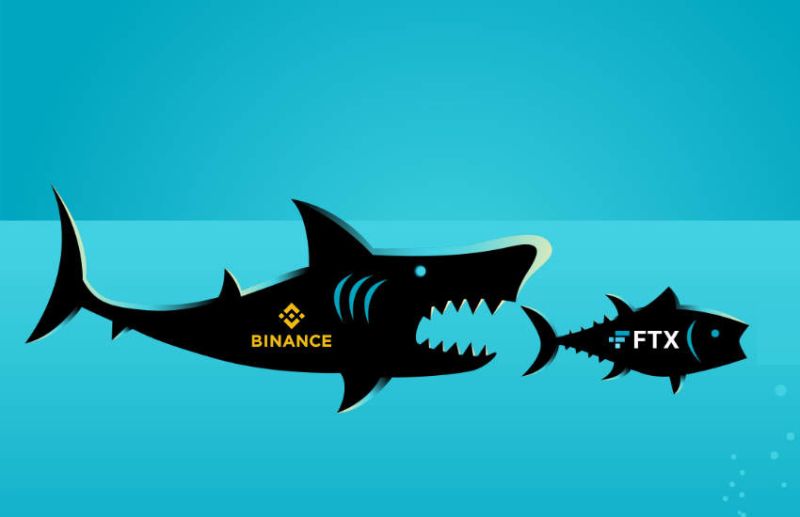

Cryptocurrency investment platform FTX is in hot water after being named in a lawsuit alleging securities fraud. The company’s high-profile investors, including Larry David, Tom Brady, and Shaquille O’Neal, are now facing scrutiny over their association with the embattled startup. FTX has denied any wrongdoing, but the legal drama is sure to cast a shadow over its reputation. Investors should keep an eye on this case as it develops.

How High-Profile Celebrities are Associated with FTX?

“We have to meet people where they are, which means accepting skepticism.” That’s what former FTX CEO Sam Bankman-Fried said on Feb. 13 in a press release announcing the company’s Super Bowl commercial starring comedian Larry David. David dismisses some of history’s most significant technological and scientific inventions, from the wheel to the light bulb, in the one-minute commercial. The commercial ends with David cringing at the thought of using FTX, a humourous moment that now appears relevant today after the cryptocurrency exchange, once valued at $32 billion, declares bankruptcy.

Tom Brady, Gisele Bundchen, Shaquille O’Neal, and Naomi Osaka are among the other celebrities named in the complaint. They were all featured in FTX advertisements. Curry repeatedly denies being cast as a cryptocurrency expert in one commercial, saying, “I don’t need to be.” I have everything I need to buy, sell, and trade cryptocurrency safely with FTX.”

How Celebrities are Vulnerable to Lawsuits and Proceedings?

In an unrelated cryptocurrency case, Kim Kardashian, a television star and social media influencer, was fined $1.26 million in October for failing to disclose that she was paid to promote the EthereumMax cryptocurrency on Instagram. The Securities and Exchange Commission (SEC) penalized boxer Floyd Mayweather and rapper DJ Khaled $600,000 in 2018 for failing to disclose that they had been paid to actively support the Centra Tech cryptocurrency project.

In both of these cases, the celebrities violated the Securities and Exchange Commission’s anti-touting rules, which prohibit the promotion of securities (section 17b of the Securities Act of 1933) without disclosing that it was a paid advertisement. In that regard, the FTX celebrity endorsements are different from previous cases in that FTX disclosed, via press announcements, that the associated celebrities were participating in marketing campaigns in nearly every instance.

However, in a case in which the celebrities who have publicly endorsed FTX knew about the internal operations of FTX and can be proved as a felon, financial watchdogs and regulators have a good chance to go after them. But if we go by rational thinking, if these celebrities had any idea about the internal operations, they would have retrieved back or had second thoughts on publicly endorsing FTX.