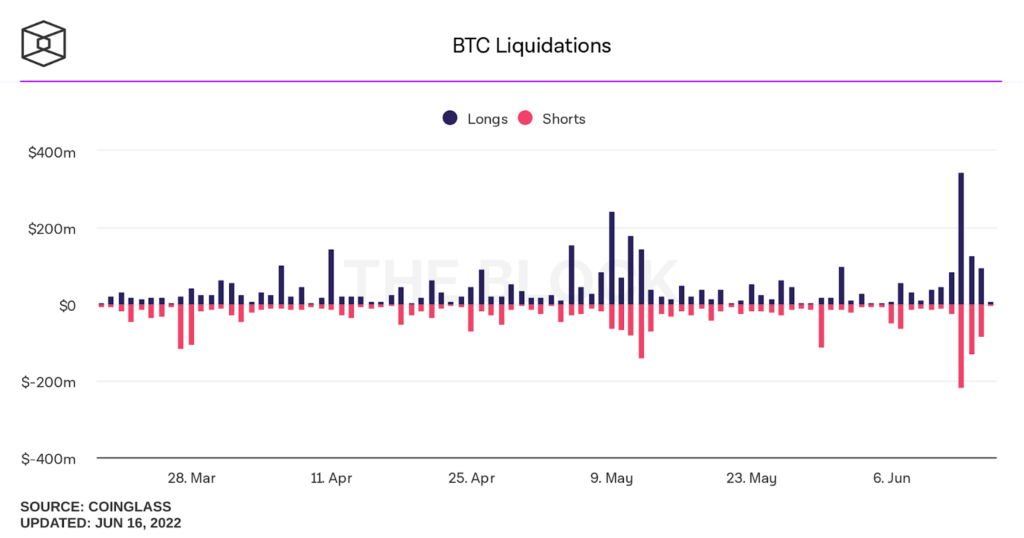

Bitcoin Liquidations Hitting Roof

Bitcoin witnessed the highest long liquidation worth $400Mn in a single day. The liquidations were the result of heavy leverage taken by traders with the aim of maximizing gains. However, these traders’ positions got grabbed by the bears and registered losses in their accounts.

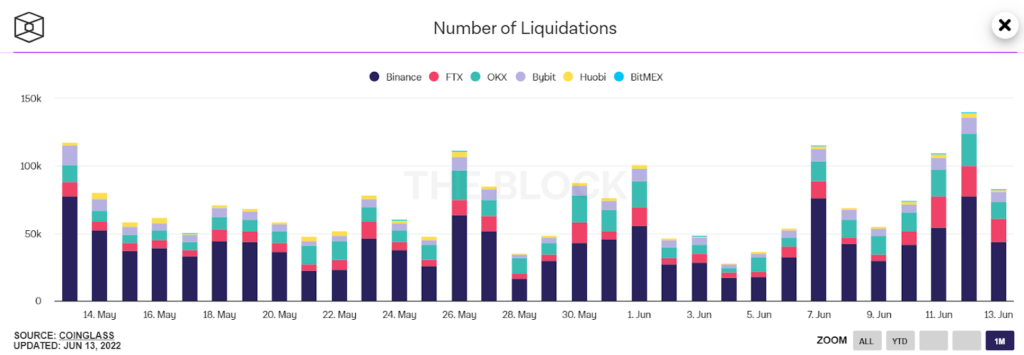

Now, let’s look at the number of liquidations that have happened over this week which also reflects the number of traders who have faced losses on their leveraged long position for BTC. The metric reached a peak of around 140K wherein 77.9K liquidations happened on Binance.

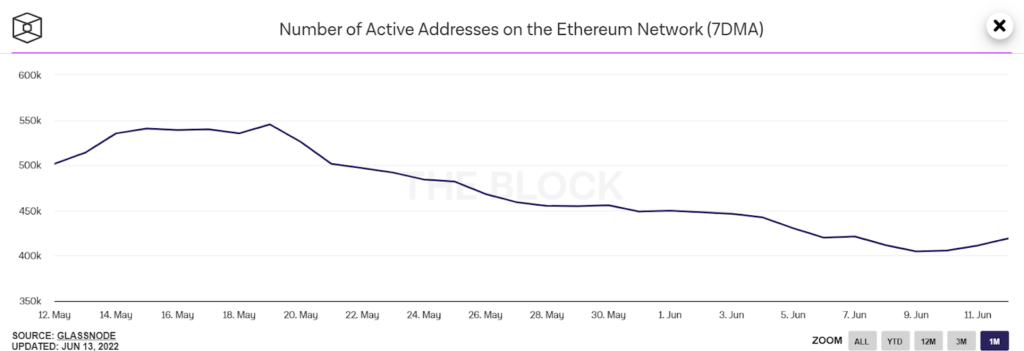

Ethereum Faces Decline in Addresses

Alongside liquidations, another harmful effect for blockchain networks can be a decline in the number of active addresses. Mainly because of the bearish sentiment prevailing in the overall market conditions, we are witnessing a sharp decline in the number of active addresses on the Ethereum network (7DMA). Since the past month, the number dropped from 550K to around 400K.

