Quick Links

Those who are active in the startup ecosystem would surely have heard of a16Z or Andreessen Horowitz. It is a private American venture capital firm with $35 AUM (as of March, 2022).

They back a majority of the top tech companies ranging from Twitter, Airbnb in the Web2 space to Opensea, and Yuga Labs (BAYC as you all may know). Pretty much soon, they have released State of Crypto 2023 which provides us with their perspective of the crypto ecosystem.

Let’s try to interpret their understanding of crypto and their vision of ecosystem development.

First and foremost, what actually is Web3 and why should we care about it?

Web3 in simple words is an evolution of the internet. The earlier versions of the internet had limited functionality, it was all about reading and consuming information, more like one-sided communication.

Web 2.0 came out as an upgraded version, it supported advanced functionality like reading, writing, creating, and engaging with the end user. The Web became easily accessible and platforms like Google, and Facebook to name a few became the linchpin leaders of this tech era.

However, the major drawback is that now these Corporations are at the nucleus of the value accrual system and the platform has centralized operations.

Web3 presents itself as a solution for decentralized data management and is here to democratize ownership. With blockchain networks being the base layer, Web3 returns the power to the users and channelises the value flow to the network participants instead of a centralized system. The creators are empowered with a greater share of revenue as compared to the Web2 platforms.

Eg- Youtube takes a 55% bite of the revenue while Web3 platforms like Opensea charge up to 2.5% only.

The Crypto Price Innovation Cycle

Rising prices are a leading indicator of innovation. Price sailing to new highs creates the right visibility, bringing in new interest and hyper-inflated social media activity.

Now, there is a FOMO all around. More people are getting involved, some FOMOing while the others contributing value as in new ideas and code. This hyper-optimistic environment being supported by a bull rally in asset prices promulgates Founders to create their businesses and leverage the opportunity to onboard users via product launches.

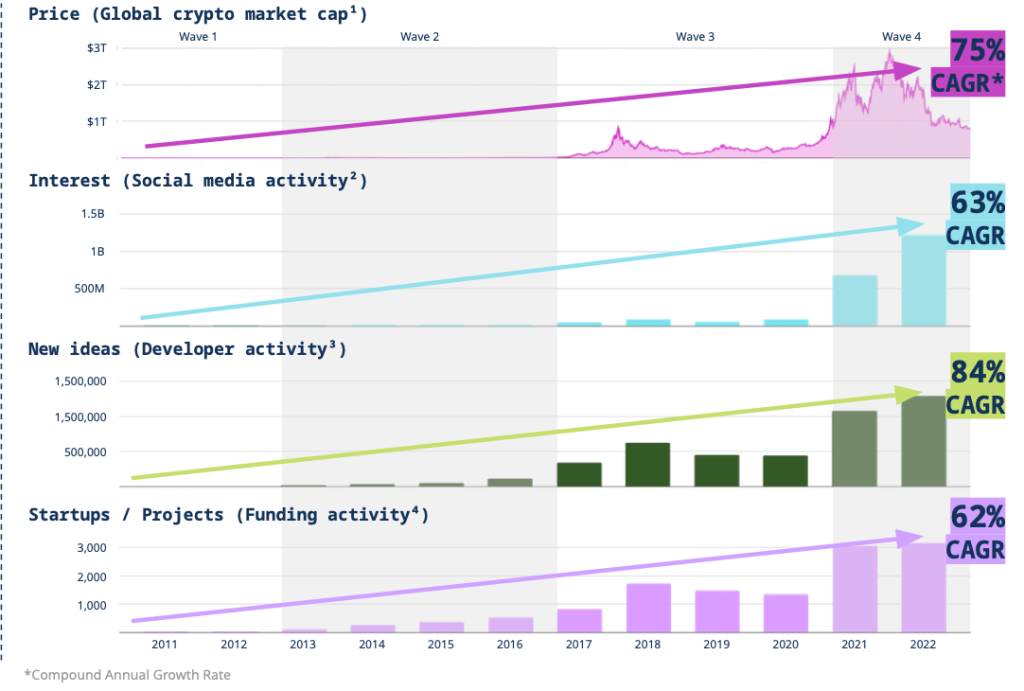

The report suggests that the market has undergone 4 cycles. The first peaked in 2011, the second in 2013, and the third in 2017 while the recent ATH in Nov 2021 marks the fourth cycle.

We can clearly see that the crypto market cap has grown at 75% CAGR since 2010 while the social media activity has witnessed an amazing 63% CAGR growth.

With the development of the market, entrepreneurs could not resist developing some amazing products as indicated by astronomical growth at 84% CAGR in the Developer activity while it’s good to see the capital infusion from the investors growing at 62% CAGR to support the decentralization revolution.

