Quick Links

Since the advent of blockchain technology and Bitcoin over 10 years ago, the crypto space has seen exponential growth and the potential for even more growth is immense. The size of the global blockchain market is expected to grow from $ 3 billion in 2020 to $39.7billion by 2025, at a Compound Annual Growth Rate (CAGR) of 67.3% during 2020–2025. This is According to marketsandmarkets.com Decentralized Finance or simply DeFi has been nothing short of phenomenal

A lot of people are subscribing to the idea of having non-monopolized money on the internet they can use for transactions without any interference from a central regulating body.

The point is, that people, want to be free to do whatever they want with their money. Earning money isn’t always easy, so of course, you can’t blame people for wanting freedom in what they do with their hard-earned money.

The search for freedom from the world’s traditional finance system has been what has led to the emergence of the DeFi ecosystem. In this article, we talk about how the rate of adoption in the DeFi space has been. But to understand how people have come to accept DeFi, we must first understand what DeFi is.

What is DeFi?

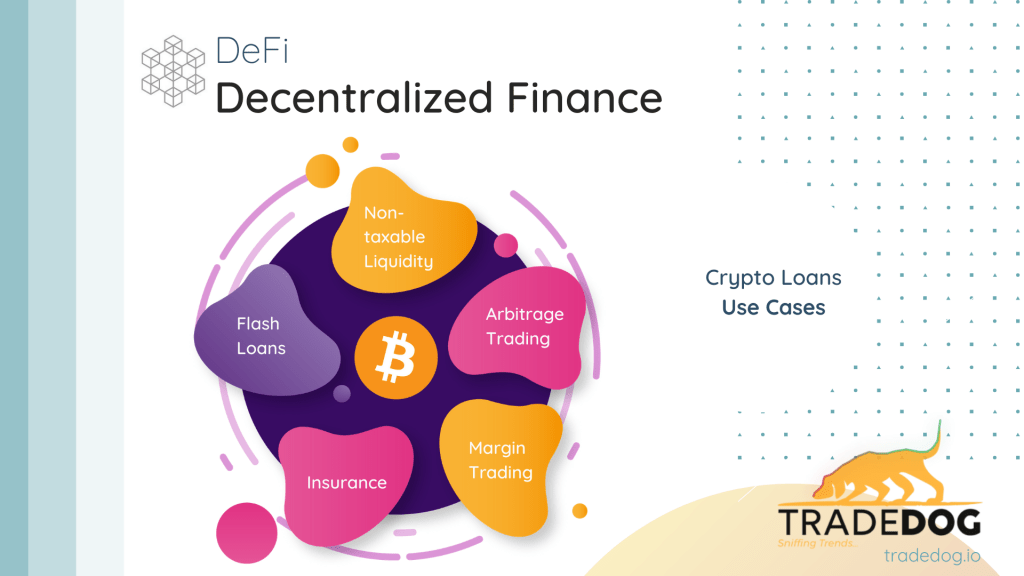

DeFi is an abbreviation for Decentralized Finance. It is a new system of finance that gives its users complete access to financial services that do not require permission and are completely open (on the Blockchain). DeFi is championing the push for transparency in transactions and reducing the risks in dealing with counterparties through the creation of smart contracts. These smart contracts are like agreed terms of transactions set by the parties involved and built in the Ethereum blockchain. The contracts ensure that everyone fulfills their parts of an agreed deal. About 612,000,000 blockchain-based transactions which amount to more than $270 billion in assets have been made as of February 2021.

Managing partner at $100 million crypto fund, Dragonfly Capital, Alex Pack said, “The goal of DeFi is to reconstruct the banking system for the whole world in this open, permissionless way.” He added, “You only get that shot every 50 years.”

Sharing the same sentiment, CEO and co-founder of TrustToken, Rafael Cosman said, “DeFi takes the key elements of the work done by banks, exchanges, and insurers today — like lending, borrowing, and trading — and puts it in the hands of regular people.” “Decentralized finance is an unbundling of traditional finance,” he says.

In summary, the main aim of DeFi projects is to push a permissionless, censorship-resistant, programmable, and fluid means of making financial transactions across the world.

History of DeFi

You really can’t start talking about DeFi if you do not first acknowledge who/what first started all of this; Satoshi Nakamoto and his whitepaper titled Bitcoin: A Purely Peer to Peer Electronic Cash System.

In this paper released in 2008, Satoshi (whose true identity isn’t known to date) describes a system of payments that’s purely peer-to-peer and allows the payment of electronic cash from one party to another without having to seek access through a financial service/institution.

Bitcoin was invented in 2009 after Satoshi’s paper was released and in 2015, Ethereum was built by Vitalik Butarin and a team of core developers. In doing this, Ethereum became the first network on the blockchain to allow assets like agreements, contracts, and currencies to be stored and transferred through the use of smart contracts. So from Satoshi’s whitepaper, the whole idea of a decentralized system of finance was born and it has evolved steadily (and to be honest quite speedily too) to what we currently have today.

Adoption of DeFi

Looking at it from a market size point of view, out of the over 7 billion people in the world, about 100 million have traded or made transactions using cryptocurrencies in non-custodial wallets.

Because the DeFi space is still relatively very young and still at its nascent stage with more than 80% of cryptocurrency investors being novices and only about 7.38% having previous experience in investing as reported by eToro. The space is dominated by the early adopters of the blockchain and the first cryptocurrencies. These adapters have a deep understanding of the technology and are steadily building and developing great services out of it.

Significant growth has been experienced by the DeFi sector in the last year. The total value locked (TVL) in the DeFi ecosystem, according to DeFi Pulse, has grown from $630 million in March 2020 to $36 billion as of March 2021 and doubled that in just the next two months. That’s over 36x growth in the course of 12 months. The bulk of these DeFi projects is on the lending, exchanges, and asset platforms.

Adopters of DeFi

Financial institutions alone have spent about $552 million on blockchain-powered projects, while large institutions like PayPal and J.P. Morgan are beginning to recognize the potential and taking part in Cryptocurrencies — this increases the possibilities that they will eventually venture into DeFi projects — there are already plenty of DeFi projects that are solving real human needs in the ecosystem.

DeFi11

DeFi11 is the world’s first fully decentralized gaming ecosystem for the fantasy sports and betting marketplace. The layer 2 blockchain gaming platform is looking at solving the problems riddling the conventional gaming system. The project solves the issue of data manipulation, creation of fake winners, lack of auditing, and lack of user privacy.

You can read more about DeFi11 here.

Drife

This is the world’s first fully Decentralized Ride-hailing service. Think Uber but decentralized. The platform offers a unique blockchain-enabled mechanism that allows drivers and riders to control their rides. Drivers and riders are given the right to govern themselves with their best interests at heart with the platform’s open governance policy. Drivers are also not required to pay commissions like what is currently obtained in the Ride-hailing industry.

The platform also has a native token, “DRF”, which can be used to access Drife’s many other great services.

Mass DeFi

Mass DeFi is an ecosystem that enables crypto and fiat users to cash against crypto holdings, shop at 0% interest loans, issue insurance on collaterals and earn yields through a decentralized platform. Mass DeFi aims to give its users the ability to enjoy the full experience of a fully decentralized system of finance with 100%security and safety of the data of users.

Conclusion

There are a lot of other DeFi companies doing amazing things in the space and the potential for even more mind-blowing products is huge.

The blockchain, cryptocurrency, and DeFi spaces are still very young and with the current rate of adoption, one can only imagine what the industry would look like in the next 3-5 years. Existing projects in the space are pioneers and market movers already and they are surely going to enjoy all of the perks that come with being here first.