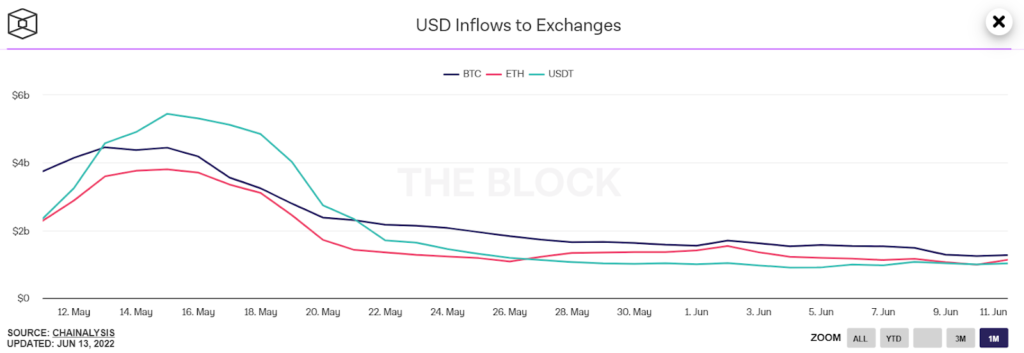

Exchanges Facing Resistance on Fiat Inflow

As compared to the previous month, the inflow of USD to crypto exchanges has nearly dropped by 50%. The inflow used to be around $5.5Bn in May and dropped down to below $2Bn this month. Certainly, the hot red heavy downfall in the price of cryptocurrencies is resisting investors to even lower the average price of buying their respective crypto tokens.

DeFi Investors Pulling Out The Plug

As seen on the chart, the total value locked in DeFi protocols has also drastically reduced over the past month. In May, TVL was hovering around $250Bn while currently, it has dropped down to $82.87Bn accounting for a 66.82% drop.

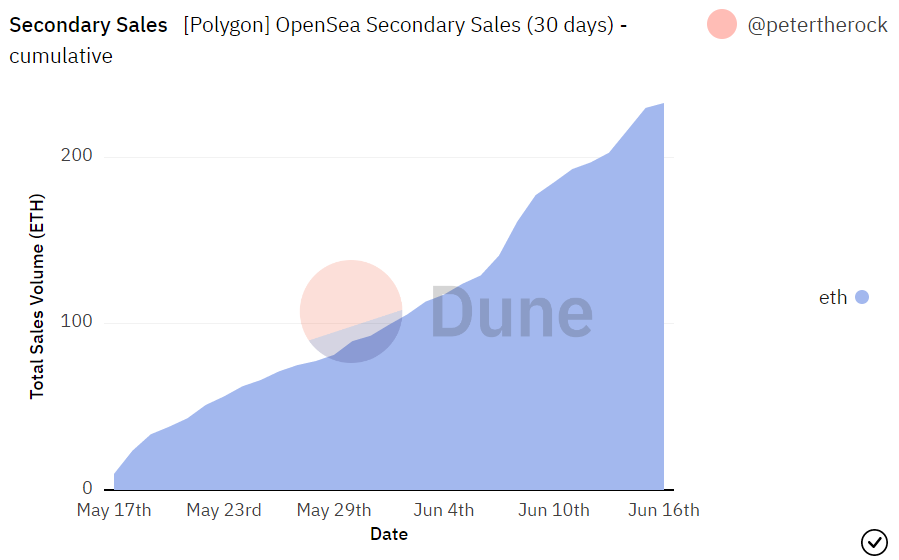

NFT Sales Continues to Thrive

Surprisingly, the secondary NFT sales on the Polygon network have thrived since the start of the month and registered daily new highs in terms of total sales volume in ETH. This certainly means that investors are buying NFTs on secondary marketplaces with the help of L2 solutions like Polygon.

So, the question still stands. Is the crypto winter really here?