A sensational year for Ethereum

Ethereum successfully switched to Proof of Stake (PoS) via the Merge on September 15, 2022. It was not an easy task as it required transporting the whole Ethereum ecosystem worth hundreds of billions to a new energy-efficient chain.

With this shift, Youtube now consumes 94000 times (244 TWh) the energy as compared to Ethereum (0.0026 TWh) annually.

Let’s decrypt the state of the ETH economy after the merge-

Since Merge, Ethereum has burnt 74.8K ETH ≈ $135.9 Mn, on the flip side, if it would have stayed on PoW, there would have been a significant addition of the new 2.2M ETH.

𝗛𝗲𝗻𝗰𝗲, 𝗲𝗳𝗳𝗲𝗰𝘁𝗶𝘃𝗲 𝗿𝗲𝗱𝘂𝗰𝘁𝗶𝗼𝗻 𝗶𝗻 𝗘𝗧𝗛 𝘀𝘂𝗽𝗽𝗹𝘆 𝗶𝘀 𝟮.𝟯𝗠 𝘄𝗼𝗿𝘁𝗵 $𝟰.𝟭𝟰𝗕.

Since Ethereum now uses less energy, it pays out comparatively fewer block rewards to stakers. As per the estimates, the annual emission can drop significantly from 4.3% ——> 0.4% (10X decrease) after the Merge referred to as “𝐓𝐫𝐢𝐩𝐥𝐞 𝐇𝐚𝐥𝐯𝐢𝐧𝐠”.

𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬 => The decrease in supply generally causes an increase in demand, therefore, it is healthy for its increase in price.

Tech to scale ETH: The Rise of L2s and ZK Rollups

Layer 2s have emerged as an innovative tech that presents itself as a solution to the Blockchain Trilemma. L2 blockchains extend the base Ethereum layer and assist in hyperscaling while inheriting the security guarantees of Ethereum.

Ethereum L2s are now accounting for about 4.5% of the total gas (computational resources) on the L1. In terms of total revenues, the top 3 L2s are doing about 6.16% of the total revenue on Ethereum today.

Will Ethereum get hurt if L2s scale out?

L2 adds the transaction proofs to the Ethereum chain. Therefore, L2s are required to submit the data publication fees with the base layer. Thus, in the scenario, if L2 scales out, this means that the transactions to be settled on the base layer will increase proportionately.

Data publication fees =(16 gas per byte of data)*(average transaction size in bytes)

Now, in this scenario, if transaction size increases, it would result in higher revenue for Ethereum validators.

ZK technology

Zero-knowledge proofs are cryptographic techniques that allow users to confirm the validity of a transaction without giving any details about the transaction. This is crucial for blockchain technology because it enables users to confirm the legitimacy of a transaction without disclosing the actual data contained in the transaction.

ZK Rollups are a layer 2 Ethereum solution that enables fast and more affordable transactions. They batch transactions together in a roll-up thereby reducing the transaction cost.

Polygon zkEVM has got 84K+ wallets, 75K+ ZK proofs generated and 5K+ smart contracts deployed before launching its Mainnet beta on March 27, 2023, while Scroll another zkEVM product had processed over 15.4M transactions and recently raised $50M at a valuation of $1.8B from investors like Polychain Capital, Sequoia China, Bain Capital Crypto, and Moore Capital Management.

Are NFTs Dead?

At the start of the blog, I mentioned that Web3 is here to democratize ownership. The tool that Web3 leverages to empower the creator economy is NFTs.

