Quick Links

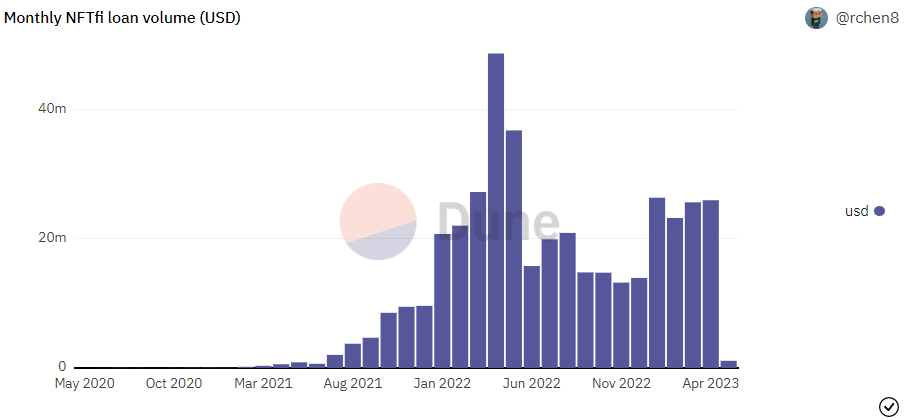

The NFT lending sphere, also known as NFTfi, is a relatively nascent yet rapidly developing sector. Platforms that facilitate borrowing and lending with non-fungible tokens (NFTs) as collateral fall under this category. The NFT lending ecosystem experienced a remarkable surge in activity at the beginning of this year, reaching an all-time high in both monthly loan volume and number of loans. In January alone, a whopping 17.9K ETH, equivalent to around $33 million, was loaned through 4,399 loans. This attracted a record-breaking 616 borrowers and 291 lenders, resulting in a borrower-to-lender ratio of 2.12.

Blur Introduces Blend: A P2P NFT Perpetual Lending Protocol

The premier NFT marketplace in terms of trading volume, Blur, has recently announced the launch of its latest offering, namely the zero-fee, perpetual loans that are now made possible by the latest Blend peer-to-peer protocol. This protocol, which supports arbitrary collateral including NFTs, does not rely on any oracle dependencies or feature any expiries. As such, it enables borrowing positions to remain open indefinitely until they are eventually liquidated, all while being subjected to market-determined interest rates.

In a recent tweet thread, Blur shared that Blend has the potential to offer yield opportunities that are 10 times higher than those provided by current DeFi protocols and also facilitates greater liquidity for NFTs. As of now, there are no fees for either borrowers or lenders on the Blend platform. However, holders of the BLUR token can cast their votes to enable fees after a period of 180 days.

In a subsequent launch thread, the squad made it known that the protocol currently embraces three prevailing NFT collections, to wit, Punks, Azukis, and Miladys, as acceptable collateral, but do not discount the prospect of incorporating additional collections in the foreseeable future. The novel protocol furnishes the opportunity to utilize select items from these aforementioned collections as security to acquire ETH, or one may opt to procure an item from one of these illustrious collections at present and make the payment at a later time.

Working of Blend

Blend has been designed to operate in a manner that automatically “rolls a borrowing position for as long as some lender is willing to lend that amount against the collateral.” Remarkably, this does not necessitate any on-chain transactions unless one of the parties decides to exit the position or there is an alteration in the interest rate.

By leveraging a perpetual lending protocol, borrowers and lenders can extend the loan expiration time by a predetermined period by default. In instances where a lender seeks to terminate the loan against the borrower’s wishes, a refinance interest-rate “Dutch Auction” is conducted when the borrower has failed to repay the debt at expiration. The auction commences at 0% refinance interest and increases steadily over time.

Backing of Blur’s Tremendous Journet

Since its inception in October of last year, Blur has instigated a significant disruption within the NFT space. The NFT marketplace and aggregator have been embroiled in an arduous battle against OpenSea, vying for supremacy as the premier platform for NFT trading. Following OpenSea’s recent launch of a more directly competitive “pro version,” Blur is once again delving into uncharted territory. This time around, Blur is set to contend with a new crop of competitors in the NFT lending arena, namely NFTfi, PWNDAO, BendDAO, and ParaSpace, all of whom offer various forms of collateralized NFT lending.

Notably, NFT influencer Cirrus is of the conviction that Blend will lead a “leverage-fueled run in NFTs,” while another user has pointed out that inexperienced traders may not be fully cognizant of the intricacies entailed.