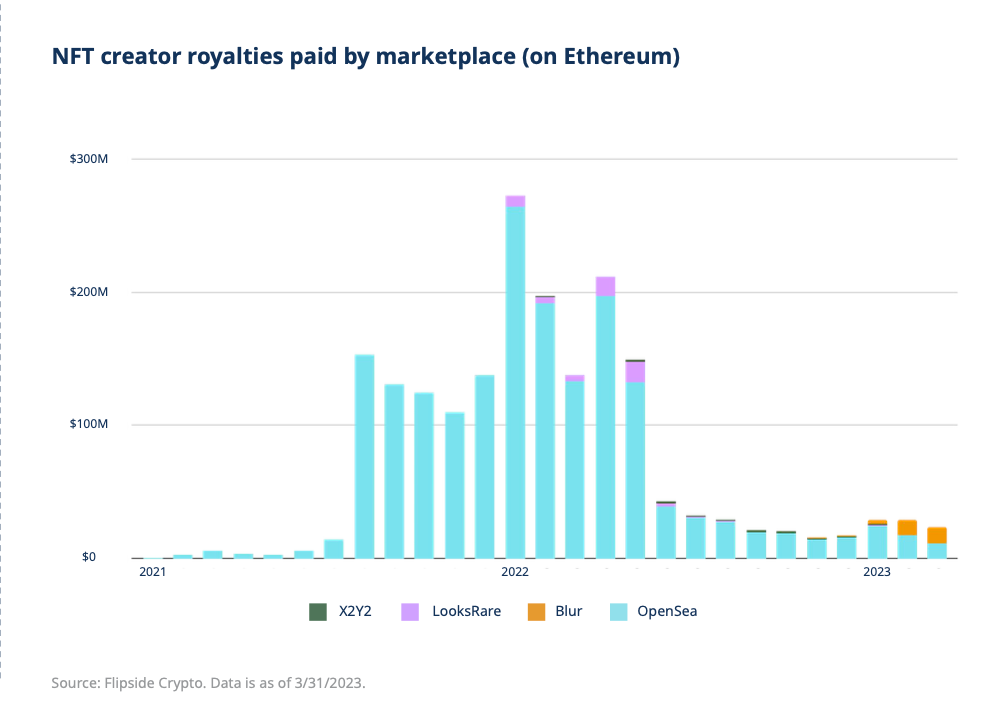

NFT marketplaces have paid a whopping $1.9B in creator royalties. The royalty distribution structure in the traditional space operates in a black box, but with the on-chain enforcement, the creators’ community have been empowered and they are enabled with the major chunk of capital formation benefit not the other way around.

The NFT activity for the majority of time in 2022 was subdued but with the token airdrop of Blur in 2023, the activity in the NFT space has ignited back. Also, brands like Starbucks starting their NFT-based loyalty program and Nike launched its NFT platform .Swoosh for digital sneakers, it clearly depicts the rising interest of these biggies and re-iterates the value unlocking that is powerful with this amazing technology.

Web3 Gaming: Catalyst for next bull run?

At first sight, it would be really difficult for a gamer to understand the difference between blockchain gaming and traditional Web2 games. Games like Axie Infinity, and Alien Worlds do not stand on the list with games like Minecraft and PUBG but then why games like Axie Infinity have been able to earn Unicorn status? Let’s find out!

In non-blockchain games, the in-game asset that we bought is identified as actually renting. Why? Because on any fine day, if the platform goes down, then the value of the in-game assets would also decimate. So, the value of the in-game assets is heavily dependent on the game and the team running it. Also, the number of in-game assets, their price and their creation are wholly dependent on the game and the stakeholders are not a part of the operations.

Now with Web3 games, gamers can create their pieces of content as NFTs, publish, trade and monetise them and participate in the value cycle, hence, bringing the power back to the users.

Is it going to be huge?

Consumers have spent around $67.9B on the purchase of digital in-game assets in 2022.

717 new web3 games launched in the last year and the web3 games have generated 23x more on-chain transactions as compared to DeFi.

The GameFi sector received a total investment of $5.4B as compared to $2.9B in 2021. In the Q1 of 2023, $719M worth of investments were deployed in blockchain games by the VCs. The industry’s dominance also increased from 42.87% in Q4 of 2022 to 45.60% in Q1 of 2023.

The sheer activity, support from the investors and VCs and the rising trend of new and engaging games fostering into Web3 is a bullish sign for the industry. As more and more gamers and investors realize the advantages of blockchain technology, I may not be shocked to see a Hockey stick adoption curve of Web3 games in the coming years.

Conclusion

Web3 is a decentralized internet where the blockchain network is the base layer that brings back the power to the users, democratizing ownership and channelizing value flow to network participants. Rising prices in the crypto market are a leading indicator of innovation, creating visibility and bringing in new interest and social media activity.

The crypto market has undergone four cycles, with the recent ATH in Nov 2021 marking the fourth cycle. Ethereum successfully switched to PoS via the Merge on September 15, 2022. Since then, Ethereum has burnt 74.8K ETH (approximately $135.9 million), while if it had stayed on PoW, there would have been a significant addition of new 2.2M ETH.

After the Merge, the decrease in supply generally causes an increase in demand, making it healthy for an increase in price. Layer 2s have emerged as an innovative tech that presents itself as a solution to the Blockchain Trilemma. The top 3 L2s generate about 6.16% of the total revenue on Ethereum today. While L2s scale, it is unlikely that Ethereum will be hurt, as they inherit the security guarantees of Ethereum and extend its base layer.

Web3 gaming is witnessing greater traction and the investments worth $719M in Q1 ‘23 back this. The increasing activity and support from investors and venture capitalists, coupled with the emergence of new and engaging games in the Web3 space, are all bullish indicators for the gaming industry. This trend is exciting and promising for the industry and as more gamers and investors recognize the benefits of blockchain technology, we may witness a hockey stick adoption curve of Web3 games in the near future.